$100k

I hope so, because after 7 years running this fund I feel like I’m 80.

When does a country become a prison?

It’s not unusual to be taxed on capital gains on leaving (like the US or Australia). Arguably you made the gains in the country and they are ‘entitled’ to their share. To extend the reach to five years after leaving, on both income and capital gains, seems extreme.

Increasingly this kind of thing has to happen though. Populations are falling around the world, the tax base is being eroded very quickly. Governments are finally discovering that robots don’t do tax returns. As the burden of taxation on the smaller working populations rises, they are going to look to leave. Let’s go somewhere where we aren’t working for the government until July every year.

Take Norway. They introduced a 1% wealth tax which was designed to raise $150m. $54 billion then got up and left. Mostly it moved to Switzerland which is just as cold with slightly better skiing. Overall cost to the state $500 million. More than that though, a very powerful local source of capital also left. Their children left too and generations of expertise and deep connections went with them.

Same thing in the UK. A vibrant population of foreigners (mostly in London) used to only have to pay tax on income they earned in the UK (so called non-domiciled status). If they had overseas income and they considered the overseas country home, that income was exempt. It made the UK very popular with expats. It was a good policy because the expats were mostly young, educated and wealthy. For several years now that benefit has been under attack.

Unfortunately (for Britain), these people were deemed “rich”. They were an easy target for the Daily Mail and the government. No one is changing their vote because a Saudi Prince gets a tax bill after all. So the two Saudi Princes went home along with 45,000 Phd qualified, hard working people under 30 who all paid UK tax.

The non-doms are still leaving. Taking their income and their spending capacity and their ambition. They took their children out of school and they left. London is now very much poorer for it, on many levels. A completely stupid policy, that raises no money (in fact costs money, as in Norway) and costs the economy enormous sums in lost spending.

The new UK government has now gone further, extending inheritance tax to foreigners.

The changes could lock Australian expats in Britain into a liability for 40 per cent inheritance tax on their Aussie assets, potentially even extending for years after a move back Down Under.

So exit taxes are now a real risk. Tax them if they stay; tax them some more if they leave; tax them if they die. If they stay and die; tax them. If they leave then die; still tax them.

I look forward to seeing His Majesty’s Revenue and Customs turning up at Circular Quay to liquidate Bob from Bairnsdale’s second hand Holden. Good luck.

In a practical sense, the Dutch move is actually a good one. Close the door first; then introduce the punitive tax.

It’s the stuff of nightmares though that was all predicted in the Sovereign Individual, nearly 30 years ago.

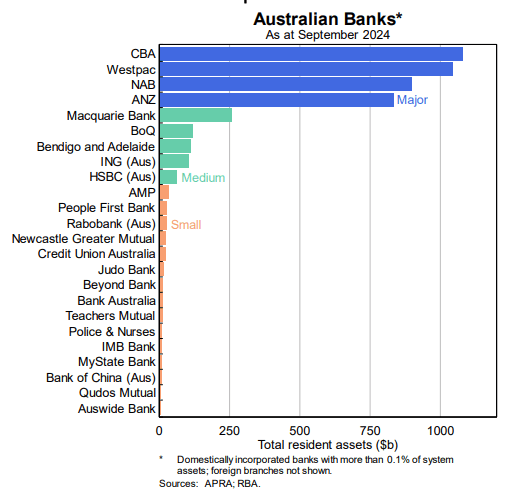

Banks

Ever heard of the CFR? It is the Council for Financial Regulators. On it sit APRA, The Reserve Bank, ASIC and the Government. The quarterly minutes are an insightful view into government thinking.

This quarter the CFR has launched a review into small and medium sized banks in Australia. How can we help them compete etc. The report points out that the big four are rather big. The issues paper is good and detailed (and brutally honest) about Australian banking.

Do we need a report though? Is this not the most obvious cartel in the world? Australian banks are well capitalised and have survived some choppy waters in the last few decades. Perhaps that is the trade off for effectively just admitting that it’s a cartel.

Australian GDP is about $1.7 trillion dollars. The big four banks have balance sheets 2x the size of the whole economy. It doesn’t take a review to work out that these entities are so large they could never actually be allowed to collapse. They would take Australia with them.

The conversation might as well shift to a “are we all happy that this is a racket but a stable one”?. Are we also happy that the Chief Execs of these (effectively government) institutions are getting paid what they are when they are actually taking zero risk? The joint can’t go bust. There is essentially zero competition and zero chance of there ever being any.

Why $5m per year then?

AI

We are in for quite a few weeks in AI. OpenAI has promised to ship something every day for the next 10 days. It started today with this.

So the model is one thing. Congratulations to them, the price is another. $200/m. This is likely a sign of things to come. For users of these tools the unlimited access is a key feature. The biggest frustration is that usage of the best models is often limited to 50 questions per day which for meaningful projects is never enough.

Significantly, the vast majority of the world was just priced out of access to the best AI model. Most people are still on the very basic version of “it’s just a better google GPT”. They are not aware (or don’t care about) the capability of the very latest models. Today though, we have jumped from $20 per month (doable for most) to $200 per month, which is not doable for most. At least globally.

It’s quite the moment. I’m anticipating three groups now:

-

Group 1: Can afford the toys + can be bothered to learn to use them effectively

-

Group 2: Can afford the toys but its just “google”

-

Group 3: Cannot afford the toys.

Group 1 has the chance to build billion dollar companies. They are hard at the task already with multiple agentic work flows building out whatever it is they are building. If you don’t know what that means, it’s because you are in Group 2.

The need for human labour is going to drop much faster than people expect. Be in Group 1.

What about Group 3? Exactly.

Euro-Trash

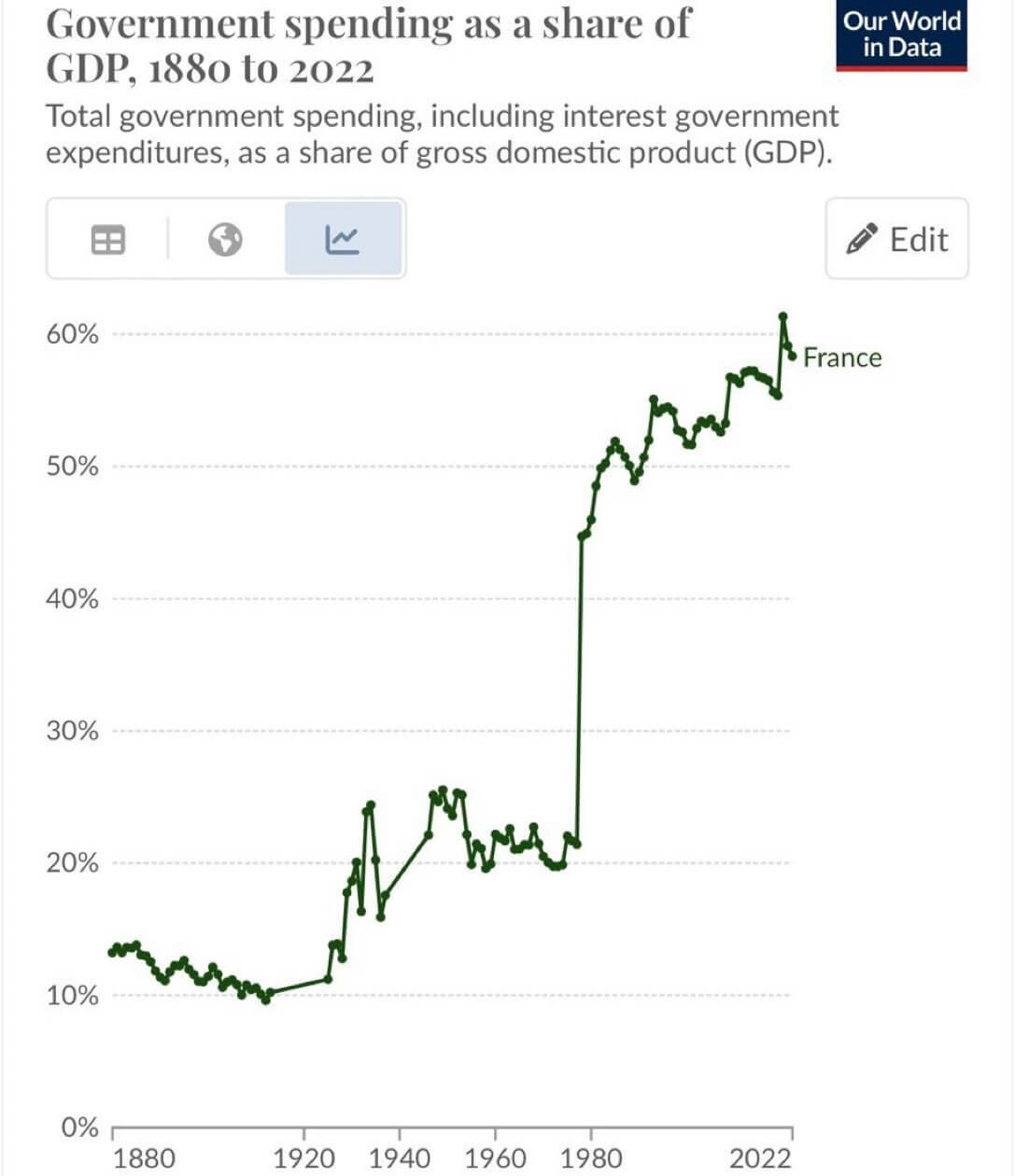

We covered the French elections some months back. The Olympics were on and Macron thought he would hold a stealth election while nobody was looking. It backfired horribly when he tried to defraud the will of the French people by withdrawing his party’s own candidates.

Ultimately he had to appoint a Prime Minister, Michael Barnier, who nobody wanted and nobody voted for. Now Mr Barnier’s government has collapsed having lost a no-confidence vote. It’s dramatic stuff. A French Government hasn’t fallen to a vote of no-confidence since 1962, the days of Charles de Gaulle and the launch of the Fifth Republic.

The problem arose because the government (sensibly) wanted to cut the annual deficit from 6.5% of GDP to 6% of GDP. Hardly radical given France has one of the highest shares of government spending in the world (60%). Topped only by a few niche communist regimes. The situation (and the spending) are completely unsustainable.

It did not surprise me then to discover that amid that calamity of government spending and collapse, a new proposal has been brought forth to raise revenue for the state. Would you welcome the “tax on unrealised gains on non-productive assets”. This would apply to cryptocurrency, yachts that are not used and uninhabited properties. Essentially, a wealth tax. It’s just a proposal for now but undoubtedly some version of it will pass because there is no will to cut spending and nobody wants to pay more tax. It might not ultimately be France, but there will be a country in Europe foolish enough to introduce something like this. We can enjoy a mass exodus of persons from wherever that is.

Where does that end though? Is jewellery productive? Art? Vintage cars? A lazy person?. There are so many non-productive assets that rise in value which would fall into the trap. Again, their rise is entirely related to the collapsing value of the Euro, rather than the assets themselves being worth more.

The battle to sustain the fiat regime is really taking shape. They will lose, but not without a fight.

For France, the solution seems simple. A Sixth Republic! It will be like the Fifth one but with an extra number.