We’ll steer clear of the daily noise this week and focus on one thing. Deflation. In the Western world it isn’t something we are really used to but the cycles of inflation and deflation are as real as the business cycle. The world has been in an inflationary cycle now for the past 50 years, since the end of WWII, but that period looks to be coming to and end.

A deflationary cycle appears to be playing out right now, as follows.

- Boom years: companies take on a lot of debt (e.g. for share buy backs)

- Non-US companies do the same, because their raw materials are often settled in USD although their revenues are not

- Some shock happens, revenue falls unexpectedly

- Companies now focus on making sure they can pay their debts. The number one thing to have is USD

- So, everyone liquidates whatever they can and buys USD to ensure that, as best they can, they can meet their USD liabilities as they fall due

- This causes the USD to rise sharply as people buy it to meet debt obligations

- Now your outstanding debt is even higher

- Panic: more liquidations and a vicious cycle begins

This continues until bankruptcies commence. The weakest fall first.

In our current environment the first dominoes to fall are the airline industry. For example, American Airlines emerged from their last bankruptcy in 2013, they have made $17.5 billion in net income since then and they have spent $15 billion of that on stock buy backs. Now, of course, they would like you to bail them out.

They are not unique though and the situation is far more critical for non-US based businesses who are a long way from the Federal Reserve printing press. They will not be bailed out and they will find every US dollar they can to survive.

Here we see the USD against the Australian dollar, this year alone. This is the third largest currency trading pair in the world. A 15% fall in three months 10% of which came in 5 days. Simply, that is the rush to US Dollars.

Kondratiev waves

Kondratiev waves

Kondratiev used the four seasons to mark out the pattern of his 50 year cycles.

Rising inflation, some new factor of production is driving growth. Times are good and inflation is rising.

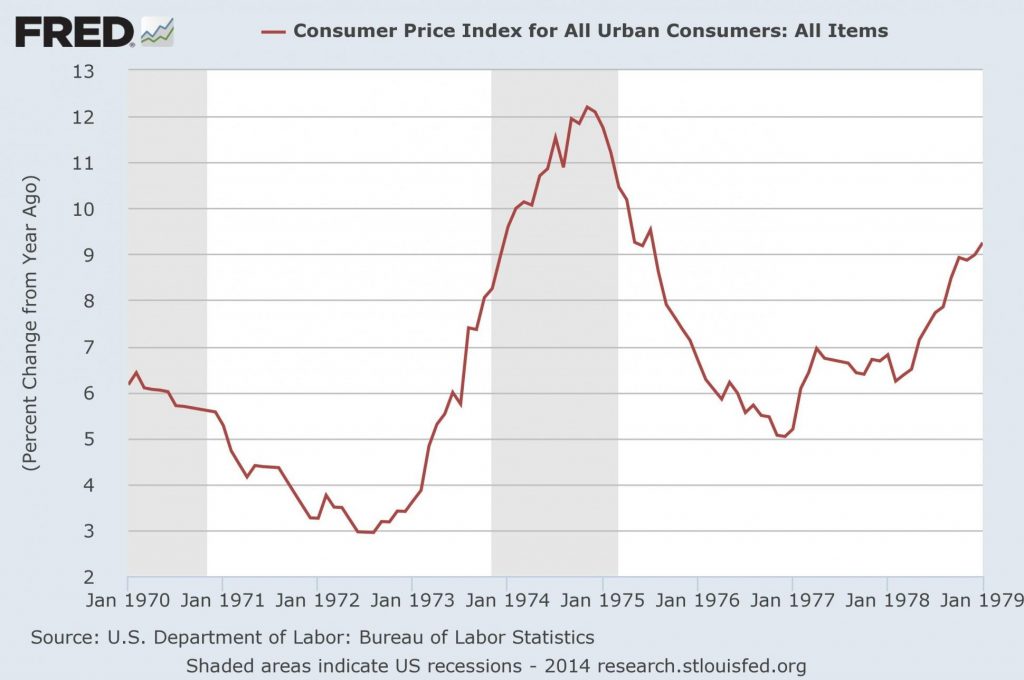

The peak. There is double digit inflation and prices are rising fast.

In autumn, inflation is cured. This phase leads to a credit boom as interest rates fall, debt soars and there is a speculative bubble.

In our case it was cured by Paul Volcker in the 1980s by his very high interest rates which brought inflation down. This kicked off a bond market bull run like we have never seen before. A 30 year drive of continually rising bond prices and falling bond yields and the current financialisation of almost everything, that we have seen in recent years. Such as, frenzied buy backs fueled by debt, unicorn businesses like WeWork with multi-billion dollar valuations despite negative net cashflow.The bond bull market will be studied by economisits for the next 50 years. The advice from many professionals is to have the percentage of your portfolio matching your age in bonds, so 70% if you are 70. From the point of view of capital preservation that has some logic, particularly if done gradually with each passing year. Still, prices have gone up for 30 years, I doubt very much they will go up for 30 more.

There is now excess capacity in the economy from a long period of mal-investment. Commodity prices fall steeply. There is steep deflation and a depression (don’t blame me, blame Kondratiev).

It is said King Canute attempted to hold back the tide but could not, that is not correct. He knew he couldn’t and he demonstrated that to his followers by trying and failing. In some ways I think the same is true of the central bankers, deep down they know their efforts will fail but they are paid to try.

The tide is now coming in rather fast, so the Fed released $1.5 trillion into the market last week to shore up overnight markets. That’s because people are going bankrupt for lack of USD, they simply will not lend to each other, behavior that suggests deflation is here. The market probably knows for example that the shale oil producers are going under, airlines are going under, downstream oil is going under, so the overnight credit markets will be frozen. These businesses are on Federal Reserve life support but it won’t work and it hasn’t worked since 2008.

In the last two years alone the United States economy added $7.5 trillion in debt, that’s in non-financial sectors. How much of that capital is actually in productive use is hard to know. The total outstanding non-financial US debt is about $85 trillion (you can find all these figures here).

Simply then, the largest announcement of central bank support in history amounts to 1.7% of the debt in issue in that country and about a fifth of what has been in 24 months. When it was announced, the markets reacted wildly with a steep climb and then 30 minutes later back to where they were. It is simply nowhere near enough, it sounds (and is) enormous but it will make no difference.

Crucially, the elimination of debt is much easier for a company than a country. A company and and individual can go bankrupt. Their slate is wiped entirely clean and they begin again, but it isn’t the end. Unfortunately, the Federal Reserve and governments around the world risk turning this debt into national debt, which is much harder and more costly to eliminate.

Reset incoming

We have written before about a reset coming. “The Green New Deal” or some such. However the marketing is packaged it will essentially be a debt jubilee. You already see it starting in the US. Interest repayments on student loans have been suspended. That student loan book is $1.6 trillion, about 7.5% of US GDP.

The interest rate on Federal Student loans is 5-7% depending on your status. So the current hiatus is roughly a $100 billion annual stimulus.

Historically, debt jubilees were common. Even in the old testament, every seventh year all debts were cleared and creditors were cancelled. While that sounds enormously radical, it is quite sensible. Most likely it would force prudence on lenders, nobody would lend at the rate they do today if they new it would be zeroed in year seven. It might cut out a lot of prudential regulation too.

In the 1930’s the debt jubilees were huge, in France they amounted to 50% of outstanding debt. There is a good article here on Sovereign debt relief in that period. The issue of course is that the money from debt jubilees must come from somewhere and generally that is the holder of the bond. Just like the American government is taking a haircut on its student loan book, holders of sovereign debt could be taking a cut too before this decade is out.

Bonds might look safe, but Shakespeare had it covered. “Neither a borrower nor a lender be” and for very good reason.

Kondratiev

The missallocation of capital in the last 10 years has been enormously destructive. There are so many businesses with totally broken business models that operate only as temporary guests of the free money ponzi. They employ thousands of people who should be doing something else. It is in fact an enormous waste of human talent and is the true cost of the last financial crisis.On the bright side though, we also know that spring will come and as Kondratiev said “some new factor of production will drive growth”. What will it be? I think a good place to start is a new benchmark measure for the proper allocation of capital. I think it will be called bitcoin and nobody will believe it when it happens.

As a side note Kondratiev’s efforts were not welcomed in the Soviet Union. He was imprisoned for his work in 1930 for eight years for being a suspected member of the “Peasants Labour Party”. On his release, he published a further five books. He was then the subject of a further trial, receiving ten years in prison “without contact with the outside world”. He never served that sentence, he was executed by firing squad.

For that reason alone I hope he is right, and if he is right, spring is coming!