$100k is hard

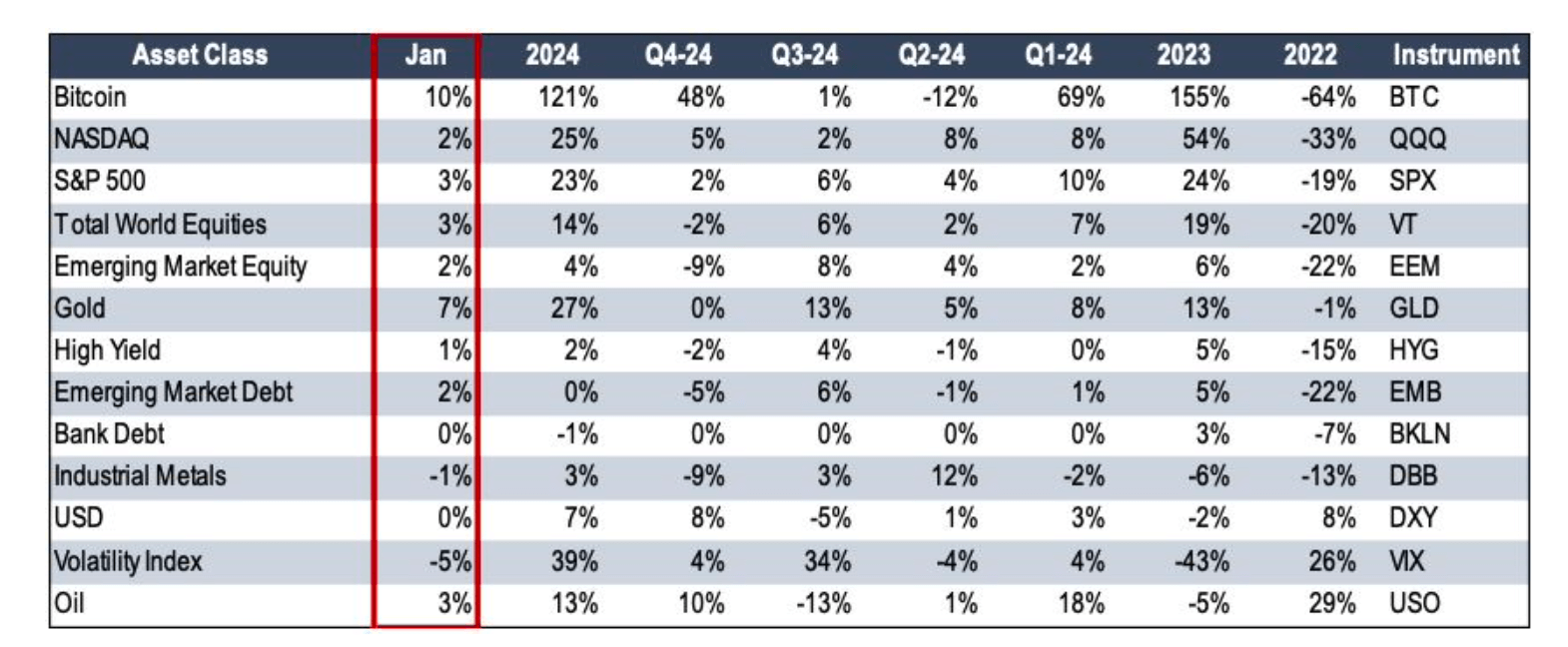

The sustainable break beyond $100k was always going to take time. It’s such an important psychological level that once it does fall, it should be far easier to progress. That we are feeling disappointed in the mid-90s (or perhaps bored) is rather encouraging when you look at overall performance versus other asset groups.

January didn’t feel good even though it was ok. February (historically a good month) has been a tariff ridden roller coaster, despite them having very little fundamental relevance to bitcoin or the sector.

The main point though is relative returns. In the longer time frame they are excellent and the only thing that matters. Take labour, my favourite topic; the relative returns to labour are falling fast.

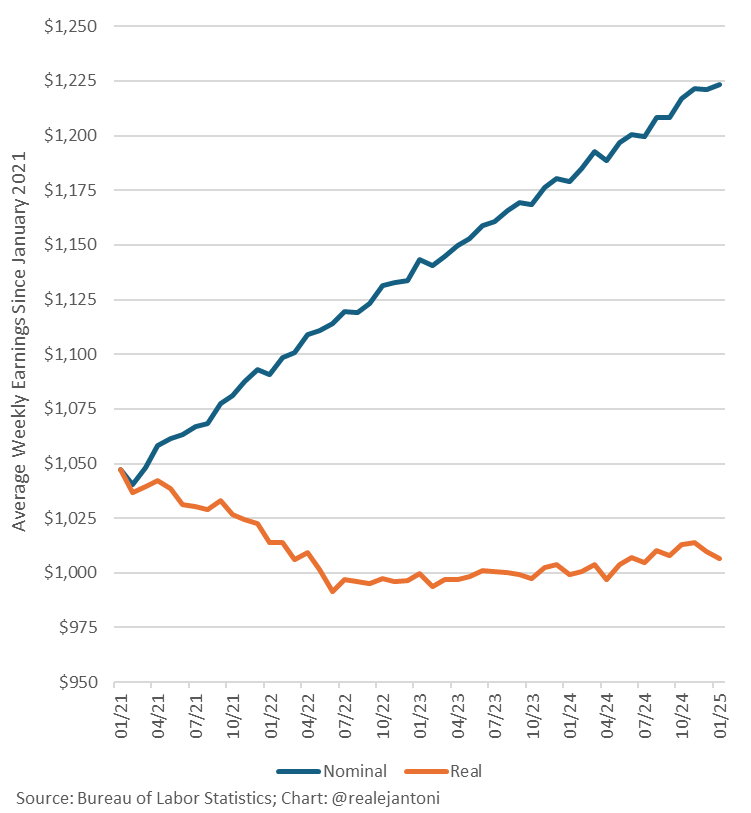

Despite a steady nominal rise in wages since 2021 to keep everyone feeling good, real wages have fallen. Since the beginning of 2024 that fall has resumed. These numbers are directly from the US Bureau of Statistics (although the chart is not), so the fall in real wages is likely much worse.

I remain of the view that the returns to labour over the next 10 years are going to collapse. In fact they are heading directly towards zero.

For those that don’t believe that, which at present feels like everyone, I strongly suggest reading this. Arm yourself with the tools, choose the relatively rising, inflation protected assets.

The Good, the Bad and the Ugly.

The bad; new European regulations (naturally) called MICA (markets in crypto asset regulation). The short version here is that Europe does not like stablecoins. Clearly people do though, Tether now holds more US Treasuries than Germany. Despite the very obvious demand, exchanges have delisted their stablecoins in order to make sure they can continue to operate in Europe. It helps absolutely nobody because the assets are in huge demand around the world and Europeans will now have to find other ways to access them.

Coinbase delisted theirs in January, as did Binance and others. The Stablecoin market in Europe is now dead, but regulated.

Second, the US. A bit ugly this. A detailed bill has been put before Congress for the regulation of stablecoins, particularly those denominated in USD. The bill requires 100% asset backing, AML compliance and interestingly is described as being a tool to “create demand for US Treasuries”. Quite the admission in fact. There are a lot of US Treasuries to sell and if you can do it through something for which there is a lot of demand around the world, then do it.

The new US Crypto Czar David Sacks, had this to say:

“Legislators are going to take up stablecoins first and then market structure will follow very quickly.”

“So I think there’s a pretty good chance we can get this done in the next six months.”

The trick will be to make the structure workable so it doesn’t kill the entire industry as Europe just did. Most likely this has been understood in the US because they have been handed one of the biggest free lunches of all time by MICA. A highly liquid vehicle through which to disseminate their dollars across the world.

Finally, the good. Outside of the regulatory sphere we have the launch this week of “Legacy Mesh”. Tether exists on multiple networks at present (Ethereum, Tron etc). Legacy Mesh enables swift exchange between those host networks effectively binding the Tether network together. The best explanation is likely to be found by using it. It’s a significant step because it also allows the introduction of new networks to Tether, like TON coin. TON is the native asset of the chat app Telegram. It has 1 billion users who will shortly be able to use USDt. It is a very significant distribution network. Specifically, India has by far the most telegram users, Indonesia is third.

Tether market cap is now $142 billion. They are heading for a quarter of a trillion now. As far as being a US creditor goes, they are as significant as most major nations. Could have all been in Euros but it will be dollars all the way.

Japan

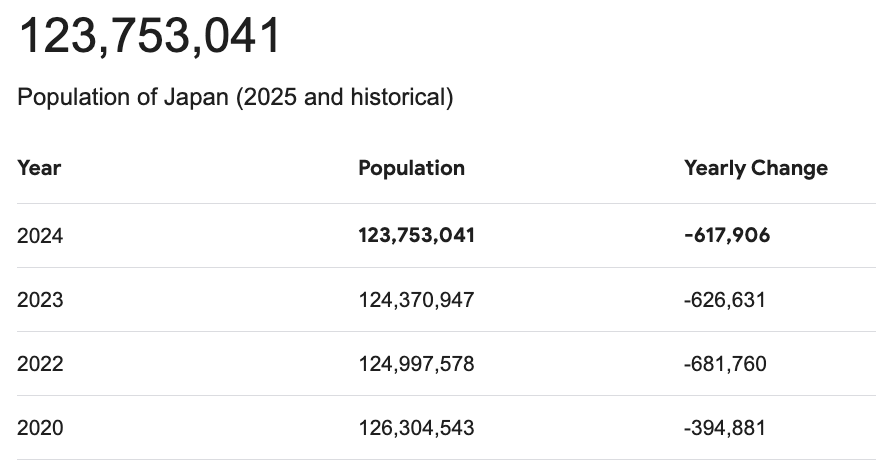

Still the third largest economy in the world and we hardly hear from them at all these days. The great tragedy of Japan is it now loses 600,000 people every year due to its declining birth rate. 1.26 births per woman and in the capital, it sits at 0.99.

Japan never really did or does anything for young people. It seems (at least from the outside) that the strict hierarchy of age worship is now reaching its natural conclusion. In typical fashion Japan was very slow to adopt cryptocurrency. Young people liked it, old people didn’t, so it went nowhere.The net result being any gains on crypto assets were taxed at an eye watering 55% when stocks were taxed at 20%.

All that is beginning to change though. Japan’s Financial Services Agency (FSA) is “considering lifting the ban on Bitcoin ETFs and reducing the tax burden on crypto investors”. It won’t happen quickly though, the policy update is due in June this year and if it goes forward would be approved mid-2026.

Even so, it’s a large economy with a huge capital base and having a regulator as conservative as this move in our direction is quite something.

Perhaps worth noting too that if there is something out there that is going to attract the kind of premium bitcoin does (because it’s scarce), it’s young people. The pendulum is starting to swing back their way.

Alt Coin Market

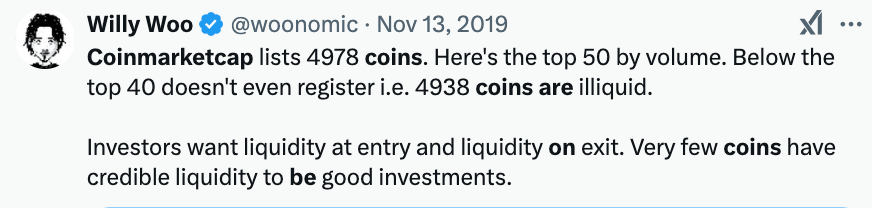

That was 2019 and it was true. In reality back then, outside of the top 10 there was no meaningful liquidity.

I would argue that today is much worse. The sector is significantly larger but it is dominated by the winners. There are now 11.2 million coins (yes, million) listed on CoinMarketCap. It grows every day.

Most of them are garbage, at least 99% of them in fact They compete with other garbage for social media share, and liquidity. Really, the only people making money out of them are the exchanges that list them. That’s why I would rather own exchange tokens than the tokens the exchanges sell.

For this reason, when we are asked “what do you think of this coin/token” which happens a lot, my instant reaction is “it’s going to zero”. Most of the time that will be true.

Euro-Trash

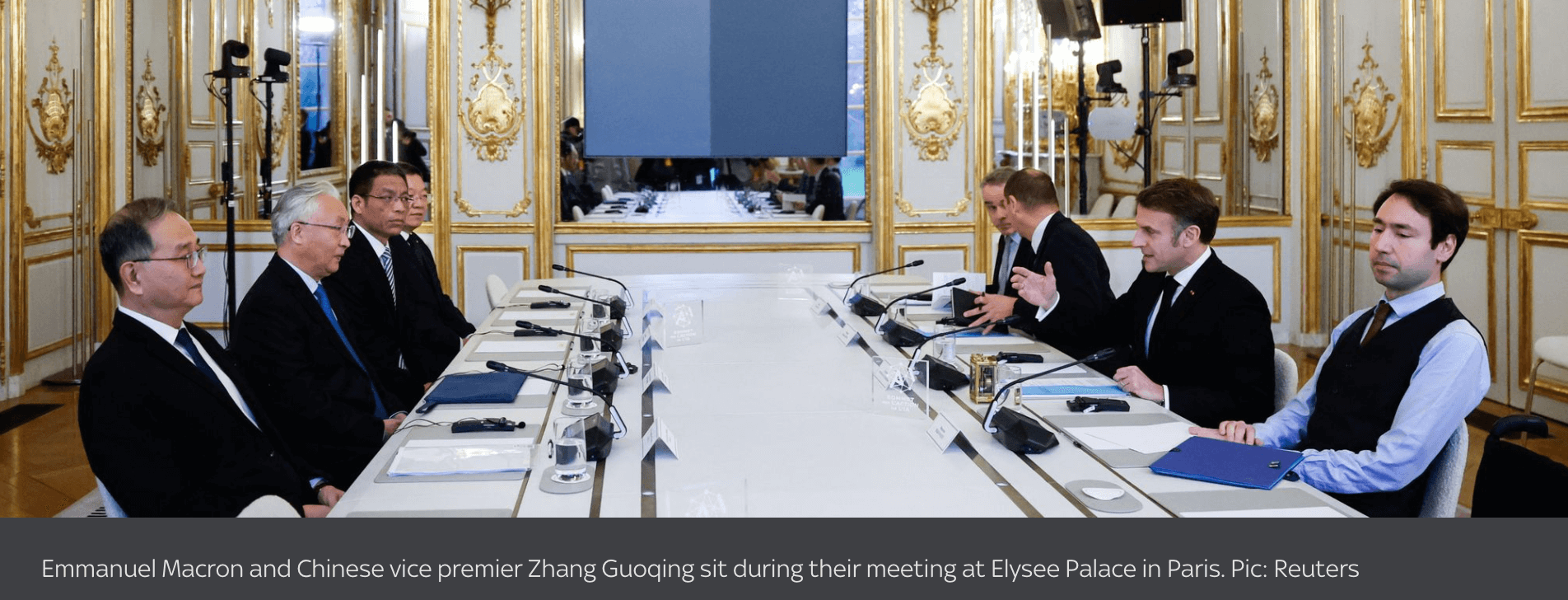

Of all the places to host an AI Summit! Europe. To be fair to hosts France, the summit was very well attended. US Vice President Vance, Chinese Vice Premier Zhang Guoqing. It was co-chaired by Indian Prime Minster Narendra Modi. So, short of Xi and Trump themselves attending, you couldn’t do much better.

The problem though is very much that: Xi and Trump were not there. A short review of the summit’s objectives says it all.

The final statement was a masterpiece, including the mandatory

“We recognize the need for inclusive multistakeholder dialogues”

What?

Frankly though it does not matter what they signed. Trump is already committed to being the leader in AI by having “the best chips and the most energy”. He has revoked Biden’s Executive Order on AI guard rails. We are about to see American models that surpass anything we have seen yet. Predictably, America refused to sign the statement (although China did).

The moment Trump moved on AI a few weeks back, China (who do not have the best chips) released DeepSeek which turned out to be unbelievably good. It also undercut a lot of US IP because the Chinese fully open sourced their discoveries. It was a big moment.

Trump said DeepSeek was a “ wake-up call ” for the U.S. tech industry. His AI advisor David Sacks accused DeepSeek of training its model on stolen OpenAI data. I mean, so what? Where did all OpenAI’s data come from after all.

The United States clearly respects its adversary here and intends to beat them. There is an AI space race on. That race is between the United States and China, everybody else is a passenger. That is quite obvious because every other nation is willing to make sacrifices in Paris because they have almost nothing to lose. The Europeans regulated AI out of existence before it got going. The UK Prime Minister didn’t even turn up this week because the UK launched its AI plan three weeks ago. It’s here and is a word salad of nothingness.

The one exception to all of this is government data. The government has an awful lot of data which is tremendously powerful for training AI and hard to get hold of. Imagine you could get hold of every x-ray ever. It would be a very short while to train a model that could correctly diagnose medical issues at a rate of accuracy no medical professional could hope to achieve. The same is true of cancer scans etc.

If one good thing were to come from this week it would be to give us the data. The summit is in Europe though, they throw up barriers instead of bringing them down as they claim to do.

I would venture that the countries with the tech (US and China) have already secretly done this. They understand the economic value of curing disease and they will happily sell the output to Europe and the rest of us.

The photo says it all. The Chinese leaders look bemused “why are we here?”. These people have no AI, they have no IP, they don’t even have the energy to power the data centres?

The US and China are going to make a lot of scientific progress in the next two years. I doubt there is a limit to what they will invest or do to make that happen. No summit in Paris or anywhere else is going to stop that.

Europe missed the train. Again.