Zeitgeist

Risk

The investment game can be very accurately characterised by simply saying, “I buy or sell assets where the risk is not priced correctly.”

Specifically, for our asset class there are a number of aspects that are not understood by the market that mean risk is hugely mispriced.

For example, while the market knows that networks are valuable (particularly from their experience with social media) they do not know anything about decentralised networks or how to value them. We believe they are hugely more valuable than any traditional network and currently mispriced.

When we look at global energy markets, we think bitcoin miners and energy companies will start merging in the next five years. Bitcoin mining will become integral to flexible grid management and support for renewable energy. With reference to our opening chart, cheap power will attract bitcoin miners, which will in turn attract chip designers who can build faster and faster mining chips. The cycle carries its own intellectual gravity and countries are waking up to this fact. Even the EU backed away from onerous regulation for fear of scaring away bright minds.

These ideas, which we as a fund view as inevitabilities, are not well understood. The longer the market thinks we are crazy, the better for us and all our investors.

Bonds

Speaking of risk, it’s worth taking a look at how the world’s ‘ultimate’ risk-free asset is performing these days.

Let’s take a peek at the United States 30 year bond that was issued in 2020 we wrote about then at the time they were issued when Trump was trying to push out the overall maturity of US debt.

The risk-free bond in question has now lost 26% of its value in less than two years, selling for 74 cents in the dollar. Investors have been comforted in the meantime with two coupons totaling 2.5%. Totally risk free, you see.

It is just extraordinary that the market for bonds continues to be so robust. The Federal Reserve has apparently stopped buying new bonds this month and so the balance sheet should stop growing. The ECB too is in the process of winding back their own purchases.

The question is, who on earth is buying this garbage? Bonds have no asymmetric upside, nothing but downside risk and a backdrop of government spending that makes value destruction seem like it will occur at an accelerating rate.

Yields on US bonds will explode at some point and the Fed will step back in and be buying like never before. Not yet, but soon.

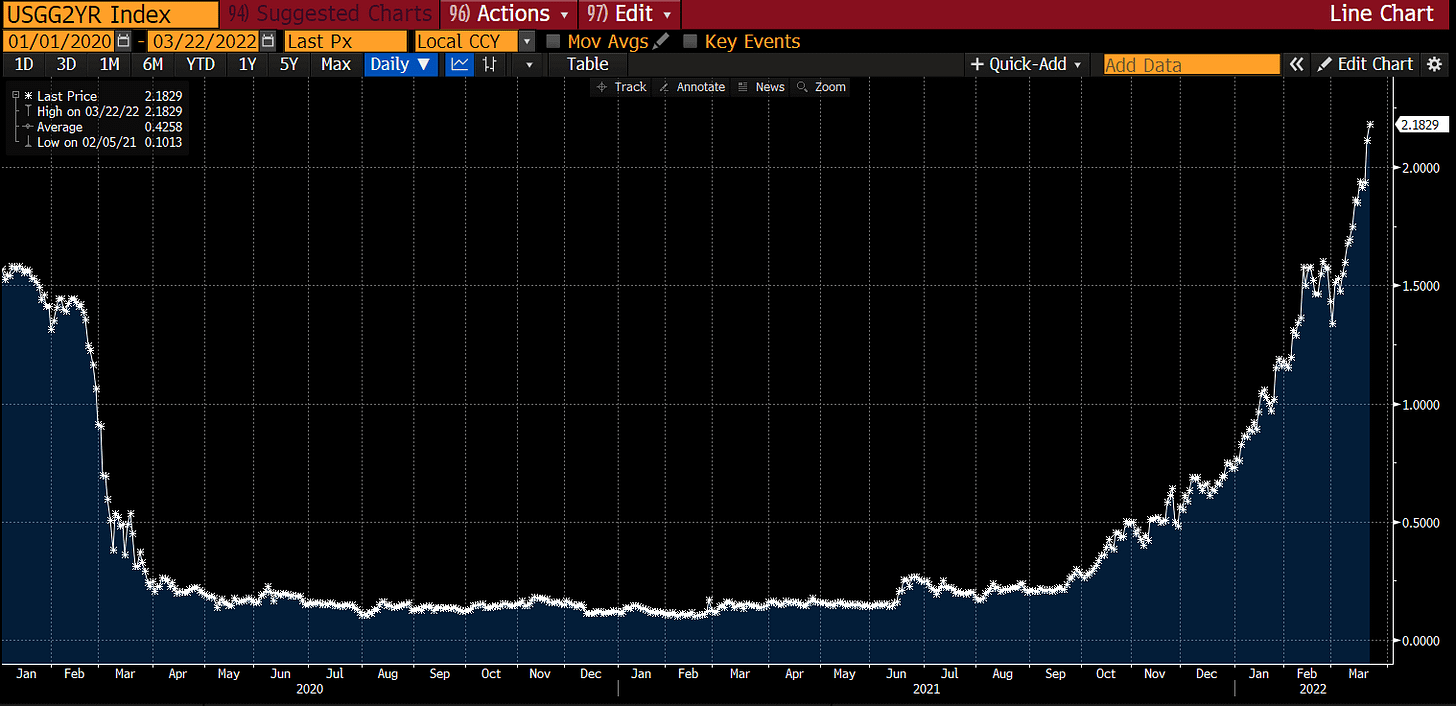

Here’s the two year US yield chart which is making a real charge at the moment, before the Fed has fully wound in its purchases. These are gigantic price moves in what is supposedly the most liquid market in the world.

Time to Merge

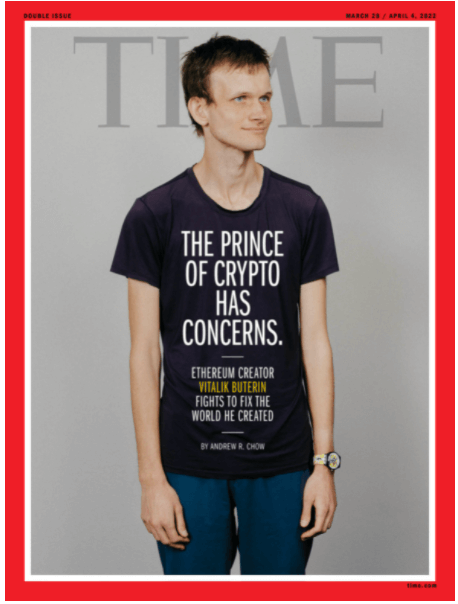

Time magazine led this week with an article on the “Prince of Crypto”, Vitalik Buterin. VB is the creator of Ethereum, the second largest cryptocurrency by market cap.

It is in stark contrast to bitcoin that Ethereum has a very clear leader in Vitalik. Many think that is good but I would argue not; the project is very far from decentralised because such significant influence sits with one man. He is an easy target for both criticism and fame. It’s the antithesis of what decentralisation stands for that one person should be represented on the pages of Time magazine as the “Prince of Crypto”.

For an outward looking observer it has been an incredible few weeks for Eth. Their much touted merge looks like it might now happen in the next few months allowing them to move to a proof of stake model. The level of token burns associated with the change from PoW to PoS is providing a great deal of price support for the token and their leader is now on the front of Time.

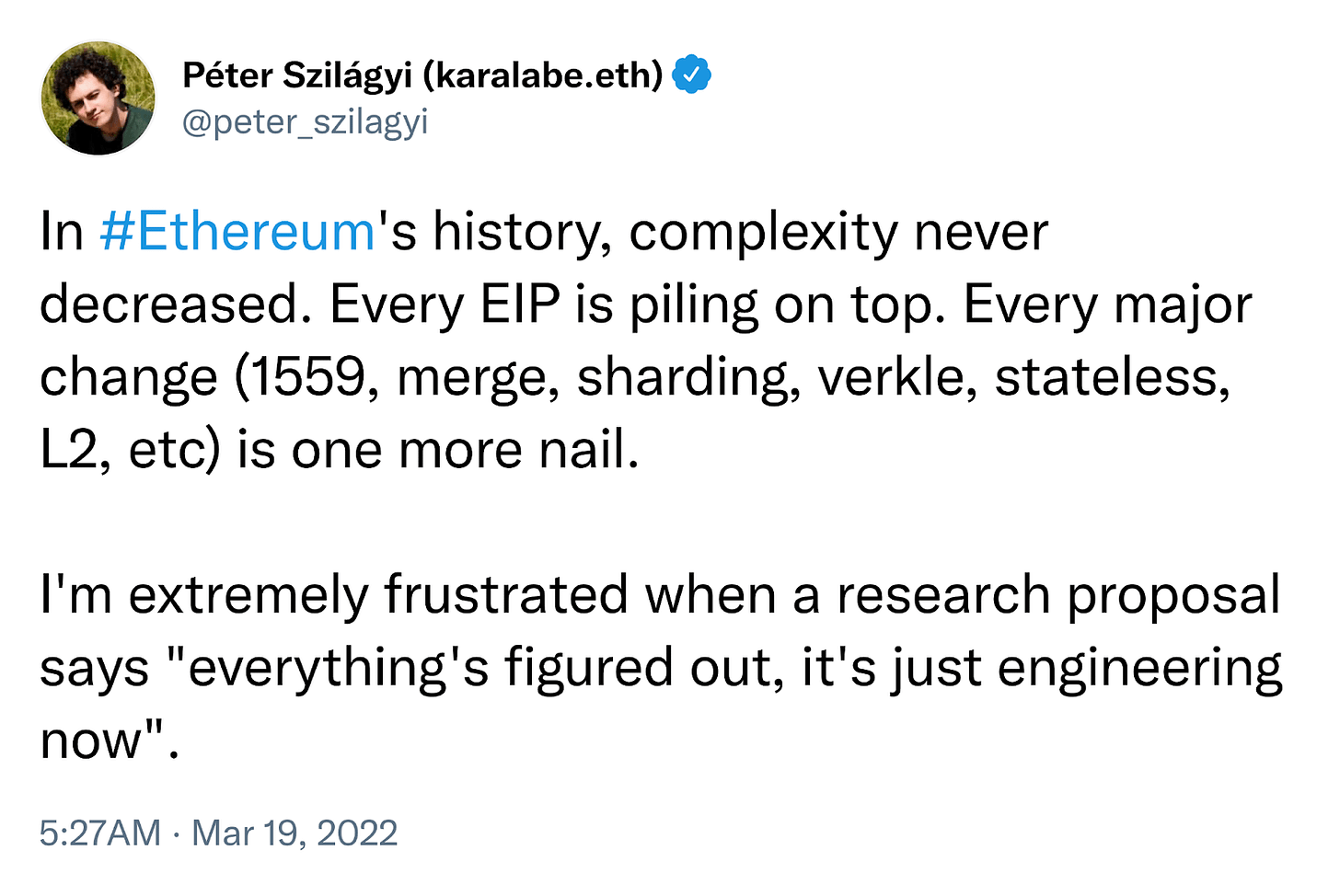

All may not be what it seems though. This thread from one of the leading developers of the protocol was very concerning; he highlighted the deep technical debt in which Ethereum now wallows.

We drew attention to these issues last year in our article about Ethereum’s mis-priced technical risk, and we stand by that article today. Eth makes up a small percentage of our fund, and has performed well, but as the ecosystem grows, the web of Eth technical debt seems to grow with it. Most people would be shocked if it fell over entirely; the cascading effect into DeFi and stablecoins doesn’t bear thinking about.

Euro-Trash

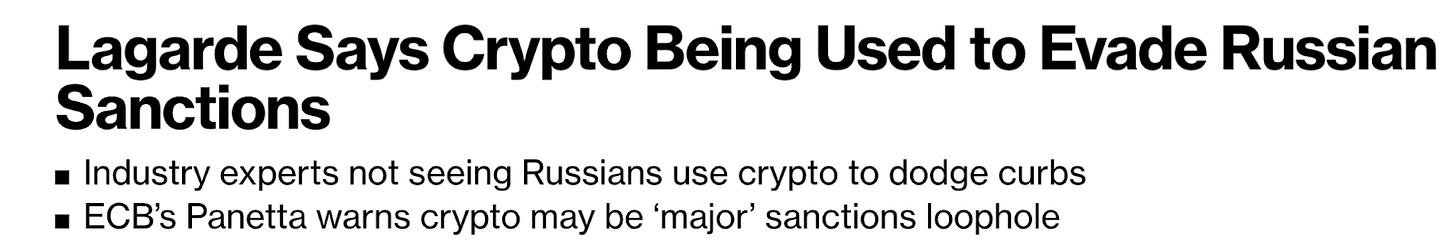

Lagarde was back this week in full flow with her attack on cryptocurrency. Essentially the allegation is that crypto currencies are being used to evade sanctions.

The fact is, it’s likely true. We know Ukrainians are using it to raise money for defense and we know Russians are probably using it because the Rouble has been decapitated by sanctions and they are now useless in international trade.

The point here is being missed though. Truly decentralised assets do not discriminate; they do not know who you are and they do not ask. It is simply open source software responding to commands on a computer screen. Everyone, everywhere can participate in the digital economy on equal terms and that was always the point.

The Western World is likely making a profound mistake in their weaponisation of currency. SWIFT has been used before to sanction Iran, North Korea, and Russia, but never before has a country the size of Russia had its foreign exchange reserves seized as has happened in the past few weeks.

The problem with the tactic is that it can only be used once. How will China now respond? Will they continue buying US bonds? Will they hold USD as reserve? Now everybody knows US dollar denominated assets only belong to you if the US Government lets you. The game is up.

Exactly the same in Europe. It would seem very likely that those who aren’t friends with the USA will now divest themselves of those assets. India, China, Russia (of course), Iran and many in South America. They represent half the world’s population.

China has $3 trillion in USD reserves. It won’t serve them to dump them on the market but you can be sure they will be looking closely at how they divest themselves of the risk they are sat on.

The era of dollar dominance is ending. I’d credit Lagarde with the same story about the Euro, but that was a house of cards from day one. If there’s one positive note for the Dollar, it will outlast the Euro.