Square

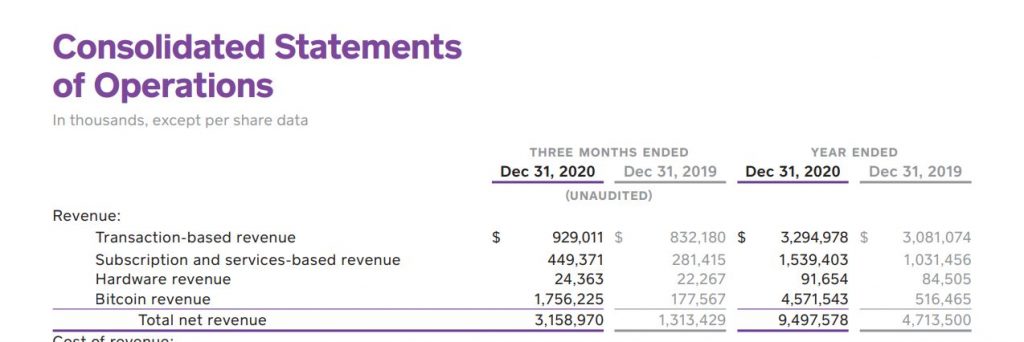

US financial services company Square reported their full year this week. Bitcoin revenue has gone from a bit of a sideshow to being the single biggest revenue item, by far. Sales grew 9x in 2020 and in their forward looking statement Square announced that in January 2021 CashApp had set a new record for monthly actives transacting in bitcoin.

Square launched bitcoin sales in early 2018, I wrote about it at the time. The start was slow, it was 5% of revenue that year. In two years it has become 55% of revenue.

Square also announced a further bitcoin buy, they had invested $50m in October last year and recently bought a further $170m for their corporate treasury, which now has a 5% bitcoin allocation.

Irrespective of volume the main point is this, more than half of Square’s users are under 35. Young people do not trust traditional institutions, they believe in cryptocurrency far more than they do fiat. Maybe they are wrong, but it won’t matter because in 10 years they will be the only people in the work place and what they believe will be true by default.

A new value measure

It was highly unlikely that the mobile phone would dominate in the way it has eating all forms of media as the predominant delivery device. It remains highly unlikely that bitcoin will grow to such a point that it can be the relevant reference rate for all other assets.

Highly unlikely, but increasingly likely all the same.

700 years of interest rates

I keep returning to this chart. Based on the returns to debt which are at all time lows, why would anyone be a lender? Why are US bond auctions not failing? You get almost no return at all, it is crazy.

The next chart from Robin Brooks (Institute of International Finance) says it all. Throughout 2020, the Federal Reserve was the major buyer of US Bonds. Note the pink lines, being the foreign buyers, they have completely gone. Households are the red lines, completely gone. It is a very loud message for the borrower, time is running out.

Pension funds were still chiming in last year mostly because they are, in many cases, mandated to be in bonds as people age.

The forecast is for a very large gap indeed this year between financing needs of the US and potential bond buyers. Either yields rise (which the Fed doesn’t want) or they buy more bonds, a lot more. It’s a tough spot to be in, the hard road is rising interest rates and bankruptcies, the soft road is printing money.

Bond yields have been rising all week……….so what’s it to be?

The Watchmaker

We are on the brink of a historical event. In a few days – or even a few hours – one bitcoin will be worth more than 1kg of gold. Ironically the rise won’t stop there – the ‘value’ of worthless crypto currency with no store value will continue to go through the roof! Until, like all bubbles in the history of humankind, it bursts into nothingness. The same nothingness it is made from.

For those of you wondering ”Am I too late to the party?” my answer is simple: no, you are not. For the same reason a decent an honest man is never too late to a drug party organised by a gang lord.

The fact that Bitcoin is fake gold is obvious to any reasonable person. It is not a currency, not an asset, not a unit of account and it doesn’t provide a scalable means of payment. No income, no use, no utility. At it’s core, it is a self serving speculative system used by criminals, terrorists, human traffickers and tax evaders, sheltering their wealth and moving money across international borders.

As a system outside government control, sooner or later, bitcoin will be crushed by governments world-wide because no government is going to allow untraceable tax-free transactions for too long. When that happens the bubble will burst and in that moment there will be no winners. Bitcoin will revert its intrinsic value – which is zero. Or more precisely below zero because maintaining the chain ledger will cost billions of dollars in electricity consumption alone.

I am not a financial adviser of any kind, but when we have a spare dollar or two, we invest in education, workshop machinery and watches. Real assets that will take our earning capacity to next level.

The best investment for a carpenter is in timber, for shoemaker in leather and jeweller in gold. Planting a few native shrubs in your backyard and painting a house with a fresh coat of paint is simply a smart investment. Investing in a new pair of walking shoes and a dog is the ultimate investment.

Obviously, the future of money is in some form of digital exchange, and sooner or later we will go ‘crypto’. But that coin won’t be a Bitcoin. In 20 years from now you will remember this moment in time with chuckle, while checking the time on your NH Mark 1, Seiko or Omega thinking – well THAT watch was a great investment.

It’s fascinating, even with all its factual errors. The characterisation of “fake gold” is strange. Who says gold is worth anything? At the end of the day its just a yellow rock that people are only interested in because other people are interested in it. Yes, you can make things with it, so what?No income, no use, no utility? Ask Venezuelans, ask Nigerians – they find it useful. How about people in Turkey and Iran? What is more, bitcoin is facilitating around $8 billion in value transfer daily, all over the world, which is hardly trivial. All those transactions are traceable, auditable and if you want to engage in criminality it is just about the worst thing you could possibly use. Far better in fact to use gold!

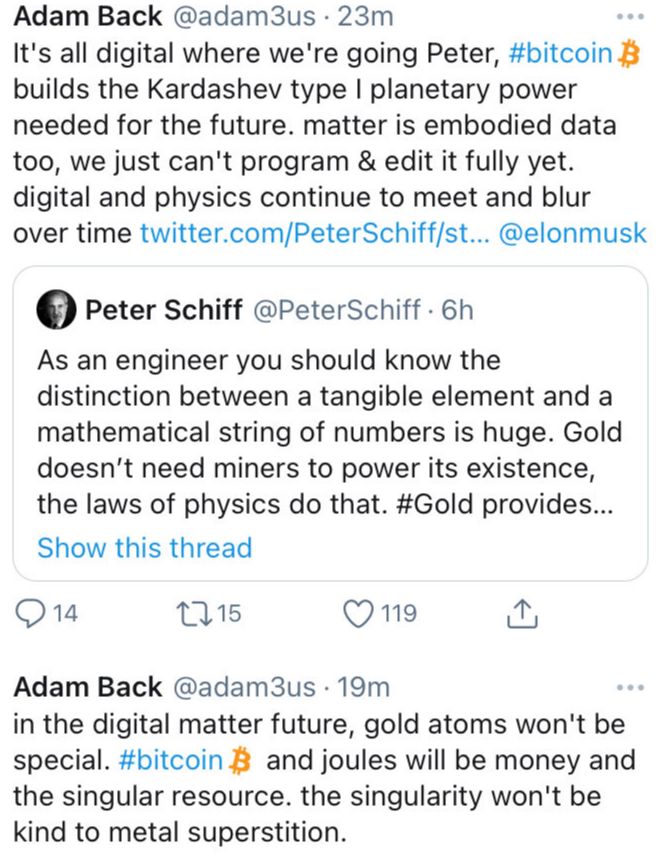

Here is Adam Back, the man who invented cryptographic proof of work, this conversation was yet another gold bug hammering into bitcoin earlier in the week.

“The singularity won’t be kind to metal superstition”. It’s hard to put it better than that.

As we approach the end of the week Nick will be saying “see, I was right”. In 20 years, he will be very wrong.

Euro-Trash

Just some light hearted fun from your friendly fiat-gulag overlords. My question is this though. Which crisis?

The 2008 financial crisis? (they are still dealing with it)

The Italian debt crisis?

The Greek economy collapse crisis?

The unemployment among the young in Southern Europe crisis?

The divergent bond yield crisis?

Shall I keep going? It’s as simple as “we will print forever” because in Europe there is always “a crisis”.