April Fool

Exxon Mobil

We mentioned last week the likelihood of energy producers and bitcoin miners merging over the coming years. As if by magic, Exxon Mobil (the world’s largest energy producer) revealed they are now using flared gas to mine bitcoin. As it turns out, the project has been running in secret for over a year and has been so successful it is now being expanded. The project partner, Crusoe Energy, claims that the process reduces overall CO2 emissions by up to 60% compared to the traditional flaring of gas and is consuming 18 million cubic feet of gas that would otherwise have been flared. Exxon claims they’re not in it for profit, purely just to reduce their environmental footprint. I suspect they’ve now realised that it is profitable and worth pursuing at other locations.

It’s pretty straightforward actually; anybody that flares gas is throwing money out of the window. Not only that, by using this technology there is a meaningful reduction in climate emissions. As far as ESG is concerned you can’t do much better than this, although it is doubtful that the narrative will run like that.

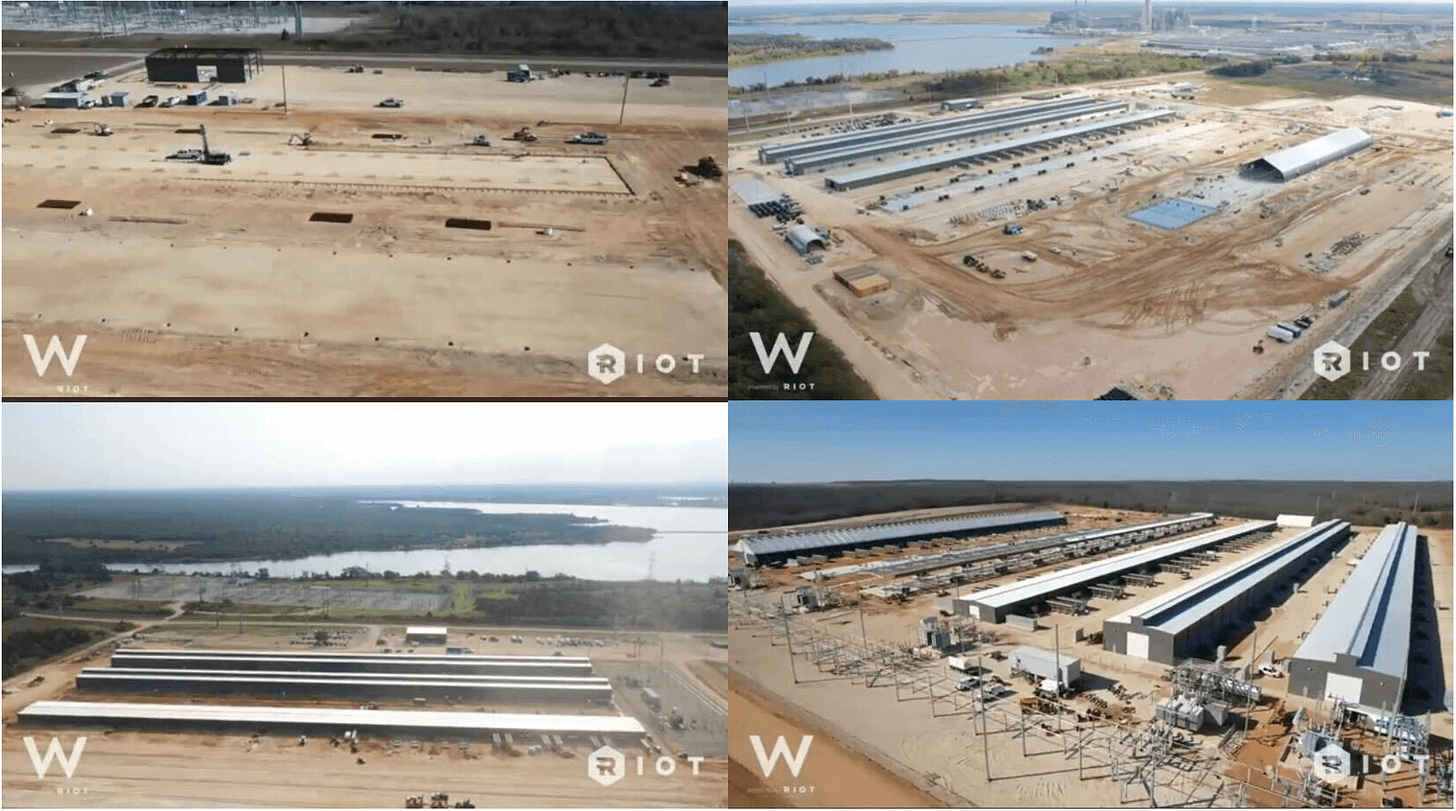

A lot has changed in a year. 12 months ago we were running into the Chinese mining ban, a massive strategic advantage was surrendered by that government. The Americans haven’t hesitated since then, with mining absolutely booming in the USA such that they’re becoming the dominant nation for hashpower. Their share of global hash is now upwards of 35%, their largest energy producer is mining bitcoin and their largest chip manufacturer, Intel, is designing chips expressly for mining bitcoin.

Take a look at the latest developments from Riot Blockchain (a NASDAQ listed miner); from dirt to massive mining facility in months. It’s a serious, and risky, business that most of the world doesn’t even know exists.

Tough times on the LME for the past few weeks, with numerous trading suspensions particularly in the Nickel market. Since trading resumed on March 16, Nickel had four limit-down days and two limit-up days, briefly interrupted by a day of almost normal trading on March 22.

We have pointed out before that the amount of intervention (you might call it manipulation) in long-established markets is very high indeed. The largest market of all, the bond market, has experienced an unprecedented manipulation for the last 30 years. Starting in Japan, through Europe and into the US via quantitative easing. Essentially, government agencies have been buying up their own debt to prop up the price of bonds. This is not commonly referred to as a market intervention but it’s hard to argue that it’s anything else.

There are very few markets where open and free price discovery actually occurs. I make this point frequently; bitcoin trades 24/7 unlike almost everything else. It has now racked up more trading hours than the NASDAQ in all its history. There is no regulator, no intervention and no preservation mechanism when selling or buying starts in earnest. The market definitively sets the price.

The whole Nickel market, bond market thing makes a complete mockery of the SEC blocking a bitcoin ETF. The essence of the their reasoning remains the same each time:

“the requirement that the rules of a national securities exchange be ‘designed to prevent fraudulent and manipulative acts and practices’ and ‘to protect investors and the public interest,’”

It’s worth pointing out that there are numerous Nickel ETFs throughout the world including on the US exchanges. Nickel; which cannot currently trade without suspension, in which market makers and regulators intervene to protect producers who can’t deliver to short contracts to prevent cascading bankruptcy. It also directly defrauds those people who would benefit from that bankruptcy, for example put option holders and others holding short positions.

A small sample of these Nickel ETFs are given here.

- iPath Bloomberg Nickel Subindex Total Return (JJN)

- VanEck Vectors Nickel ETF (GMET)

- Global X Nickel Miners ETF (NIK)

There are even more bond ETFs of course. The most manipulated market in history is the one best served by SEC approved retail investor vehicles.

For whatever reason, our industry is held to a much higher standard than almost every other. Long term, that will be a good thing but watching the Nickel market unravelling is becoming a very bad joke on the SEC.

By the time a bitcoin ETF does launch, investors will have been ‘protected’ from several orders of magnitude of gains they could otherwise have enjoyed.

As a customer you might feel somewhat violated on receiving an email like this. If you wish to spend $1,000 of your own money, the Canadian government would like to know the name and address of the recipient. This sounds like some form of bizarre overreach but in traditional banking it’s a trivial matter for a bank or government to identify the recipient; hence the war on cash transactions where such tracking is harder.

This kind of regulation is not limited to Canada; the European Union this week is considering legislation that will require exchanges to identify the owner of what are identified in Europe as “un-hosted wallets”.

So, if you host your own digital assets on your own computer, that means you. It is a direct attack on financial sovereignty. There is a very clear directive from governments that individuals should not be able to transact value in an entirely private way. You might reasonably ask why? The arguments around privacy and individual rights run deep, we need not delve into them here.

Know Your Customer extends only as far as the exit door from traditional financial institutions. It is the door governments seek to close. In banking, the exit door is withdrawing to cash. Once money becomes physical cash nobody can trace it and once cryptocurrency goes from a wallet hosted by a regulated business to a personally hosted wallet, that’s the exit door too, and it becomes harder to trace (easier than cash though).

In general, there is support among the public for this kind of legislation. The government posits; “is it not helpful that we know that criminals are using cash or digital assets for nefarious purposes?” The answer of course is yes, hence the public support. However, if the question were framed properly the answer would likely be different. “Do you agree that we should surveil every financial transaction, including yours, in the hope of catching a criminal?”.

The fact is, no criminal ever answers the KYC questions honestly. It’s a gigantic administrative burden for honest people that dishonest people totally ignore, making the whole thing a facade.

Which person ever withdrew $10,000 from their bank and on being asked what the money is for says; “I’ve just organised the murder of a close colleague and this is a downpayment, thanks for asking.”

We know this is true because despite endless tomes of regulation, one of the biggest launderers of Mexican drug cartel money was good old HSBC, one of the world’s largest banks. They paid a $2 billion fine and nobody went to jail, because, you know, they were only facilitating mass death and addiction across the globe and it was no big deal. Not some story from the 1980s either, it was last year!

The whole thing about the $1,000 transfers is a joke in Canada and it will be a joke in Europe. I say, give them what they want. If we have to pretend that these rules actually do something, then that’s what we have to do. Everybody knows it’s pretend and so we all just pretend and move on.

Energy price pressure is building in Europe, and as usual, the pain is being felt mostly in the southern states. At last week’s meeting of EU leaders, Spain and Portugal were given the go ahead to introduce price caps for energy to relieve the pressure on their citizens.

It is an extraordinary measure indeed, because who foots the bill? If price caps are introduced and Iberian wholesalers start making a loss, there will be even less energy to distribute and surely that cannot represent a long term solution.

EU leaders also agreed that they will commonly purchase gas in the market ahead of next winter on the assumption that the buying power of the combined block is much greater than each country on its own. They referenced the “success” of the joint purchases of covid vaccines which, you will recall, was an unmitigated disaster on a truly European scale.

In any event, the merger of Europe into a supra-national state continues. For those freezing in the chilly mountains above Granada, rest assured your interests are being properly represented by the Eurocrats you have never met, have never seen and never will.