We have written extensively about the bitcoin halving and how that creates a unique supply curve. Our full report on it can be downloaded on our website.

The essence of the bitcoin supply curve is simple. New supply is a permanently falling percentage of existing supply. Currently 12.5 bitcoins are produced in each ten minute cycle, this grows total supply, but at a falling rate.

The second component of halvings is much more dramatic. Every four years the number of bitcoin mined in each 10 minute window falls by half. By mid-May 2020, the new incremental supply each 10 minutes will be 6.25 bitcoins. Nothing else has a supply curve like this so we don’t really know what will happen, we can only observe from the previous two halvings. See the report for full details.

The post-halving period is a big test for bitcoin. Fiat currencies have taken a different approach during this crisis with massive devaluations of their buying power though money printing, Over the next few years we are going to find out which approach works.

The thesis of our funds is that history has taught us governments cannot resist the debasement of fiat currency, they have never resisted and ultimately it leads to dramatically reduced purchasing power. Interestingly the new Governor of the Bank of England took on bitcoin in his first meeting with a Select Committee of MPs, he said “bitcoin has no intrinsic value”. This is not correct, bitcoin cannot be produced without expending energy through mining, I know that when I buy a bitcoin today it has cost a miner roughly $7,500 in energy terms to produce, they cannot fake it.

Fiat currency on the other hand, can be produced by pressing a button at the bank. Fiat means “by decree”; it is money because the government says it is money. Intrinsic value? None. Many of the public believe their national currency is backed by gold, it never is (even Switzerland gave this up under US pressure). Indeed, in Britain prior to the last financial crisis, then Chancellor Gordon Brown sold the bulk of the UK’s remaining gold at prices around US$282. The government caused the price to fall by pre-announcing their move. Amusingly, this became known as the “Brown bottom”, the price is now nearly six times higher at $1,600.

The point is, the idea of scarcity is tested, it works. Nothing quite has a scarcity profile like bitcoin and we don’t exactly know what will happen. I suggest, prepare for disappointment first, followed by explosive performance subsequently. You only need patience, governments around the world are doing all the work for us.

Repo

I know, you’re bored of Repo but this is a great find from website Zerohedge.

Quick recap: the Repo market is a short term market for cash, generally I offer my bonds for $99.90, the lender keeps the asset as security. In the morning I give them $100 and get my bonds back. So it’s secured lending, cheap, everyone trust it and it works well until it doesn’t.

As we know, it stopped working and the Federal Reserve offered virtually unlimited repo, up to $500 billion every night but when this didn’t calm the markets, they did something else and restarted quantitative easing.

What happened? Well, nobody put up their treasuries for repo with the Fed. Why? Well you now have two options:

1. Lend your over-valued asset to someone and get cash for it overnight at more than market value, but get the asset back at the end of the term under the Fed’s Repo scheme.

2. Permanently sell your over-valued asset and get cash from the Fed’s QE scheme.

The market? Well they chose option 2. It is comforting to know that there are others out there who don’t think the US Government’s bonds are worth what the “market” says. Indeed almost no market participant appears to believe it.

So who is buying? Well, like poker. If you can’t work out who the mug is at the table, then it’s you. Nearly all pension funds are investing in bonds on a daily basis.

Digital Currency

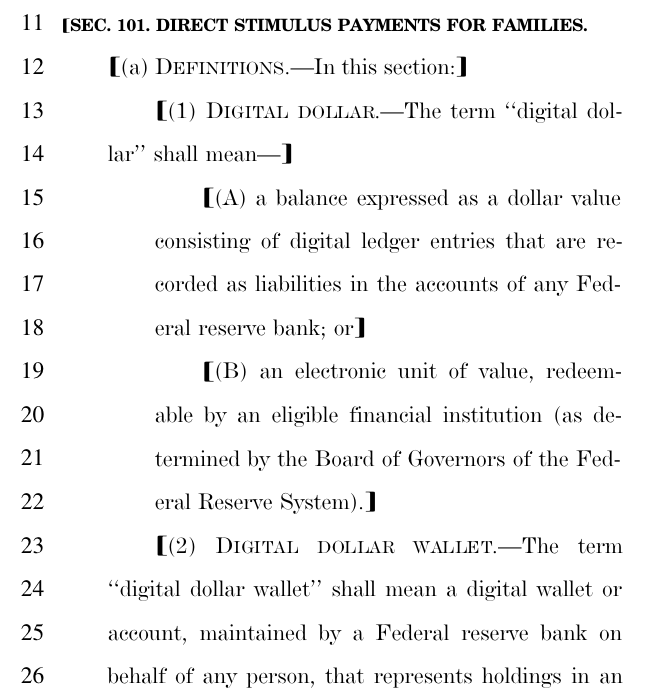

That is an extract from Speaker Pelosi’s direct stimulus plan. It is a digital United States Dollar (as if the dollar were not digital already). It simply dreams up magic money and puts it directly in the wallets of Americans. There are some advantages here, in that this money will be different from existing American dollars, specifically it is designed for spending and stimulus not for saving and investment. So, for example, it cannot be loaned.

This could work if those magic dollars were somehow backed by real dollars, I do not believe that is the Speakers plan. The name of the game right now is get money to people, fast – deal with the rest later. In effect she would be giving all Americans an account at the Federal Reserve.

There is a serious bout of inflation waiting for America, when it comes it will bite hard.

> Monetary integrity is no longer of importance, that is clear from recent printing activities

> Will trade recover with the biggest trading partner China? Those cheap goods might not flow anymore

> A lot of new money will be chasing many fewer goods.

Buy something scarce!

Debased incentives

Most Americans approve of the idea that they will receive $1,800 as part of the government’s $6.2 trillion stimulus plan. It’s puzzling in many ways, the stimulus itself costs $17,500 for every American for which you get $1,800. It sounds like a bad deal.

This photo explains the system. It is taken on the day multi-billion stock buy back company American Airlines was bailed out. It is a picture of American ICU nurses wearing bin liners, they will get $1800, AA will get billions.

It will all be paid for by monetary debasement. The disgrace is most people do not realise. They are wearing bin liners and cheering their $1,800 from the stands.

You would have heard a lot last year about Facebook’s currency and all the wonderful companies that joined the Libra Foundation. Subsequently, under pressure from government, most of those companies pulled out and we here a lot less from Libra.

While all that noise happened, one of the leading companies in bitcoin development, Blockstream was building its own Federation. They have built a bitcoin side chain known as Liquid. It has all the features of bitcoin but is much faster and much less secure (that’s the trade off). This chain is maintained by the Federation members.

Cutting a long-ish story short, ListedReserve is now a member of that Federation. We can issue our own assets and redeem them all via this new side chain. For example, we could run a stock exchange, issue a currency, that kind of thing.

More to come on this but the full story is here.

Zero

Here’s a fascinating article about humanity discovering the concept of zero. Most of this was new to me. Health warning, it is a long read (probably 30 minutes).

The essence of it is when something better is invented, it meets all sorts of resistance from incumbent technology. Ultimately though, it is so superior it prevails through inevitability