London

The driving force here is the fear that Trump will place tariffs on gold transfers back to the US. It seems unlikely but why run the risk? After all, gold in a vault is gold in a vault. As a result, the stuff is being shipped by boatload to New York.

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

It’s a little bit embarrassing because the wait to get gold is now 5 – 7 days. It’s raising the question “is the gold actually there?” No central bank ever has an audit of their gold holdings and the BoE famously sold the majority of its stash during the Gordon Brown era. The more gold moves to New York, the more the liquidity pressure in London builds. It’s not just a question then of if the Bank of England has the gold it says it has, does everybody else? If the bank starts calling in physical holdings of gold from other sources and they find themselves short, anything could happen.

It might be an interesting one to watch because not three years ago there was another crisis in the London Metal’s Market. Remember the Nickel saga? The price of Nickel surged 200% in three days and the largest market participant was basically bankrupted by it. The London Metals Exchange simply cancelled all the trades for that day, $12 billion of them. It was a massive blow to their reputation and the big winners on the other side of trade are still in court pursuing their money.

More and more in traditional markets we see this override of contract law “for the good of the market”. We saw it in 2008 on a grand scale. Then in 2022 with Nickel and again with the Credit Suisse collapse in Switzerland. In that case, the Swiss regulator ordered the write down of bonds before equity holders were wiped out. It was controversial to say the least simply turning corporate law on its head.

In unregulated markets, if someone defaults you lose your money. See FTX, Terra Luna, Mount Gox.

In regulated markets, you normally lose your money. Unless you are very, very large and then you will be bailed out and everyone else will pay. It seems to me a very bad trade indeed. Regulation seems to bring safety 99% of the time and then enormous socialised losses when things go horribly wrong.

In this case, the situation highlights the archaic nature of the yellow metal. To actually take physical possession of the stuff requires boats and security and a five day wait in London, followed by a four week boat journey, followed by sorting out safes in New York. Gold cannot compete with bitcoin on so many levels. Difficult to transport, difficult to assay, difficult to audit.

If the Bank of England actually ran out of gold though…..that really would be something. Seems unlikely but if you had gold there now you wouldn’t be feeling too good about it.

R1

It seems the world has finally woken up to DeepSeek. The press is characterising the whole thing as a battle between China and the USA. While it is true that the clever elements of the training of DeepSeek are indeed Chinese innovations, they are all open source because China gave them all away for free under an MIT licence. Unsurprisingly this has spawned lots of other very capable models trained in a similar way.

So we enter a surprising situation where the US is investing hundreds of billions in AI and China is producing similar (better) results at much lower cost. Then simply giving the whole thing away (including the model weights).

You can download the DeepSeek model here. In theory, a few months ago, this IP would have cost you several billion dollars. You can now run it locally on your machine and it will perform as well or better than the Open AI o1 which costs $200/month. The proviso being that you need a powerful enough machine to do it (which is a fully maxed out Mac Studio). Shortly though, you will be doing it on your NVIDIA DIGITS device.

The whole thing about the NVIDIA stock dropping 20%; maybe they are overvalued but the new model training method does not put NVIDIA at risk. There is absolutely no limit to the amount of compute that could be dedicated to artificial intelligence. It doesn’t matter how good the model, or how efficient the training. The more chips the better.

That is not true of OpenAI though; DeepSeek is a real issue for them because open source models are now as good and open source has a history of winning. The entire internet is run on Linux (open source). The most successful investment of the last 15 years is Bitcoin, open source money.

Expect developers across the world to keep buying Nvidia chips and delivering models that outperform the nerfed slop we have been served by OpenAI.

There is a good chance you are mightily confused at this point on which AI to use. Ethan Mollick’s recent piece should help a lot. He’s good and worth following. Sadly, most of what he writes is out of date in 90 days but that’s the pace of change at the moment.

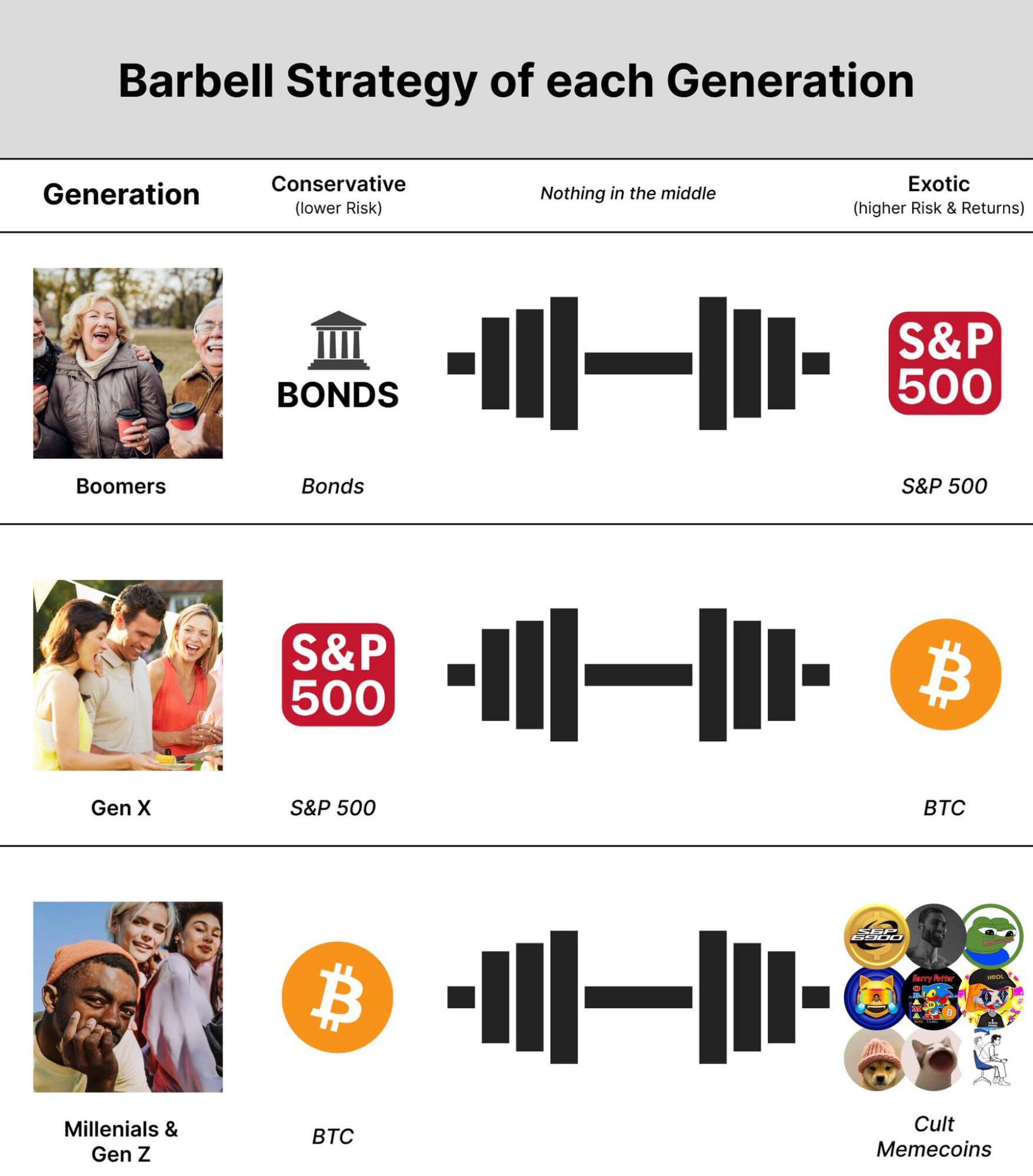

Barbell

This graphic appeared on X through the week and was meant to be a joke. Except, the more I looked at it the more it’s true. The Boomer generation are very much bonds and equities and it has done well for them. The Gen X’ers, who we hardly hear from because they are busy running the world, are equities and some bitcoin. Everyone after them has a default allocation to bitcoin. Part one is true, part two is a bit true and part three probably isn’t true at all, which I guess is the essence of the joke.

All told though, it accurately depicts the risk perception of bitcoin across generations. Older people believe it to be very risky; they are right in some ways because they have on average less time. As we move down the curve younger people don’t think bitcoin is risky and include it long term in their portfolios. Clearly, if you are prepared to lose 60% of your savings on TRUMP coin because it’s “fun”, then you aren’t that worried about bitcoin volatility.

I think it’s absolutely true that the younger you are the less risky you perceive bitcoin to be. As a consequence flows to bitcoin are only going to increase with time.

Just like the S&P went from exotic to not and dominated flows. Bitcoin will go from exotic to not and dominate flows.

What’s your investment strategy?

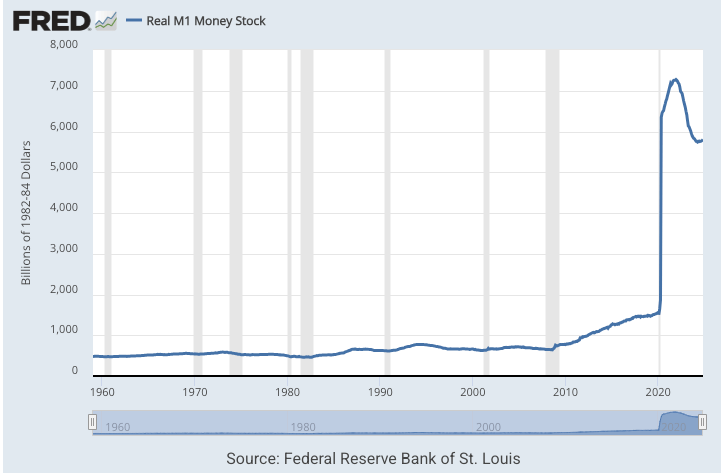

The M1 money stock is cash and bank deposits immediately at call. Basically the denominator of what you get paid in. It’s no exaggeration to suggest that rather a lot of this has been created in recent years (5x in 5 years). The trick will be what happens next, the worm has recently turned upwards again.

I don’t want to dwell on the chart too much other than to say my expectation for 2025 – 2030 is the complete collapse of real wages. If so, this chart will start shooting upwards again as money is simply given away for want of other options.

Why? Because the thing that you have, the only thing that you and I really have, is our intelligence and that intelligence is now a commodity. An appropriate investment strategy for the next five years might be to buy scarce things and get unbelievably good with the new AI toys. Human+AI will beat any AI. At least for a while.

In the famous Human v AI Go series, Lee Seedol played Google’s DeepMind. It hammered him for three games, he then won game 4. It’s kind of unbelievable that he did that. Aside from anything else, all professional Go players are now a lot better than they were before DeepMind came along. Because? They use it, they practice with it.

Everyone that wants to stay competitive and relevant in the modern workforce will have to do the same. A capable person with an excellent grasp of computing and AI capability is a match for pretty much anyone else now.

Euro-Trash

The Lámfalussy Sándor Award may be awarded to outstanding financial and economic professionals who performed internationally acclaimed professional work, scientific publications or educational work that have a major long-term impact on the development of Hungarian and international monetary policy, economics and the professional community.

It beggars belief that Lagarde has won this. Lámfalussy was a Hungarian economist and Hungary is currently resisting joining the Euro because of its massive underperformance versus everything else. At the very same conference were Lagarde collected her award the Hungarian Prime Minister had this to say:

“It is the European Union that is isolated, not Hungary. We are walking on the main street of history, while the EU is stumbling somewhere in the muddy backstreets”

Sure, the Hungarian Prime Minister is a controversial figure (look him up) but on this particular score is he wrong? The EU economy is now 50% smaller versus the USA compared to the day the Euro launched. The population of Europe is ageing quickly because young people leave as soon as they can. Most of that can be traced to political policy. They have absolutely no clue how to get out of the mess they are, they appear completely adrift.

Lagarde has contributed almost nothing to monetary policy. Point to something? Anything? Yet somehow she wins some international prize for her brilliance.

If that were not enough Ms Lagarde won another award this week.

Can’t wait for April then. We’ll get another “leckshure” about the fight against inflation and the history of Europe and move on. The 600 attendees will fawn over her; apparently ignoring the economic disaster zone that surrounds them. It’s becoming weird frankly.

The list of previous winners of the “prestigious” Sutherland Award will make you wince too. It includes recently sacked Facebook employee and Euro-wimp Nick Clegg and the man most directly responsible for the calamity the UK and Europe now find themselves in, Hank “2008” Paulson. Perhaps fitting company for one of the most risible yet lauded Central Bankers ever.