One coin to rule them all

Not an optimal week then. In fact Monday was the largest leverage wipeout yet beating FTX and Covid. $2 billion of positions were liquidated in 24 hours. However, As the market scales this will necessarily be true and we will always be setting liquidation records.

Even so, it was big.

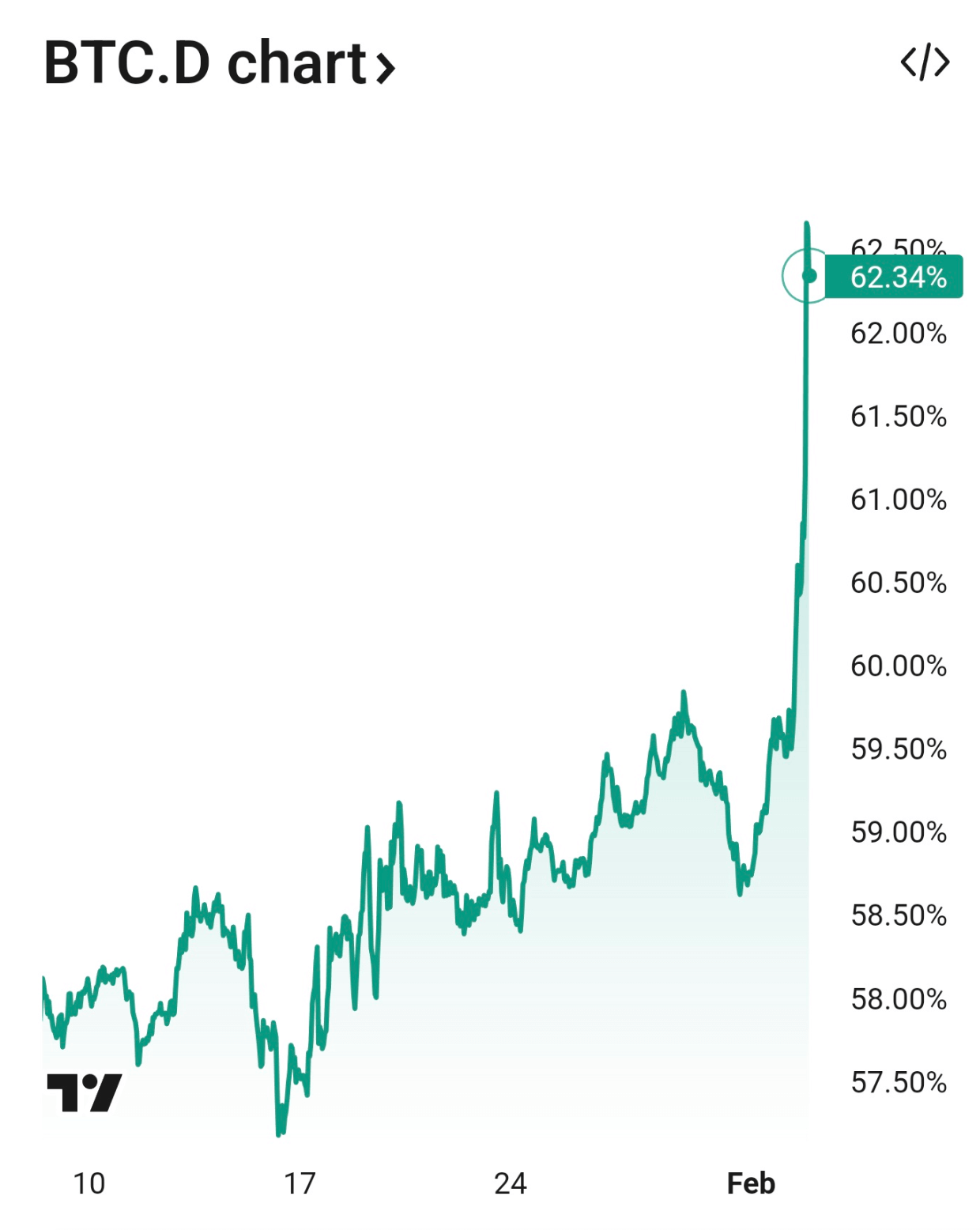

Despite having a rough time itself, Bitcoin was the best performer with dominance levels spiking over 60%. (Dominance = bitcoin market cap divided by everything else market cap).

Down the line of market cap though there are bodies all over the road. The official TRUMP coin is down 80% from its highs two weeks ago, as is MELANIA MEME, which fell even more.

If you are interested in a bargain, I looked up the underlying metrics of MELANIA MEME. “Melania memes are digital collectibles intended to function as an expression of support for and engagement with the values embodied by the symbol MELANIA.” Perhaps not then.

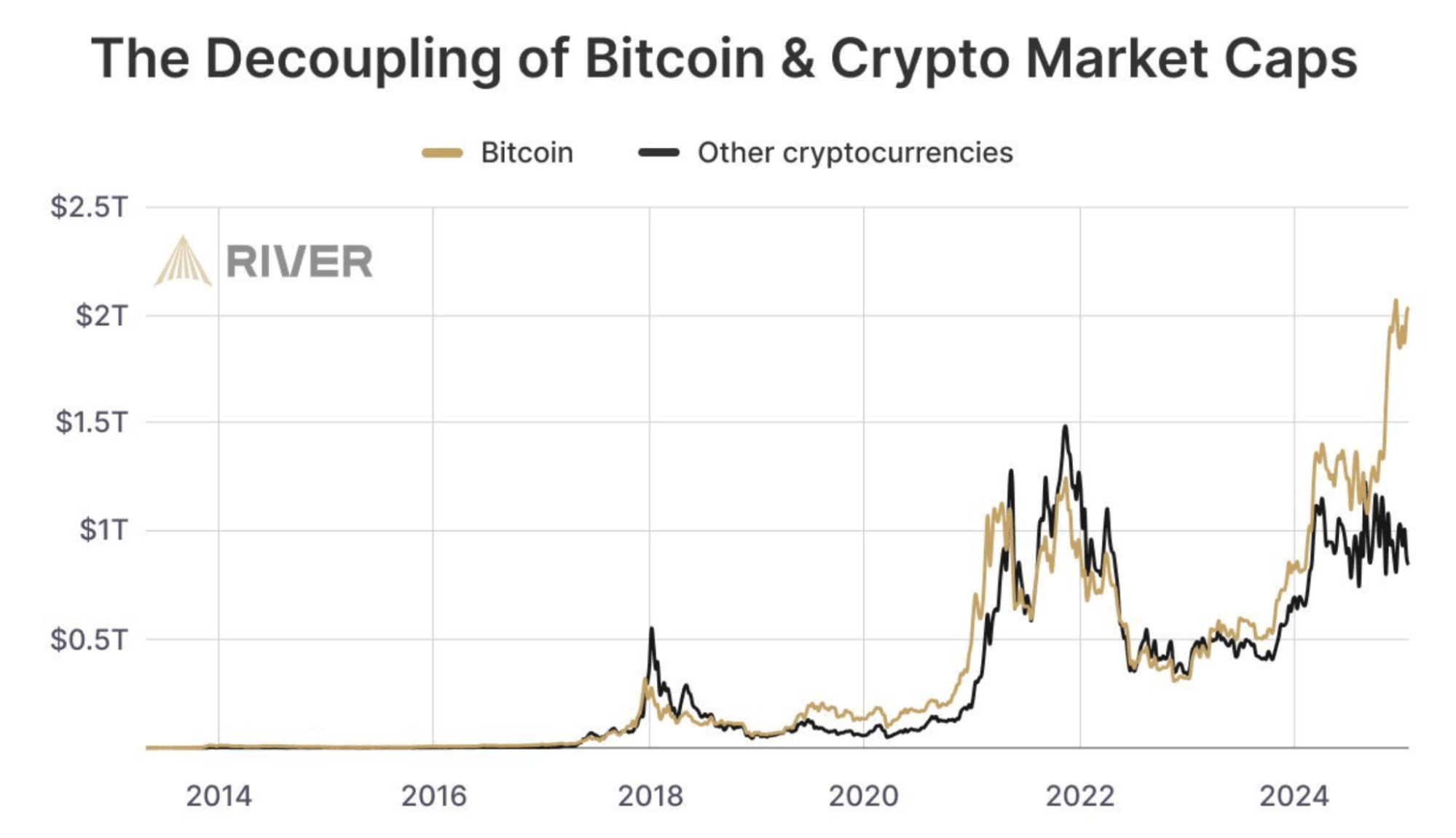

Two separate markets in this sector are now emerging.

We have long been of the view that there is bitcoin, and then there is everything else. They are quite separate. One can lay claim to being sovereign, decentralised money. Everything else is something else. Software, transport mechanism for other tokens, “Faster and cheaper”. None of them compete with bitcoin. Importantly though they do compete with each other (Solana and Ethereum being a fine example).

That is not to say there will not be other successful ideas and assets (Tether for example). As the number of coins and assets making fabulous claims grows, they will eat others’ market cap. A case in point: the best performing asset we have held in our Managed Fund has not been bitcoin but when we reduce it, we swap into bitcoin.

I think we saw that in this week’s stampede; people exit bitcoin which is why it does so relatively well in circumstances like we had this week. It’s not a new trend either. This chart from River Financial showing the separation really began accelerating in 2024.

If you are considering this industry or economic decisions within it, the question you need to ask is: Will what I am doing leave me with more bitcoin or less? It’s as simple as that and over time that question will extend outside the realm of digital assets.

Tether

-

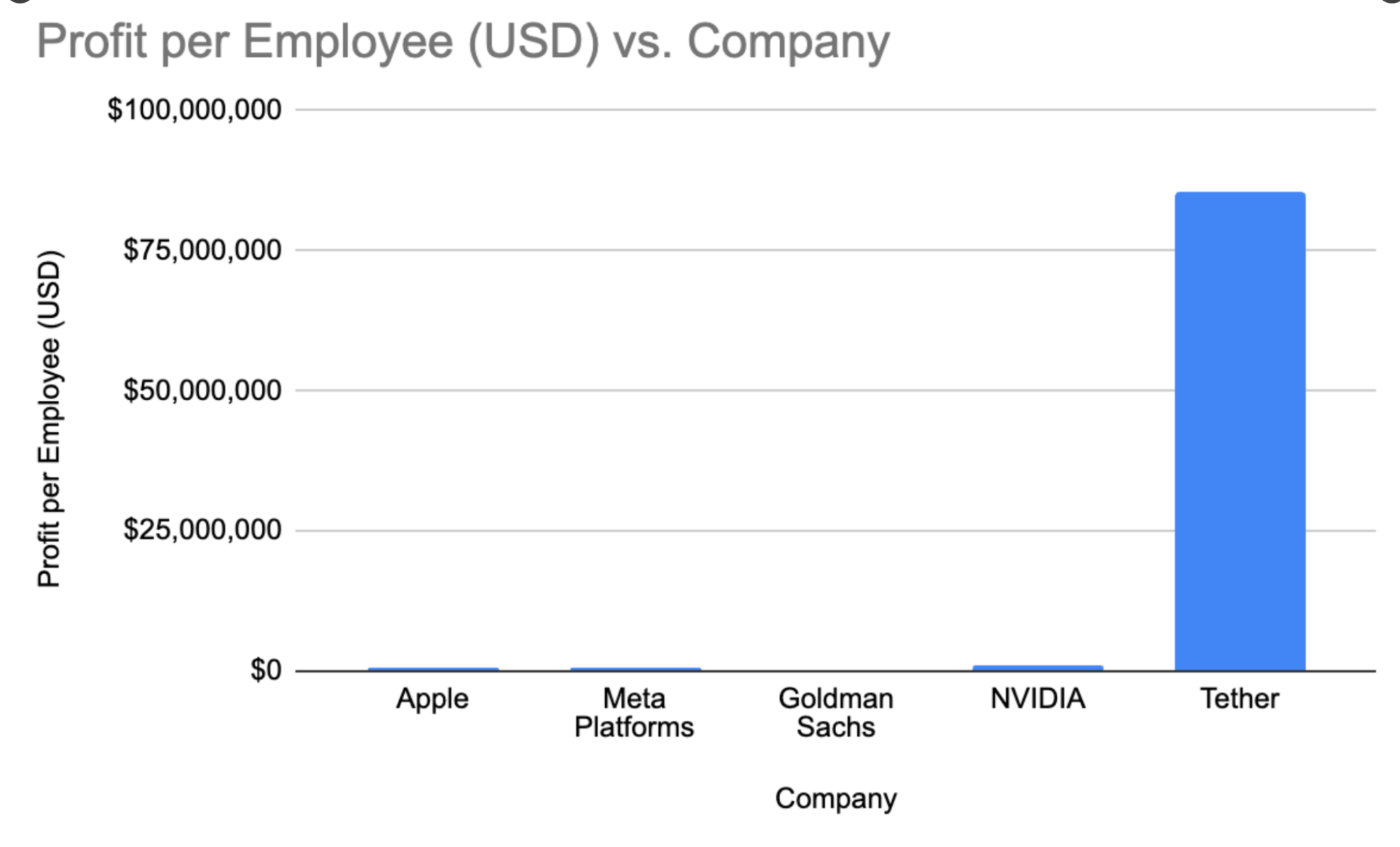

Tether said it booked $13 billion in net profits last year across its group of companies.

-

Some $7 billion of the profits derived from the firm’s U.S. Treasuries and repo holdings, and $5 billion from unrealized appreciation of the company’s gold and bitcoin holdings.

The more accurate number is the $7 billion, since that reflects the operations of the business rather than the unrealised gains. Even so, it’s amazing and their profit per employee is an even more astonishing $75 million per head.

Tether reached $10 trillion in transaction volume in 2024, closing in rapidly on Visa’s $14 trillion.

The business is misunderstood though. All they ever did was make the US dollar easy to use. You give them a dollar, they give you a dollar of digital token that lots of people accept. Unlike dollars you can send it anywhere, whenever you want and unlike dollars it is 100% backed by US Treasuries. In return, Tether takes the interest on the Treasuries which is a very good deal for them, especially recently.

They basically scaled the US dollar into a new industry by making it fit for the digital age.

For the first few years their whole business had two blokes and a microsoft excel spreadsheet before it exploded in scale. They did it though. They made it and now everybody is sad and angry and calls them criminals.

Their independent audit for December 2024 can be found here.

Tether made another announcement this week regarding the launch of USDt on bitcoin’s lightning network. All the instructions for nerds are in the linked blogpost. It’s rather niche, but so was Tether five years ago when it was 25,000 lines on a spreadsheet. USDt on lightning will be big.

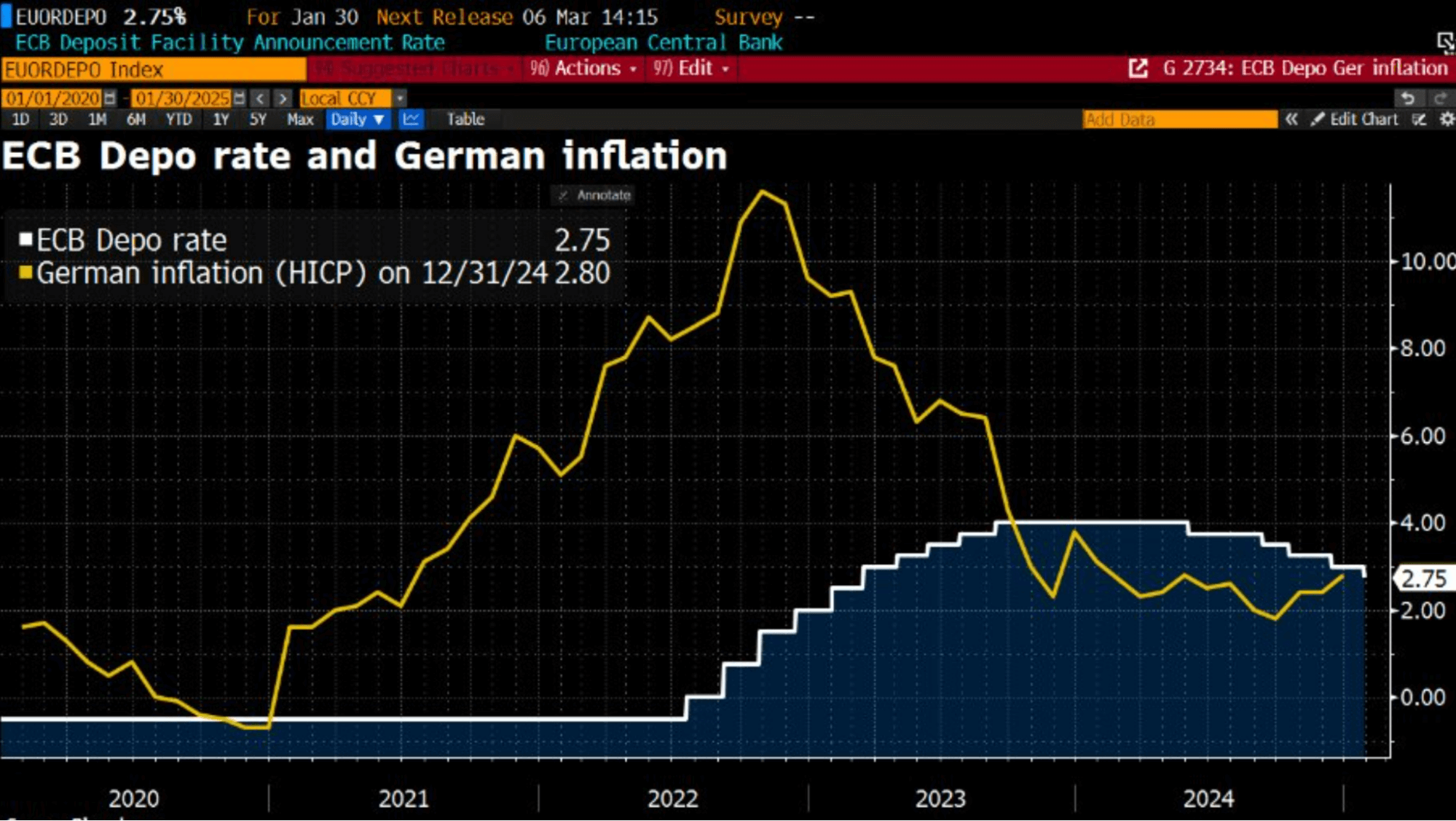

Don’t get caught saving

The ECB cut its rates again last week with the deposit rate now at 2.75%. It serves to show just how tricky things are becoming over there and it pushed the real deposit rate negative in Germany. Official inflation rates (which nobody really believes) sit at 2.8%. Even at the official rate, the net saving rate is now negative.

Negative rates were a covid era phenomenon but we are allegedly back in normal times and one wonders what on earth is going on in Europe.

The EUR is clinging desperately to parity with the USD sitting at 1.02. Once the wall breaks, 90 euro cents could arrive rather quickly and may in fact be helpful in getting the European economy going again.

So extreme have the inequalities become that you can buy a castle in Italy for the price of an apartment in Sydney. This website, helpfully called Castleist.com, will guide you through the available options.

This one is A$850k. Externally unappealing yes, but…… “The Castle has a rectangular plan and ample and bright spaces, embellished with stairs, stone fireplaces, ceilings with typical vaulted and barrel vaults.”

The rear courtyard is actually very special. In Sydney you won’t get a one bedroom apartment for the same price.

The hidden cohort

Coinbase acquired an on-chain advertiser this week called Spindl.

It’s a small acquisition in the scheme of things perhaps interesting only because it targets the hardest cohort of all to attract. Male 18-30. For example, In national censuses that cohort basically disappears. Either they are not at home during the census, or don’t fill in the form or say they are a 300 year old jedi.

Advertisers face a similar targeting problem. Surely it’s obvious, “do your ads when the sport is on”. Those slots though are expensive and compete with huge companies like Nike and every gambling company you can think of.

It might then be an astute acquisition by Coinbase. There are green fields in this sector where nobody has ever advertised because they haven’t worked out how to. It might equally be disappointing for the rest of us because YouTube was better before the ads and now ads appear before every video (unless you pay the $20/m and they go away).

That embedded advertising has arrived also speaks to the change in the perceived value of the industry. Until recently very few brands would want to associate with the digital asset sector. That is obviously changing.

Advertising on very new platforms can have an outsized effect too. One to watch; particularly if you sell things to the ‘hidden cohort”

Euro-Trash

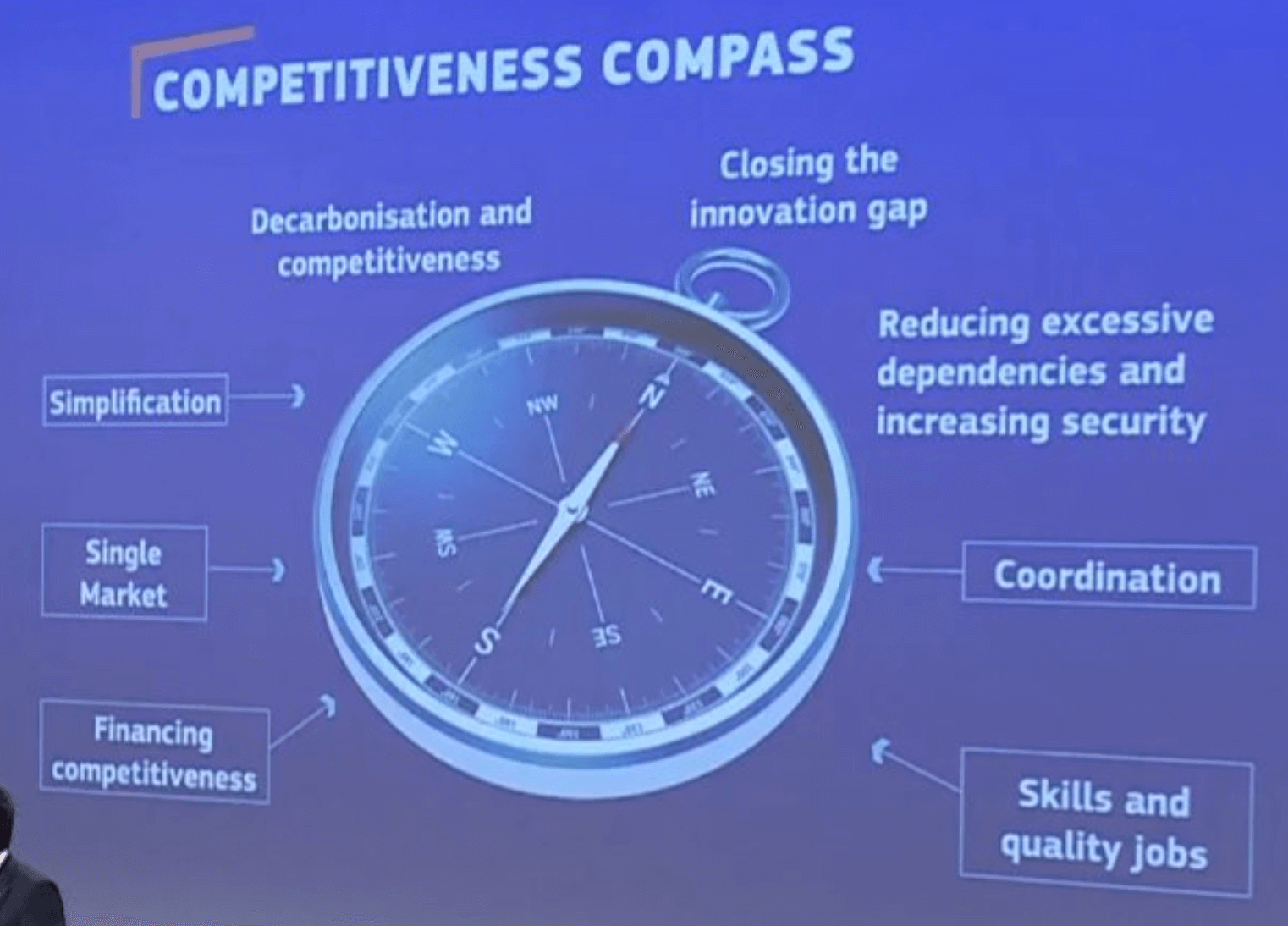

Only euro-moron Ursula McStupid could come up with something this daft. ”The Competitiveness Compass”. Launched to great fanfare at Davos, Urusula declared Europe was “open for business”.

Explaining the chart is hard because it makes absolutely no sense. Some of the annotations have boxes around them, some do not. Some have arrows, some do not. North, does not in fact point north, which to my mind would ordinarily be at the top of the chart in the middle. “Coordination” is lounging somewhere east of north-east, just above “Skills and quality jobs”, whose arrow doesn’t quite reach the compass. Quite frankly, if you delivered this chart in investment banking you would instantly be fired.

The whole dog’s dinner was accompanied by a press release from the European Central Bank (allegedly co-authored by Euro-besties Ursula and Christine). So this wasn’t just some last minute powerpoint whoopsie.

Europe also has the necessary ingredients to catch up in the technological race. The EU turns out almost as many STEM graduates per million inhabitants as the United States.

“almost as many”

Two out of three EU companies say that regulation is a key obstacle to investment, while just 14% of them are using AI

They banned AI….remember? Now the Americans don’t let them use it because it is impossible to comply with the regulations. I’m surprised 14% of European businesses can get past the GDPR pop-ups on their browser.

We need to make doing business in Europe cheaper, especially in terms of energy costs. While the shift to renewables creates good jobs and strengthens energy security and independence, it also comes with greater intermittency and greater energy losses through curtailment. For the benefits of decarbonisation to show up in companies’ bills, we need massive investment in grids and storage and smarter market design.

What to say here? Perhaps we have to be honest and say “the benefits of decarbonisation” will never show up in companies’ bills. The benefits are not a corporate benefit, they are a corporate cost and a societal benefit. The fundamental dishonesty about the tacit energy tax in Europe goes to the heart of the issue.

They made their choice and turned off their power stations for valid environmental reasons. Since they did so, the Chinese and Indians have built more power stations than Europe has. That’s just how it goes. Overall carbon emissions are up, but they aren’t from Europe. I find it quite unlikely that the solution is dropping a massive battery near Berlin and thinking it will power industrial production. It’s complete fantasy land nonsense.

Europe actively sought a low energy economy, they got one. Expect an awful lot of explanatory powerpoint slides. The “Competitiveness Compass” is just the beginning.