Wrong

For a change of scenery let’s try some arguments about why our macro-thesis might be wrong. Every week we bang the same drum, well it’s time for a new tune to see how convincing it is.

Interest rates

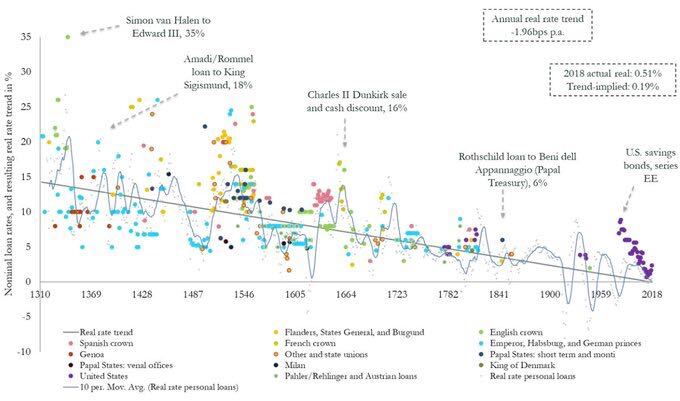

Let’s start with interest rates and the 700 year chart below.

- Capital markets are now so efficient that money has been priced to perfection.

- Many people around the world have spare money at any moment, so that money should be cheap provided it can be efficiently allocated.

- Even someone with no money has $10 in their wallet for most of the day until they spend it on dinner, that money could be put to use during the day in a hyper efficient market.

That’s why money is nearly free, because of market efficiency. Excess money anywhere in the world can now be used almost immediately anywhere else in the world.

The proof of this is credit cards. A regular person can directly create money that did not previously exist through using a credit card. This is a very recent innovation and arguably has vastly increased the efficiency of global capital markets, since the provider of the card can finance the funds from anywhere else in the world.

Prove it to yourself. Buy something on a credit card. Pay off the card at the end of the month, no interest to pay. Not only is it free, it is highly likely that some part of your borrowing was financed from overseas through a global liquidity pool.

Is it technology that has made money cheap and not quantitative easing? Also, why should the 700 year falling trend stop at zero?

Inflation isn’t coming

- The largest cohort in the world, the baby boomers, are winding down. Spending peaks in your 40’s. Housing, children etc. Then it falls steeply and it never stops falling.

- In the Western World and Japan you are seeing the full effects of this. Europe in particular, is in decline. There is nothing the scarf lady can do to make inflation go up because the rising spend cohort is now so much smaller than the falling spend one.

- Today, one of the only significant rising costs is healthcare because the primary consumer of that is older people.

What happens next?

- Grandma wants to sell her 8 bedroom home because she can no longer carry the vacuum cleaner upstairs, indeed she hasn’t been in the loft since the Reagan administration.

- Unfortunately big families are a thing of the past. Demand from the the millennial generation does not exist and the price of the mini mansion falls.

- Save for specific services (like health), it is likely that general demand in the West will fall, simply through the force of numbers. Prices will follow and that is deflation, not inflation.

More generally?

- The big drivers of inflation have been education and healthcare, technology costs have always been falling.

- We know expensive education is now under existential threat, that driver is gone. Healthcare and hospitals will still rise but everything else may well now be in a downward trend.

Monetary policy is right

- More government bond buying.

- Full Japan effect for Europe and the US.

- The Federal Reserve and ECB will find a way to buy equities through another vehicle.

Accordingly, is it so crazy to buy Telsa, Amazon, Afterpay at their current prices? Do you know anyone without an iPhone, why not buy Apple then? After all, you can own them for near zero per cent if you borrow the money.What is more, you would have to think that governments have generally improved their application of monetary policy over time. Genuine examples of improvement would be the provision of information, like that from the Federal Reserve Bank St Louis. We use their charts nearly every week, they are up to date and informative. Also, minutes. The minutes of meetings from every central bank around the world are available to us all we can read into what they are thinking and why they are doing what they are doing and act accordingly. Data processing ability too, in banking and government it is now orders of magnitude better than it was even 10 years ago. So surely the modelling, predictions and resulting policy interventions are easier to manage and tweak than they have been in the past? What is more, we now have so much data from past actions and history, that must inform and improve every new decision, right?

What looks crazy may not be crazy. The powerful computer algorithmic central banking super correlator, may in fact be cleverer than common sense. If you have ever used one of these models you will know that if you tweak cell D11, then extra money printing does indeed cause additional economic activity and wealth creation. This then trickles down the columns of excel and directly benefits everyone. Indeed, if you move across to the tab marked ” —–> OUTPUTS DO NOT EDIT”, you will see a steadily rising path of GDP.

For a long time, both towards the end of the First World War and into the early 1920s the German Mark, while weak and falling, did not collapse. Indeed, German industrialists made a fortune because their input prices were very cheap and to foreigners, the products were even cheaper. Exports boomed. Once again those closest to the monetary spigot were able to take significant advantage of the situation presented to them. The biggest winners of the era were farmers and exporters, a thought you might like to hold, particularly if you are in Australia.

The trick in the 1920’s was to ask the importer to underpay for the products in German Marks, the exporter would then retain the excess funds overseas. So I sell 100 Marks worth of product to the UK, ask them to pay me 70 Marks and keep 30 Marks out of the country which I convert to pounds. Consequently money flooded out of Germany as business found a way to own anything but the local currency.

The general public had another trick. Piling into industrial shares, which were somewhat immune to the falling value of the currency:

This outraged comment seems quite quaint now “couldn’t expect a return of even 1%” since you can’t even earn that on a government bond.

All the while, protests from different Marxist and right wing groups raged across the country as the battle for the the post war soul of Germany raged. There were political murders and all manner of social unrest.Meanwhile, those on fixed incomes had a tough time.