I told you so!

Everyone who says I told you so. Didn’t.

A quarter to forget (or remember)

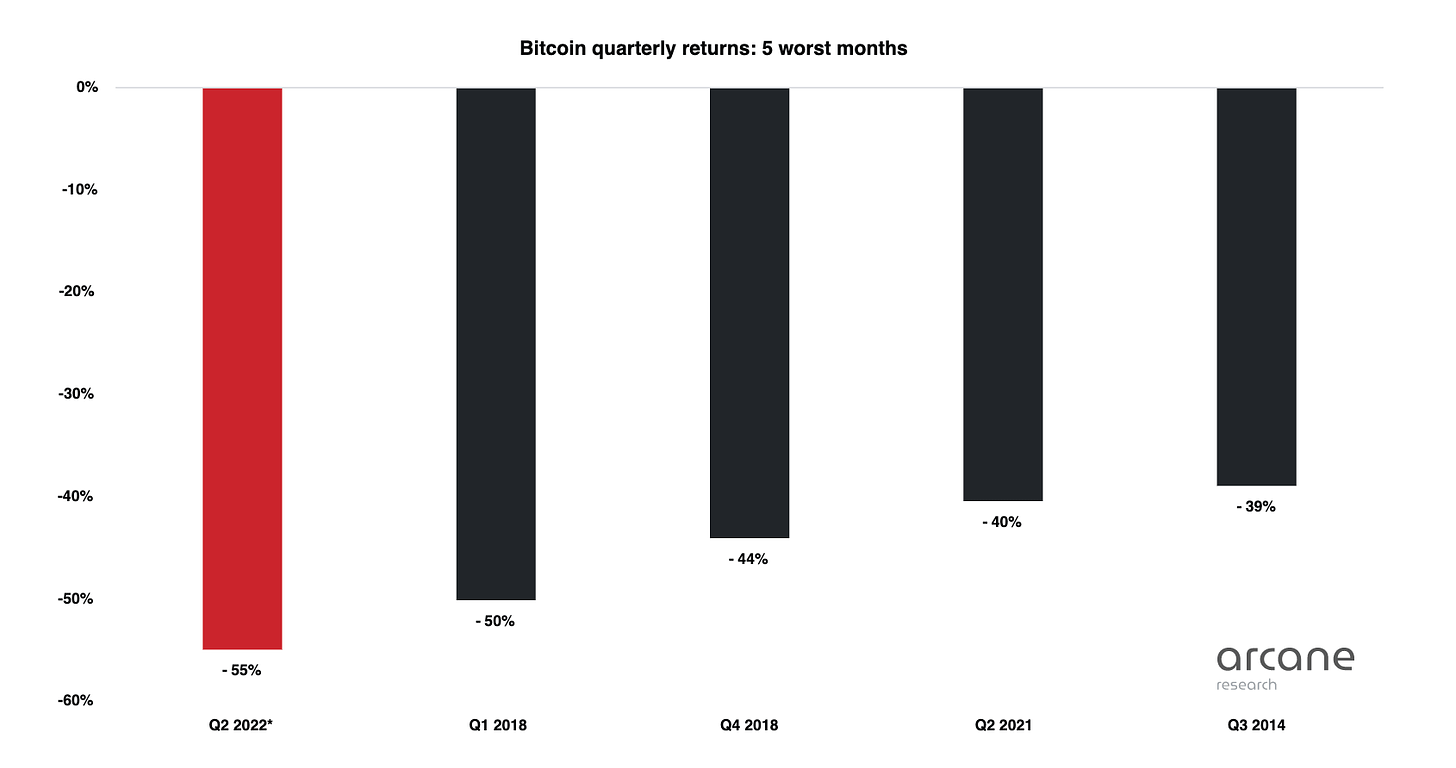

Quite something this last quarter. Massive collapses in DeFi, massive liquidations across the sector and the price movement proves it. Below are the five worst quarters in bitcoin’s history:

Our fund has operated through four of these five quarters. Yet, we have outperformed the NASDAQ, the ASX200, Gold, Apple, Google and nearly every equity fund in the country.

Still, we can’t pretend the last few months have been fun. They haven’t.

One question that does come up in quarters like this is “why don’t you go short?” For example, we had a high degree of confidence that lots of the DeFi sector would struggle.

The answer is simple. We have two vectors that work for us, quality assets and time.

In going short, you need to be right about quality and timing. It would have been tempting (and accurate) to short Celcius from about $3. It went to $8, then it reached 32 cents before recovering a bit.

Another “obvious” short would have been HEX. It spiked to 18 cents mid last year in what looked like a very obvious scam. It is now 3 cents and falling for a very profitable trade; except that on the way through it reached 50 cents.

You can be very right going short and bankrupt while you’re at it.

Real markets

In real markets people go bankrupt. That is the cycle of creative destruction. Excessive risk has a price.

In fake markets, there is intervention. Systemic risk is not allowed to die in giant explosions and a great deal of things are done ‘for your safety’ but really at your cost long-term.

Several recent examples are Quantitative Easing, Yield Curve Control (which spectacularly failed in Australia), and the suspension of trading on the London Metals Exchange coupled with the effective bail out of a large market participant.

This week in Australia, yet another. The spot market for electricity was suspended by the regulator because the price of energy was too high.

The statement can be found here. It reads rather like something from the Soviet Union.

The market suspension is ‘temporary’, and will be reviewed daily for each NEM region. When conditions change, and AEMO is able to resume operating the market under normal rules, it will do so as soon as practical.

Nothing is more concerning than ‘temporary’ measures from politicised bodies. I suspect these measures will be permanently recurring in their temporary nature.

I note the victory laps of those in the bond market, the housing market and the energy market about the recent price clearing movements in bitcoin. A market that trades 24/7 without suspension or intervention. A market that clears at the prevailing price, whatever it is.

All markets clear in the end. You cannot avoid it, even with printed money.

Bearer bonds

The unending negative press for bitcoin is also accompanied by the widespread promotion of central bank digital currencies (CBDCs) by all the major banks. Jay Powell was quite open about the need for a digital currency to maintain the relevance of the US dollar last week and the ECB has stepped up its campaign on why such a tool is needed. In China, it is a matter of when.

A CBDC is quite different from the currency we know today. It would be the same as each person having a bank account with their own central bank. It is profoundly negative for retail banks. The ultimate form of these currencies is still under discussion but this is no small change; it’s a wholesale restructure of finance.

Launching his own advertising campaign this week was the General Manager of the Bank for International Settlements, Agustin Carstens. He had this to say:

“My main message today is simple: the soul of money belongs neither to a big tech nor to an anonymous ledger.”

Fascinating. So death to Meta Platforms and their attempt to create money, and a shot across the bows of Apple and others. Indeed, we have already seen Meta back down completely from their proposed Libra coin. More importantly for us, the concept of holding digital currency independently on a ledger or laptop will come under attack in coming months.

“The soul of money is trust.”

No. The ideal money requires no trust. Indeed the very problem bitcoin solved was one of trust. In traditional finance, I need to trust that your bank will pay my bank. I need to trust that the central bank will not inflate the money supply. I need to trust that my value will not be destroyed by politics.

Anyone who still trusts their central bank is either a fool or a politician.

The ideal money requires that I can independently verify all that I need to transact with you, while not trusting you or anyone else at all.

This particular statement from Agustin is precisely why over the next decade or so he is going to lose in a spectacular way.

“Central banks have been and continue to be the institutions best placed to provide trust in the digital age.”

No. Central banks are in fact a political creation. They are not required for the function of the economy at all. In particular they are redundant in the digital age; never before have they had to advertise in this way. It is telling that they now need to.

Euro-Trash

It is with some concern then that I note the ECB has stepped up its French press releases. Despite my very weak French, I’ve had a go at translating.

“Something about inflation. I use Nivea sun cream, 2% strength. I will be even more tanned in the medium term.”

In other Lagarde news, to my shock and horror, she received an honorary degree this week from the London School of Economics, where I attended university.

I take comfort in the fact that the honorary degrees are pretend and require nothing more than a $10 taxi ride across the city. Still, I’m a bit miffed.

It’s not the first time French infamy has hit the university. International terrorist and French prison resident Carlos the Jackal also failed to get a real degree at the university in the 1960s. He went on to cause great destruction before being convicted of serious crimes. History rhymes.