Merge complete

Ethereum’s Merge completed last night around 4.30pm Australian time. Bizarrely, it was marked by the appearance of Pandas for those running Ethereum nodes. Perhaps a more robust species could have been chosen?

It was a complete non-event which is exactly what was hoped for. Blocks continued being produced and some 18 hours on, no major issues have been reported. Whether you agree with the direction of travel or not, failure suited nobody and hats off to the developers.

The promise is higher transaction throughout, lower inflation and a lower energy footprint. More fundamentally though Ethereum has now given up its anchor in physical reality (through energy) and retains an anchor only through its own value. If that’s an oxymoron, welcome to Proof of Stake.

The two big chains go head-to-head now on consensus mechanisms.

Nothing is happening

Meanwhile, what’s happening with bitcoin? It is the most common question we get. Perhaps that is because for most people who are not living and breathing it, the only thing that ‘happens’ is price.

In fact, something remarkable is happening that we discussed here some years ago and I will make some broad predictions today for the sake of interest and argument.

Firstly, bitcoin is integrating slowly into the global energy market. It is already a critical factor in the grid in Texas and will likely become more and more important everywhere. Australia is a prime candidate because of its increasing penetration of intermittent energy sources.

Why is this true? Because it can profitably consume energy nobody else wants. It can (and does) bootstrap renewable energy projects by consuming energy when there is a surplus for its own security model and it can pay for that energy.

Prediction 1: In the next five years bitcoin will be a critical element in energy grids across the globe, providing a demand response service to grids. Turning off when others need the power and otherwise consuming the surplus. The general public will not even notice.

I should also point out that there is no substitution effect either. Bitcoin miners cannot afford to consume energy that other people want to boil their kettle. They are the consumer of last resort.

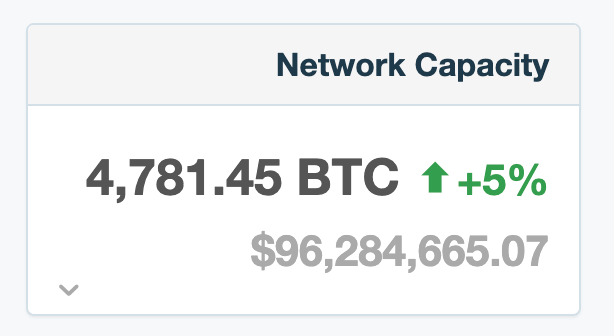

Secondly, a totally separate use of the network is as money and value exchange. Bitcoin transacts billions per day on-chain but more exciting is the Lightning Network, which grows daily.

Network capacity is around $100 million which can support an order of magnitude more than that in daily payments, since Lightning is essentially a closed loop system cycling between participants instantly. It is particularly taking hold in countries where the currencies are weakest. Nigeria, Turkey and Argentina are all seeing explosive growth.

Prediction 2: We have state adoption already in El Salvador but bitcoin will be naturally adopted in a country with a collapsed currency before the end of the decade. So no legal enactment; the people will just be using it for commerce.

The point is the network itself is garnering multi-billion dollar investment in its security model from energy investors and at the other end of the scale it is being selected naturally for use in nano-payments. Neither party has an interest or knowledge of the other.

But why does the price not reflect this? It does. It exactly reflects the number of people who realise what is happening, a number which grows each year.

Scale of the bale

In politics, you need luck. It would seem in the United Kingdom that their new Prime Minister Liz Truss has found an ample source of it. Her first course of action as Prime Minister was to cap household energy bills at £2,500 for all 14 million households in the UK. The contribution equates to at least 5% of GDP. When we include the equivalent contributions for small business, it will top £170 billion.

There has never been any peacetime intervention on this scale. It is unbelievable for a country that cannot afford it.

Far from suffering scrutiny for the decision though, it has been avoided altogether with Parliament and the whole United Kingdom in official mourning following the death of Her Majesty the Queen. The last official to meet with the Queen was Liz Truss, in the billiard room with the lead piping, so I’m slightly suspicious about the whole thing.

The bailout has the interesting feature that is an open ended short position on the energy market. So, imagine energy prices double from here and the bailout becomes £340 billion. This is probably the largest short position anyone has ever taken in history. It also has another interesting feature that whatever happens in energy markets, like prices collapsing, the UK government will be unable to make any money from it.

Unlimited risk and no reward. Sounds like the bond market.

The government now has the unenviable task of competing with quantitative tightening in order to raise money. The Bank of England has announced already it will start to reduce its bond holdings of £863 billion by £80 billion each year. They need to as well given they own 70% of UK short-dated debt.

So, the UK is left with the government selling bonds worth £170 billion to pay for heating. Their ordinary course of business borrowing is something of a similar magnitude and now the Bank of England will be selling another £80 billion.

Pretty much anything could happen. It’s beyond ridiculous.

Euro-Trash

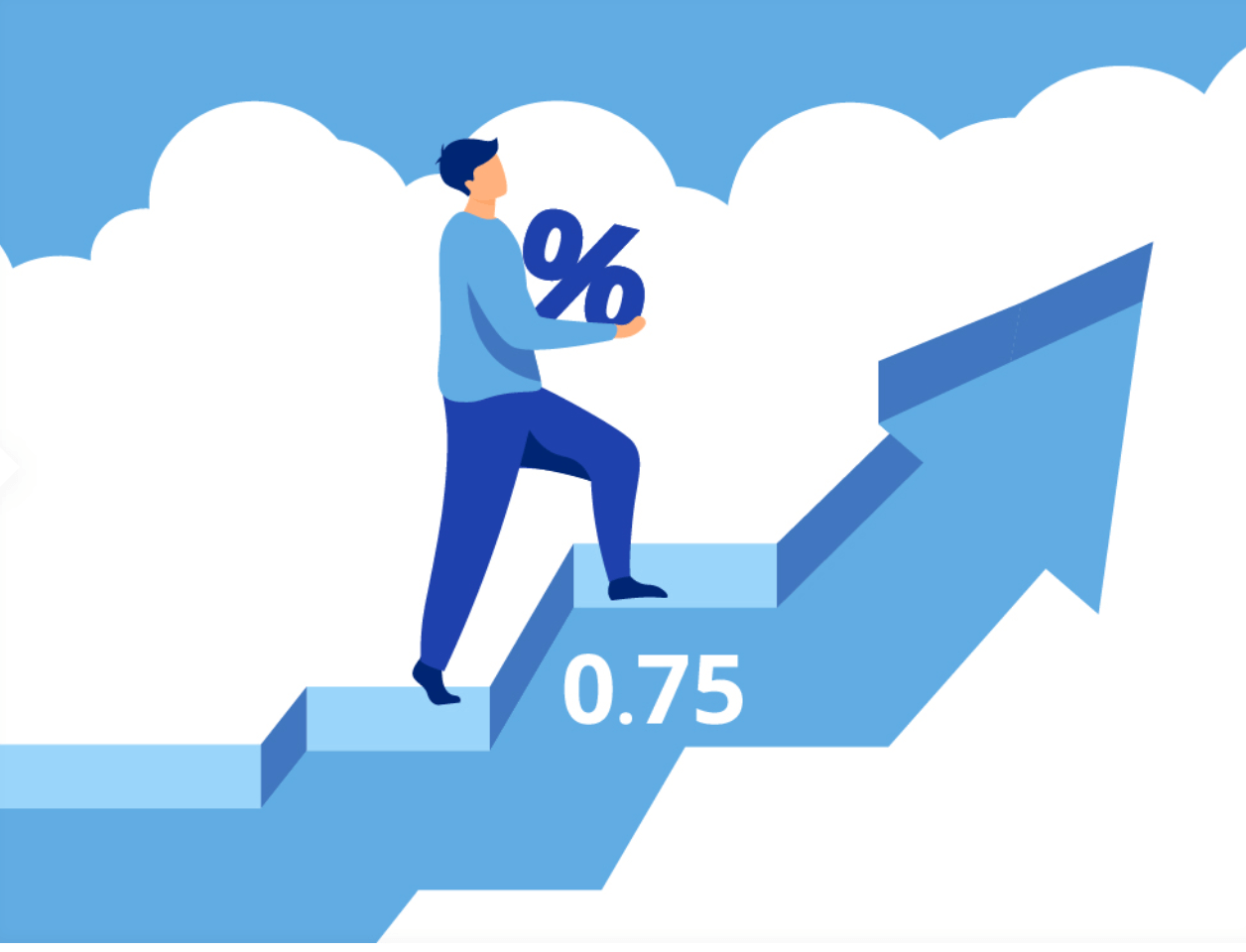

Christine is firmly back at her desk and her first course of action was to lift the interest rates in Europe by 75 basis points. As usual, we had a cascade of demented cartoons to explain the decision. Unusually, they were deeply telling this time. The mask has slipped a little.

“We raised our interest rates by 0.75 percentage points”

“Inflation remains far too high and will stay high for a while”

Our head in hands European is probably a true reflection of what’s going on. The economy is truly collapsing on the back of a lack of energy. German industrial output has never fallen at a quicker rate than currently. One must ask, is raising rates in this environment really the right move?

The ECB has been forced into this position by a collapsing Euro which is barely at parity with the USD and will surely collapse further at the next rise in US rates. In effect, monetary policy is out of the ECB’s hands and is dictated now by the movements of the Federal Reserve.

Europeans are seeing massive increases in their energy bills that they cannot afford. Do they really need their mortgage payments to soar as well? Any sober analysis would conclude no, but that matters not.

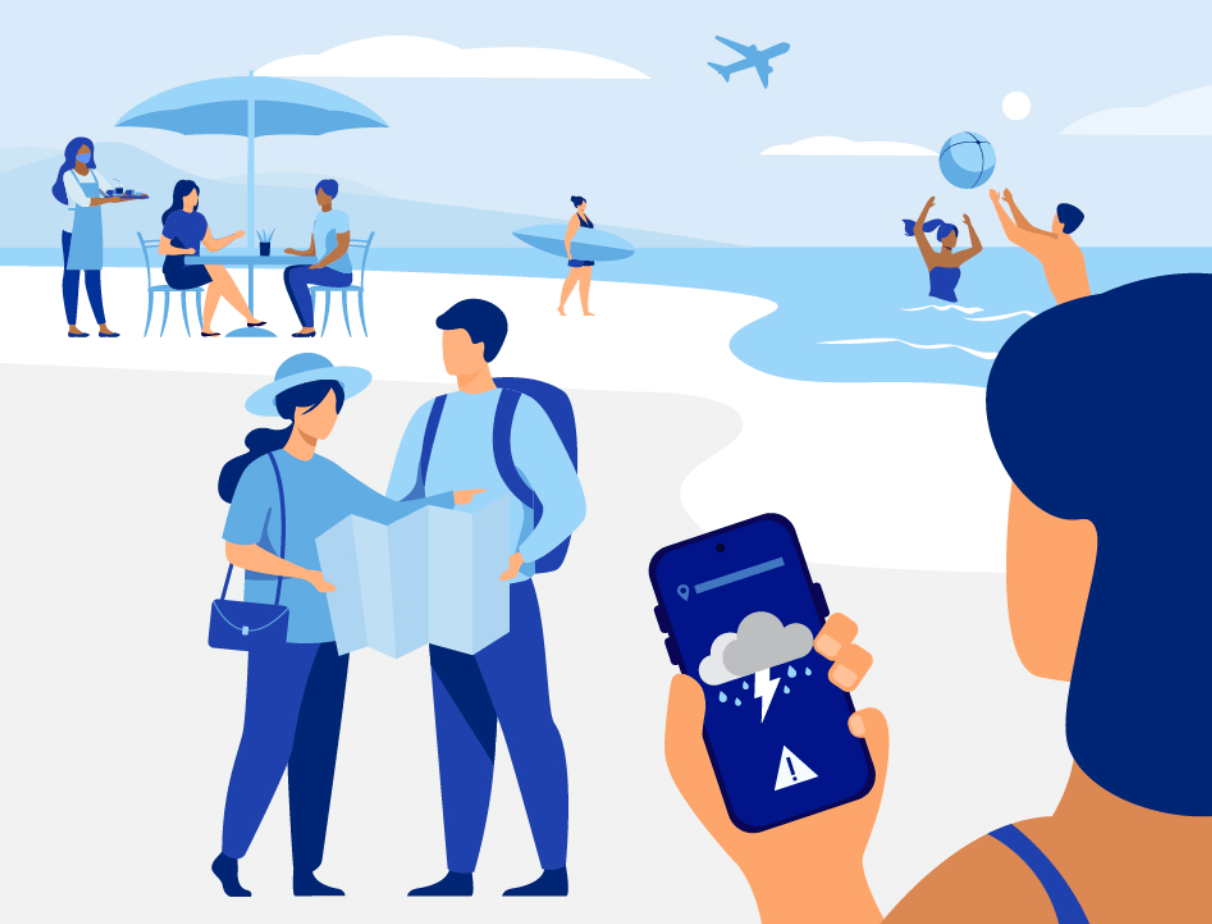

“The economy is holding up for now, mainly because of tourism”

The ECB is never this honest. An industrial economy sustained only by people being on holiday? It’s quite extraordinary and if it is true (and it is) why raise interest rates which will only make matters worse? Note the weather forecast on the phone in the foreground – no accident that was chosen.

“The economy will slow down substantially later this year”

The economy will slow down substantially! So why raise interest rates then? If you know what’s coming. Why?

The answer is the European bond market will collapse if they do not. The ECB will shortly be intervening on a scale never before seen. A bizarre mix of a hiking cycle while simultaneously engaging in quantitative easing for Spain and Italy and quantitative tightening for recession hit Germany. It’s a zoo.

One other thing was notable by its absence. For the first time in years Lagarde did not mention the ‘green transition’. The word green does not appear in the press conference at all. Why could that be?