The magic of forecasting

That cartoon is from the early 1980s; not much changes.

On that theme, the whole market took a dive last week as Jerome Powell reaffirmed his commitment to higher interest rates and fighting inflation. He couldn’t really say anything else though, could he?

The strange thing is the Federal Reserve now has the following forecasts:

- Interest rates are going up

- They are staying up until inflation comes down

- No recession forecast

- No material increase in unemployment forecast

How all things simultaneously happen is anyone’s guess. The better guess is that they won’t.

DALL-E 2

There is genuine excitement in the tech world with serious progress being made in Artificial Intelligence. DALL-E 2 is one of a number AI projects that allows users to generate images from words. It sounds quite ordinary but it is fun to play with.

The machine basically consumes an unlimited number of images and styles from the internet and then regurgitates them as it wishes according to user requests; it then continues to learn as it goes.

I asked for “Mona Lisa as Lego”. It returned this, which is quite subtle because it isn’t directly Lego.

I got multiple failures too, but my favourite was “bitcoin parachuting into the US economy in the impressionist style”.

It’s not brilliant but it’s also not easy to reproduce if I fired up my own watercolours. Access to DALL-E 2 is restricted, but I did all of this via the chat app Telegram. Simply opened a channel with a robot someone has built, typed my request, received an invoice and then paid for it on the Bitcoin Lightning Network. If you want to have a go you need the apps BlueWallet and Telegram.

Once done you can ask a piece of software to generate some art for you via another (more intelligent) piece of software and you can pay for it with yet another piece of software.

There is an open-source equivalent of the art generator software known as Stable Diffusion. It’s not as good but it’s free to play.

Not sure where all this takes us but it’s amazing nonetheless.

Handy tips from the UK

As energy prices skyrocket in the UK, Rupert Murdoch’s Times newspaper was on hand to provide money saving tips.

I can’t imagine that things are so bad that people might make two cups of tea per day with the sole objective of saving 16 pence, but perhaps they are.

More alarming though is the final point, which implies that someone in Britain was heating their lunch at home in the morning and defying the laws of thermodynamics by maintaining that heat level until lunchtime. In so doing, they were also avoiding the need to use the office microwave.

The energy crisis in the UK is not trivial though. Consider that the UK mortgage market is around £1.6 trillion and 25% of that rolls annually, a £400bn refinancing. The 2% increase in interest rates recently will cost consumers around around £8 billion in extra payments. Not a small sum; but compare that to the upcoming £1,500 per year price cap increase in energy for 24 million homes. That equates to £36 billion with a similar rise forecast for January.

From a consumer spending perspective those two energy increases are like having an interest rate increase of 9%. I’m sure I will be advised by some sage that this isn’t how it works and if so I’m open to superior analysis on this one.

Slash & Burn

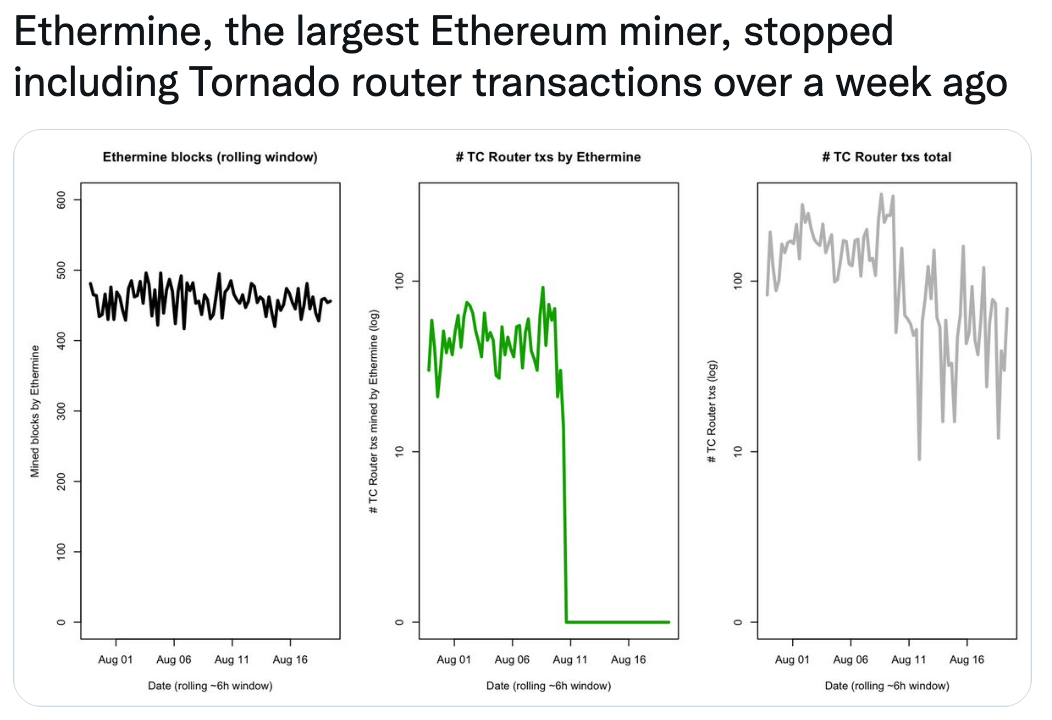

With two weeks to go until the Ethereum merge we may have hit a snag. Many users have now realised that the protocol will move into the control of the major staking networks under Proof-of-Stake. Namely, Coinbase, Binance and Lido. These large public businesses will be forced to follow any US sanctions around blacklisted addresses if they are asked, as they recently were with Tornado Cash.

The proposed solution to this issue is known as ‘slashing’. In essence, slashing is a penalty imposed by the network when a participant proposes a block that is fraudulent or erroneous. It is designed to ensure that the participant actually does the work they are required to do as a network validator.

The proposal in this case is that slashing would be extended to entities who deliberately do not include transactions in blocks because those transactions are on sanctions lists.

Cue a whole host of moral dilemmas. In a decentralised system like this one, who will choose which sanctions are valid and which are not? The whole idea of political neutrality in a decentralised network is immediately destroyed. The two ideas just cannot co-exist.

Unfortunately if you run an open-source system you simply have to accept that there will be good people, bad people, state actors, foreign intelligence services, criminals and basically everyone. The software must treat them all equally and when it is truly decentralised it has no other choice but to do just that.

The Ethereum community would be better served by simply letting people who are willing to stake censor transactions until the point at which a block is mined by someone who doesn’t censor. At that point it will be included in the chain. This would make censored transactions slower and more awkward, which might be sufficient to dissuade their use but it would not compromise the network. Miner censoring is not hard to achieve either. The largest POW miner, Ethermine, is already rejecting Tornado transactions.

The argument against this is that some block validators would not build on blocks that contain censored transactions causing continual forks in the network. I suggest this is unlikely though and they would more likely take the easy route and not participate in network validation at all.

It’s another case where doing nothing is best. In comparison in bitcoin, you absolutely can choose which transactions are included in a block as a miner. Indeed, in 2017 the network was attacked by some large miners who decided to mine blocks which contained no transactions at all. This cost them money but it made a point. The response was simply nothing. All transactions went slower than they otherwise would have and eventually the economic incentive for the miner ran out and they stopped; the disruption lasted months though.

Open-source protocols are for everyone, and attempting to force good behaviour through anything other than economic incentive will fail; at least it ought to fail if the system is well enough designed.

Euro-Trash

He went on to add that while Italy’s economic prospects were “good’ it should not overlook the structural reforms agreed with Brussels.

Unfortunately, Mario is no longer Prime Minister because of exactly these reform commitments, which limit Italy’s borrowing capability to the point it simply cannot move. The country’s growth is forecast to be 0.9% in 2023 which is wildly optimistic given its rapidly shrinking population and complete lack of money.

The population is averaging a 1% fall annually now; its birth rate at 1.27 births per woman, some 40% below the replacement rate for a population.

I guess Mario has to say something positive but holders of Italian debt are only getting paid as long as Germany agrees to it. That might last five years or it might last ten. It won’t last 50 though.

As a matter of interest (and by no means a forecast), were the population to decline by 1% for 50 years there would be half the number of people in Italy than there are now. Highly unlikely because migration will be used to make up the difference but there is no doubt the current death spiral is real.

In other Euro-news, there is no sign of Christine yet, but this should be her last week off. She did release an interview with Madame Figaro, a French magazine, in the week which was recorded in early July. The interview was the usual boreathon until this emerged

My family is a great support and always has been. And there’s a motto that I took from my time on the French national team for synchronised swimming: “Grit your teeth and smile”.

I’m impressed actually and after a long search through the international synchronised swimming archives, we were indeed able to verify these claims.