Terra update

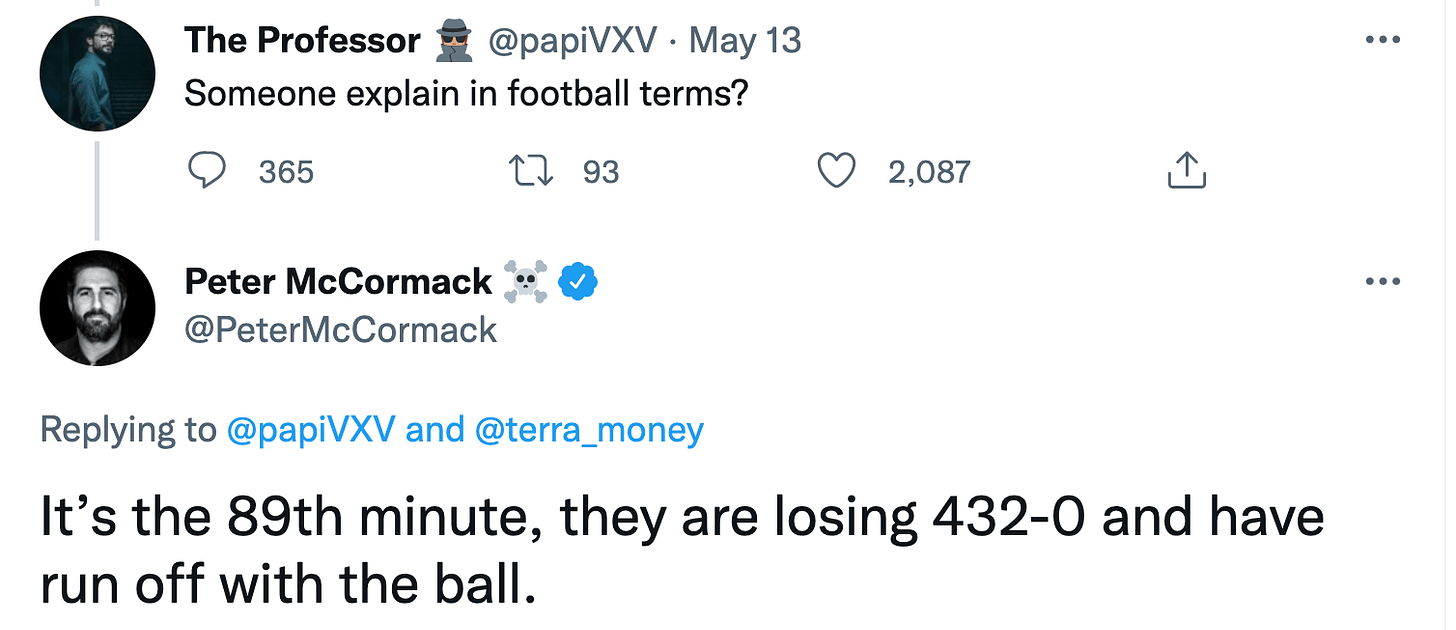

Many of us are struggling with the complexity of the collapse of the Terra stablecoin. A rather simple explanation was provided in the week clarifying matters:

What else could go wrong?

Actually, quite a lot. Here are three other things that would be viewed as existential threats to the sector, when in fact they simply prove the core value of decentralisation.

1. An outright ban on private stablecoins

This actually seems like the natural response to the Terra debacle. The issue of course is that coordinating this internationally is hard. The week has been awash with opinion pieces about Tether losing its peg for example, because Tether remains the most robust and largest stablecoin to date.

Let’s assume such a policy succeeds. Tether is worth $75 billion and most of that money is not going back into fiat. It will flow into Bitcoin, whose price could react quite remarkably.

I suspect monetary authorities are aware of this and they tread quite carefully when it comes to Tether, following their settlement with the New York Attorney General a few years back (Tether basically won that argument).

So, in the immediate short term it would result in a massive short squeeze. Longer term it hammers home the power of truly decentralised assets (of which there is really only one).

Likelihood: High. However, Tether will likely always be legal in some jurisdictions and so probably survives.

2. A technical issue with Ethereum

Before I begin, our fund owns Ethereum. However, our position size takes into account the very real risks, which we view as primarily technical. Firstly, Ethereum cannot scale as it stands. Secondly, the proposed solution is not clear to us.

Eight years into the journey and you won’t really be able to find anyone that can coherently explain the technical journey this asset is on. I don’t view that as terminal, but I do view it as fundamentally different and more risky than bitcoin.

If anything bad happens to Ethereum in their technical upgrades this year they will be able to roll back but probably not before lots of DeFi projects that rely on it get killed in a liquidity crush.

The worst case scenario here is that something really bad happens in the upgrades but the weakness isn’t exploited for six months (which would prevent roll-back). A real danger. Indeed, even the consideration of a roll-back is the antithesis of the whole sector, but Ethereum does have form there.

Likelihood: Low, but some form of mini disaster on moving to proof-of-stake is likely and will cascade through DeFi projects.

3. A carbon tax on bitcoin transactions

The prevailing narrative, particularly in Europe, is that proof-of-work assets are an environmental bad. Therefore taxing those transactions is good. You can see the groundwork in Europe for this happening because they are effectively banning exchanges there from sending assets to self hosted wallets unless they KYC the owner and understand what the owner wishes to do with the asset (also, entirely coincidentally, they will be able to tax that person). Bitcoin in Europe would under such proposals live within the walled gardens of regulated exchanges.

Likelihood: High. However, it will be a giant failure and simply render all European participants in this sector redundant. It won’t make the asset itself less investable though, simply it will exist within regulated vehicles under the purview of Euro-regulators. It’s the kind of bonkers policy that eventually collapses under its own weight.

Crucially, all three examples demonstrate one thing. Decentralisation is the invention. In each example above, true decentralisation prevents government intervention, makes changing software extremely difficult and resists taxation.

Which is why bitcoin remains the number one pick in the space. It has no leader. It cannot be stopped. Globally, I think regulators are acutely aware that every move they make against it is an advertisement for its resilience. My expectation is that non-bitcoin assets get hammered with regulation and they tread extremely carefully otherwise.

If any or all of these three happen, people will panic, and we will buy bitcoin.

Safe assets

The obituaries have started to roll, led by one of Australia’s well-known bond fund managers, who has been utterly relentless in his delight. We counted over 10 articles and 50 posts on social media that were about ‘crypto’. He wrote nothing about bonds. Nothing.

That’s because the performance of those bond funds is a total disaster for investors who often allocate over 50% of their portfolio to them.

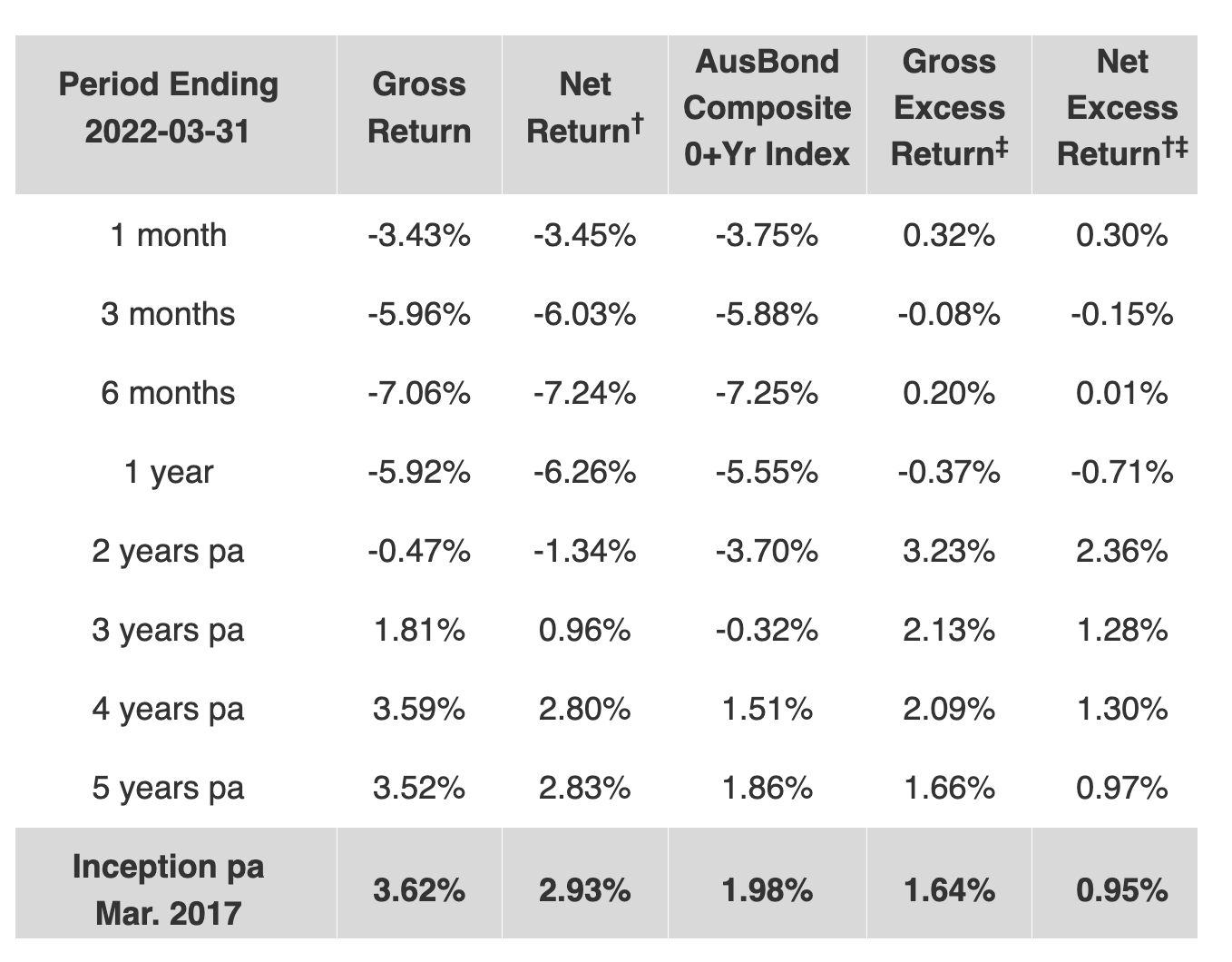

Here are the fund manager’s returns on their “Active Composite Bond Hedge Fund”. The fund offers a “relative return fixed-income strategy focused on mispricings in government and corporate bond markets”. The performance objective is to outperform the Bloomberg AusBond Composite 0+ Yr Index over rolling 12 month periods by 1-2%.

This fund has materially underperformed inflation and almost every other asset class as well. More recently of course, for such a stable asset, 7% losses over 6 months are not good and could take a very long time to recover. Running against 8% inflation, bond investors are going to get a lot poorer.

I’m not for a moment suggesting our fund is comparable, as ours is vastly more risky. But in four years we have returned our investors a five fold (5x) increase in portfolio value net of fees. Yet, Australia’s “most respected managers” do nothing but pour scorn and fire on our sector while they massively underperform. Which is why they almost never talk about their own funds. Neither would I.

How can you be in a bond fund for two years and end up with less money?

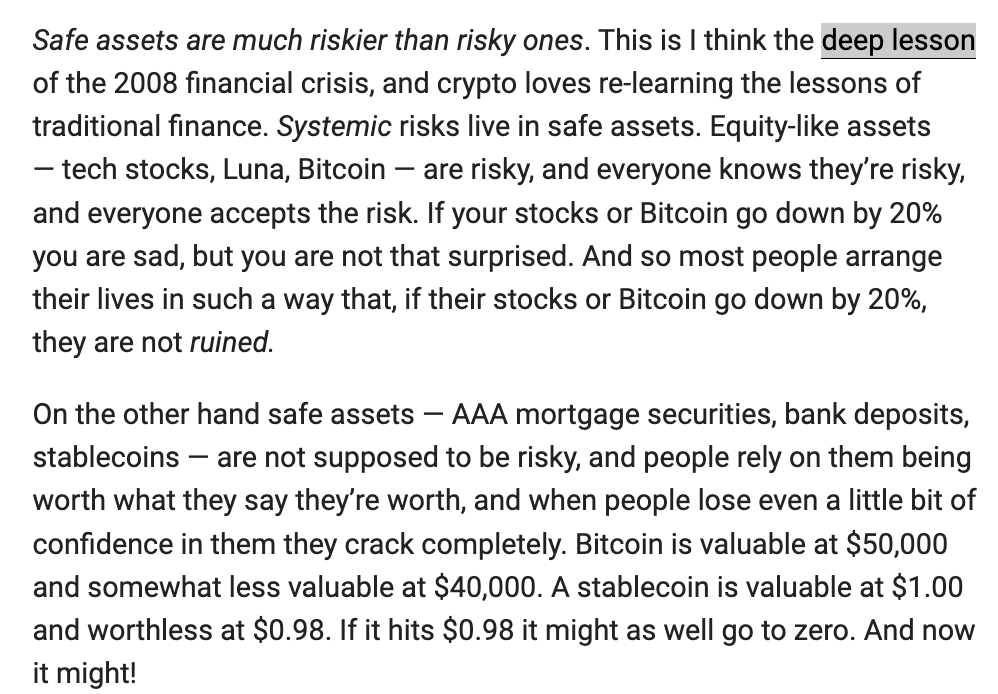

Matt Levine of Bloomberg made the following excellent point this week about risky versus ‘safe’ assets.

The real concern in environments like these is these ‘safe’ assets. So much portfolio weight is allocated to supposedly safe sectors that are not safe at all. When downswings come they are vastly more painful in the safe sectors than they are in ours.

The HODLRs

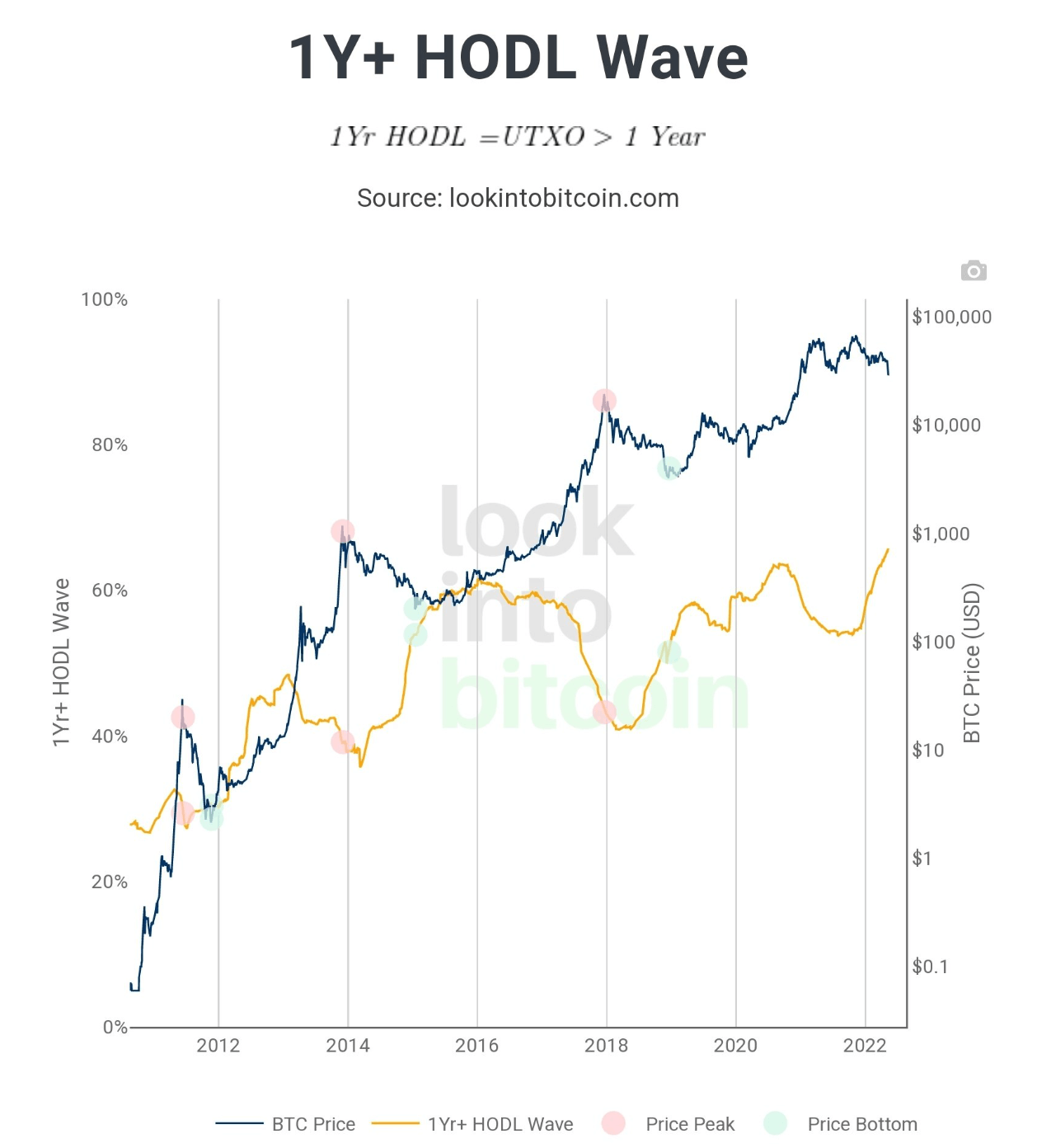

What have bitcoin investors done in the last two weeks? Interestingly, almost nothing. Nearly 90% of the movement in assets in the last two weeks (exchange addresses excepted) has come from wallets with less than 12 months involvement. Most likely because they are making a loss and have panicked.

The one year HODL Wave is now at all time highs. As with all markets, it is the marginal seller that sets the price. That’s all that matters in markets like these but there are an awful lot of bitcoin that weren’t for sale at $69k and still aren’t for sale now (more than 60% of supply).

Bitcoin is not like cash; the asset gets more valuable with time, not less. This chart simply shows people learning that lesson.

Euro-trash

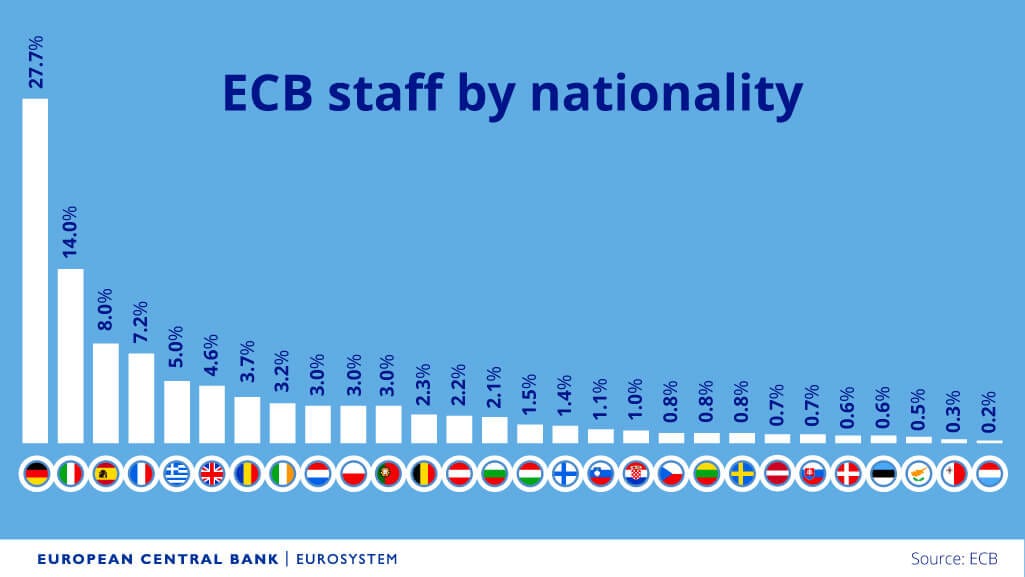

Amid economic crisis, the ECB has been busy showcasing its diversity. I must say, I found this chart rather Germanic. What’s more, there would appear to be zero non-EU nationals at the ECB which probably isn’t diverse at all.

Anyway, we are all biased one way or the other. A terrific example provided by Christine herself recently. Two exhibits; first a slightly underwhelmed photo congratulating her “dear colleague” Jerome Powell who was confirmed into his second term by the US Senate.

Second, a rather more animated level of pleasure for the French President on his recent victory.

National bias is real in Europe but the country that pays all the bills dominates the bank. Not a criticism, a simple observation.