Start small

This is Greg Schoen, with a genuine tweet from 2011. You can look him up on Twitter @GregSchoen.

Greg’s 1,700 bitcoins are now worth US$18.5million.

He is very open about it in fact. I think he got a good deal. Totally untried technology which back then absolutely nobody had heard of. He had a go on something very new and made 5x his money, which was a lot to him at the time. It’s a great story but it is somehow presented as a failure. In fact, even being able to interact with bitcoin in 2011 took considerable technical skill.

That people like this gave bitcoin their time when it was still very young made all the difference. It became an accepted currency among IT geeks and internet forums long before the mainstream had heard of it.

When you are assessing a cryptocurrency investment it is quite likely you will be told numerous reasons why it is “better than bitcoin”. Whatever they are, they will miss the point, which is: bitcoin had no pre-mined coins, marketing budget or internet advertising. It simply was and is a piece of code that was released into the wild and it would either survive on its own, die, or be killed.

In 2011 very few people believed it would survive. In 2018 when the market crashed even more people joined the chorus of doom. Computer code doesn’t care though. It has no emotions, it never stops operating as designed and importantly it is apolitical. In today’s world that is one of the primary drivers of its success.

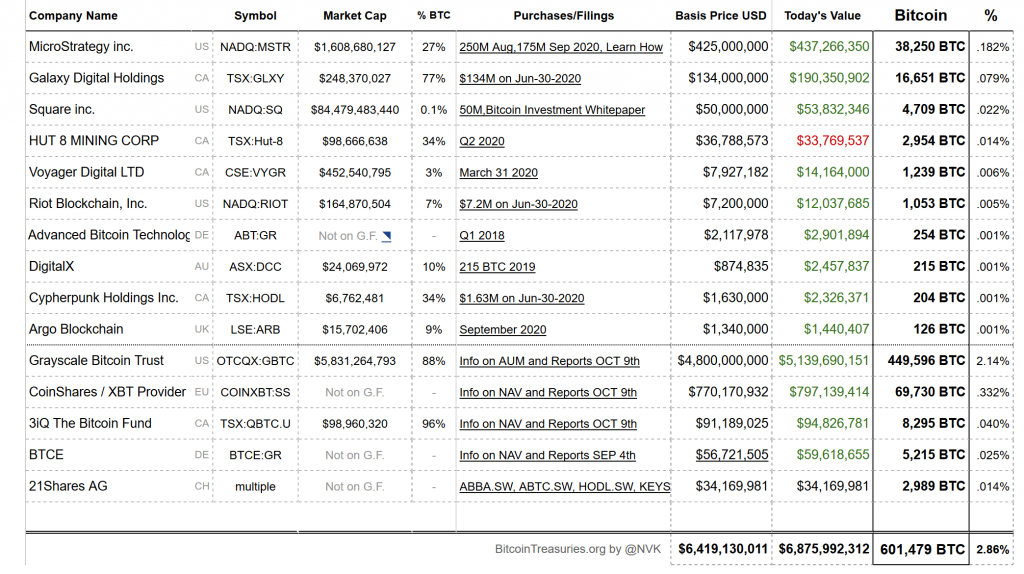

Bitcoin Treasuries in Publicly Traded Companies

We can add Square Inc. to the list of companies who hold bitcoin as a reserve asset in their corporate treasury. They purchased $50 million worth last week, which is probably less than their annual table tennis rental bill. The list is not long and is dominated by companies with founders who are the majority shareholders. I think we can discount Grayscale and the other fund managers too, whose assets are held in trust for investors, but even without them it is a lot of money. Nearly 3% of total supply now sits on the balance sheet of listed companies, which will probably surprise some of you sat on the sidelines.

The expectation is that many more companies will add bitcoin to their treasury holdings. I find that hard to believe. All the companies in the list have some unique features that mean they can pretty much do what they want because one person owns most of the shares, I expect almost zero public companies without the founder present to add any bitcoin at all. Which CEO is prepared to take the risk? Most public companies have their eye on the next quarterly announcement and their senior managers’ share options, highly doubtful they will want to ride on what they view as a volatile asset.

In reality (Grayscale aside) these numbers are tiny compared to the quiet volume entering the space. It’s totally irrelevant in my view but it makes a good story and it’s good PR for companies that want it.

If you want listed companies with bloated workforces and ridiculous valuations, well you have the whole stock exchange to go at. If you want something alternative, buy bitcoin.

While stocks last

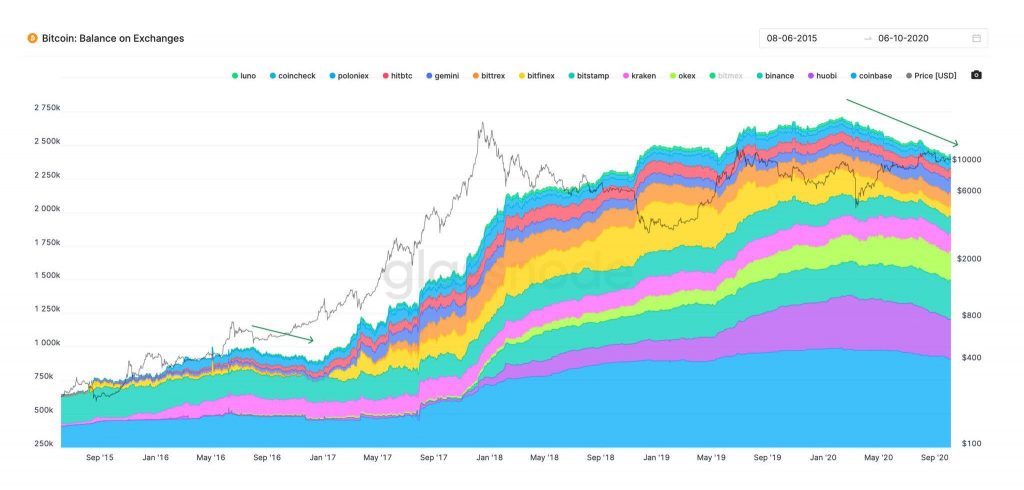

Over the years Bitcoin analyst Willy Woo has lead the way with some of the more nuanced macro-indicators for bitcoin. His site is excellent if you are interested in looking at the different metrics which drive bitcoin.

The latest, and possibly least sophisticated, is coins held on exchanges. This first chart looks solely at US facing exchanges whose bitcoin holdings have risen strongly over time. This reflects the growth of interest in bitcoin and that growth is dominated by the largest exchange, Coinbase (in blue). Bitcoins held on exchanges have grown from 200,000 in 2014 to 1.2 million this year.

Since about May though, coin holdings have started to fall, a situation which has few parallels in the history of bitcoin.

The exchanges themselves are holding the bitcoins on behalf of clients, they will however include their own treasury stock. Falling exchange stock tells us two things:

1. More people are taking their coins off exchanges and sending them to cold storage – indicating a willingness to hold long term.

2. Exchanges themselves may be selling down their own stocks, a process that cannot go on forever, particularly if demand is growing.

The last time this trend of falling stocks happened was immediately post the 2016 halving. It does make some sense, simply their are fewer new bitcoins coming onto the market and everyone needs to adjust accordingly. Last time around that adjustment took 6-12 months.

The trend of falling bitcoin stock is even more pronounced on global exchanges now back at 2018 levels.

My personal favourite indicator from the Willy Woo stable is the bitcoin difficulty ribbon. The red lines show the difficulty of mining bitcoin over 200 days, 128 days all the way to 9 days. When the lines compress it means that the rate of difficulty increase is slowing as weaker miners are taking equipment off line and selling coins to fund operations. It happened after the 2016 halving and it’s happening again now.

Generally, and the sample set is very small, the compressed ribbon indicates a good time to buy. Suffice to say that right now, the ribbon is compressed.

100 years

In 1920, with the First World War recently ended, there was turmoil in defeated nations. We have focused before on Germany, but the issues were no less severe in Austria. Hyperinflation came to Austria first. From 1914 – 1923, the Austrian price index rose by a factor of 11,836.

Fast forward a century. Austria became the first country to lend out money for 100 years, which seemed ridiculous. In 2019 I called it ridiculous and since then I have been totally wrong and the price of those Austrian bonds has doubled as the yield has collapsed to 0.53%.

At 0.53% per annum, for 100 years. It’s a as simple as lend me $100 and I’ll give you $170 in 2120. You might wonder why anyone bothers?

Well, there is a concept in bond investing known as convexity. Convexity, measures the rate of change of a bond’s volatility to changes in current interest rates. It increases with longer the duration and lower yield. So there is perhaps no more convex bond in the world than the Austrian 100 year bond.

I would suggest its performance is simply related to traders betting on that convexity. They know that the European Central Bank will keep printing money and keep rates very low. Convexity works in both directions though and the speed with which it changes direction will be rapid. When we reach the end game there will be two things you won’t want to be holding – one is an un-exploded grenade and the other is the Austrian 100 year bond.

European finance has become a full blown casino, the VIP rooms are open only to holders of a banking license and drinks are complimentary for employees of the ECB and the IMF.

Don’t Trust, Verify

Never failing to deliver, we have the European Central Bank. “The value of money is rooted in citizens’ trust”. So says Fabio Panetta, ECB Board Member.

Finally, we have an admission from a banker that their none gold backed currencies are utterly worthless pieces of paper.

In Bitcoin there exists a notion of “Don’t Trust, Verify”. The whole idea of it is that you don’t need to trust anyone at all. You can receive money from anywhere in the world from a person you have never and will never meet and can immediately tell if it is valid.

This actually goes to the heart of the “Bitcoin is backed by nothing argument” so often thrown around. Let’s be absolutely clear, the Euro, The Pound, The USD, AUD, JPY are backed by nothing, they are fragile.

Bitcoin on the other hand is costly to produce. It is backed by the energy required to mine it. If you want to mine bitcoin today, pay for the equipment and the electricity and you are a hyper efficient operator, maybe you could mine it for $10,000 per coin on average.

Anybody can check right now the exact total amount of work (and therefore cost) that has gone into mining bitcoin since its inception on their own bitcoin node. It is the largest continuous computing calculation ever undertaken, at great cost.

I will reiterate this very important point. The “bitcoin is backed by nothing” argument is wrong. Almost always it is rolled out by a central banker as it was again this week by Andrew Bailey in the UK.

Fiat money is backed by nothing and to prove it we have the ECB urging citizens to trust them. Fiat means by decree. It is money because the law says so. Bitcoin is money because it harnesses the energy used to mine it, you can independently check that as well as the exact total supply. No need to trust me or anyone else.

Big, big, difference.