I hear about your clever friend a lot. He (and it is always he) has a lot to say about bitcoin. In general he is highly educated, normally at a cost of more than $150,000 for the many letters appending his name. He has a highly paid job in an unspecified low tax jurisdiction. His flat overlooking the lake is always “paid for by the firm” and his girlfriend works for Vogue. He always works in trading, some zero sum game algorithm type arrangement.

Bitcoin is useful, and scarce

Your friend says that quantum computers will put an end to bitcoin because their power will mean the end of the power of prime numbers. I say prime numbers have been around a lot longer than your quantum computers that don’t even work, and:

Bitcoin is useful, and scarce

Bitcoin is useful, and scarce

Your friend says invest in his money market fund which algorithmically trades across currencies to arbitrage interest rates and manages the downside with complex derivatives that only he understands. I say:

In 1985 the Chess world was ruled by the Soviet Union’s Anatoly Karpov. He was the undisputed world champion and had been for 10 years. Anatoly Karpov did not lose.

Enter 21 year old Gary Kasparov. He took on Karpov in 1984 and immediately went 4 nil down. The speculation was for the total humiliation of Kaspraov but for another 46 grueling games Kasparov fought back. The contest was so brutal it was cancelled by the referee (the only time that has ever happened). The rules of the next encounter were changed, it would be the first to 12.5 games.

In 1985 the second contest began. It was close throughout and at the end of game 23 Kasparov led 12-11. He has since described the final game as the game of his life. He had the black pieces, a major disadvantage but he only needed a draw to win. He equally knew that his style did not suit playing for a draw, so he played to win. Karpov was well in front but Kasparov’s aggression threw him off and under time pressure, Karpov made errors and lost. Score 13-11. Garry Kasparov became the youngest world chess champion ever at 22.

They played again in 1986 as Karpov had been granted a rematch in case of defeat. Kasparov was winning easily but things changed. Karpov won three straight games. Something was wrong, Kasparov suspected his support team had been compromised and had sold his strategies to the Karpov side. He sacked his team and then won 12.5 – 11.5. There was more to it in those days, Karpov was the Soviet’s man, Kasparov the Gorbachev guy, with everything that put him up against. KGB bribes included.

Most stories about chess are about player v player but only one person will be the first to take on a machine under world championship conditions and that man will always be Gary Kasparov.

In 1986 IBM designed a computer that they believed would be able to beat Kasparov, it was called Deep Blue. Deep Blue was a brute force monster, no AI back then. It’s processing power was enormous running chips specialised for the purpose of playing chess. The machine had consumed over 700,000 grandmaster games and was fined-tuned by multiple grandmasters and the Carnegie Mellon University before the contest. Kasparov requested that he be allowed to study the other games that Deep Blue had learned beforehand. IBM refused.

Garry Kasparov won 4 – 2.

IBM then went back to the drawing board. They massively upgraded Deep Blue and massively expanded their grandmaster support network. In 1997, he took on IBM and just about everyone else in the world of chess. He lost, 3.5 – 2.5.

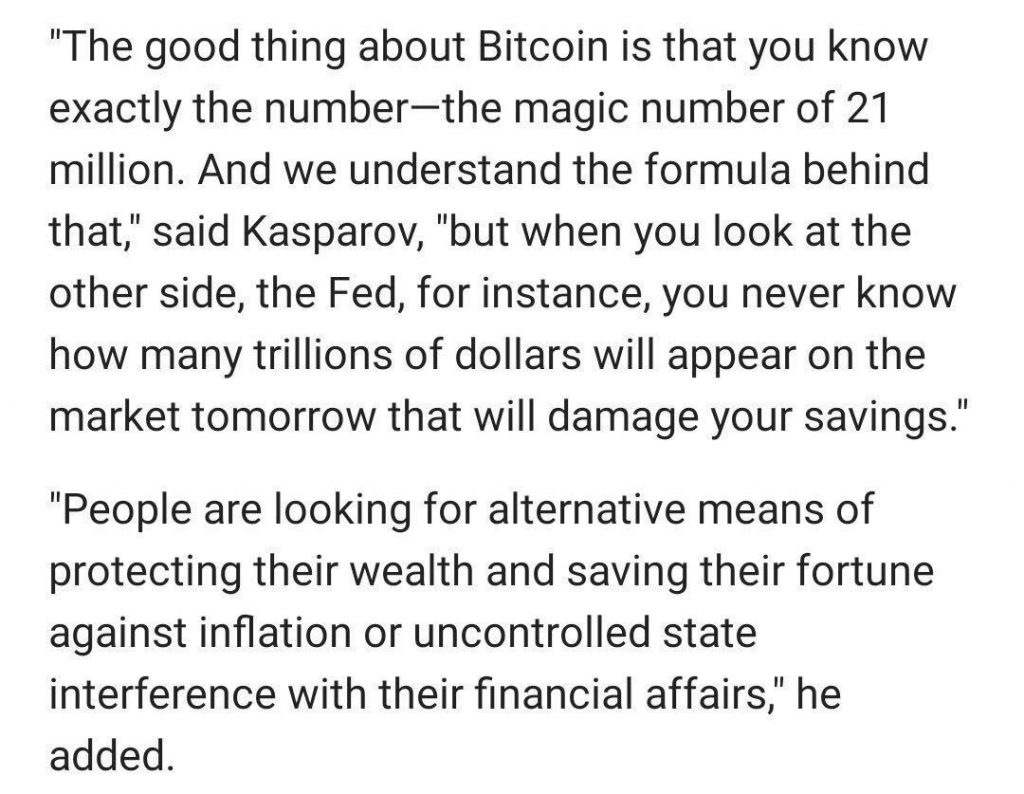

And why do we care? Well Gary Kasparov was in action this week on an unlikely subject.

It’s especially pleasing because now when your clever friend says blah blah I can simply say, “Garry Kasparov”.

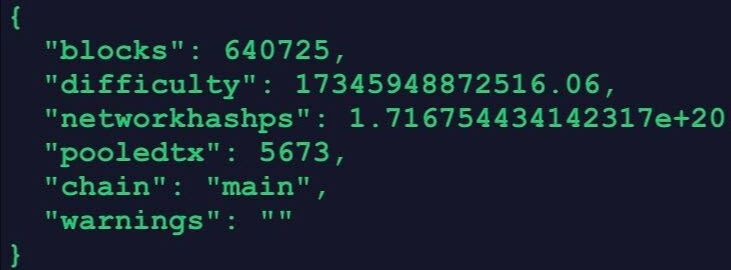

Bitcoin Mining

The fact is, hash rate is absolutely exploding. I have said many times that bitcoin mining is highly risky, it really is death or glory. So why are people risking so much capital in bitcoin mining?

I do not know the answer, but I am willing to speculate as follows:

Bitcoin mining converts energy directly into money. Almost everything in the economy is an attempt to turn energy into money, even if that energy is simply provided by a human being answering a phone. The entire economy boils down to energy— > money.

Bitcoin provided the first way that you could directly convert one into the other. If you are successful and have fast mining chips and energy then you do not need the following:

– marketing

– distribution

– customers (no need, you already have the money)

– large workforce (maximum 10 for a very large operation)

This week the OCC announced in a public letter than any bank can hold on to the “unique cryptographic keys for a cryptocurrency wallet”. Meaning that US banks can now custody digital assets.

Banking is a very hard business now. With interest rates at all time lows it’s hard to make margin in traditional sectors (with the exception perhaps of credit cards). This letter has not fallen from the sky, banks have lobbied the OCC for it. They know they must participate in digital assets or they are simply going to be wiped out.

We seem to be moving further away from the outlawing of digital money and closer to a resigned acceptance. The end game is nigh.