Strategic Bitcoin Reserve

Perhaps sanity did prevail. As I had hoped last week, the initial holdings in the American Strategic Bitcoin Reserve will indeed be made up of assets already held by the US Government. The majority of those were seized as part of the Silk Road case in 2013.

Government BTC deposited into the Strategic Bitcoin Reserve shall not be sold and shall be maintained as reserve assets of the United States utilized to meet governmental objectives in accordance with applicable law.

At the same time, the US also established a “United States Digital Asset Stockpile”. Interestingly this is separate from Bitcoin, which I think is also sensible. The US Crypto Czar, David Sacks, was quite clear when he said “there is bitcoin, and then there is everything else.”

The Reserves can only be funded in ways that are “budget neutral” and do not impose costs on taxpayers. So, there will be no direct spending on the acquisition of assets which seems entirely appropriate to me.

Sanity then.

I was rather in the camp that a Strategic Bitcoin Reserve was unlikely to happen. In ruthless terms, the currency hegemon (in this case the USA) has the most to lose from Bitcoin. At some level then it’s surprising that they would do this. You could equally make the argument that they are simply dominating the opposition. If they build a reserve large enough then it is an incredible hedge at almost no cost to America (since they can print the dollars that buy out the opposing asset). The supply cap means it is very much first in best dressed.

It may not feel like it in a week with the price action we have had, but the Game Theory moment is approaching. The United Arab Emirates was buying bitcoin late last year, now the United States of America is bolstering its own stash if only by not selling any. They laughed at El Salvador, they laughed at Bhutan and the joke is obvious to some of us and not to everyone else.

OCC

I had intended to write about the OCC approving banks to custody digital assets (which is a bit boring despite being good news). Having mentioned the OCC before I had a look through our archive. I did find it along with this more interesting extract from 2021.

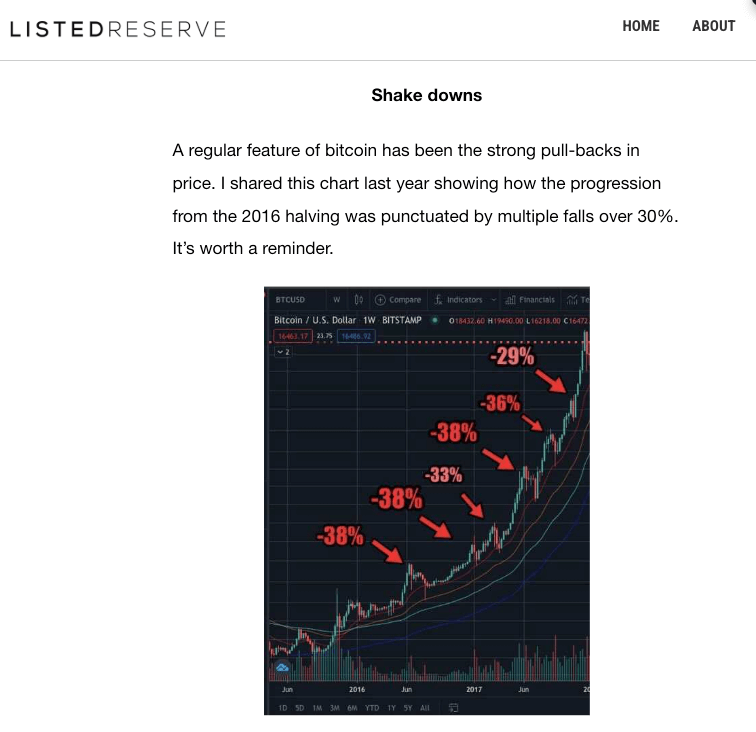

The price was around $15,000 when I first posted the chart in 2020. When I followed up in 2021 we had just dropped below $30,000. That decline was caused by the China mining ban which was a far more serious challenge to bitcoin than current conditions are. I imagine the Chinese are now considering an entirely different stance.

Pectra

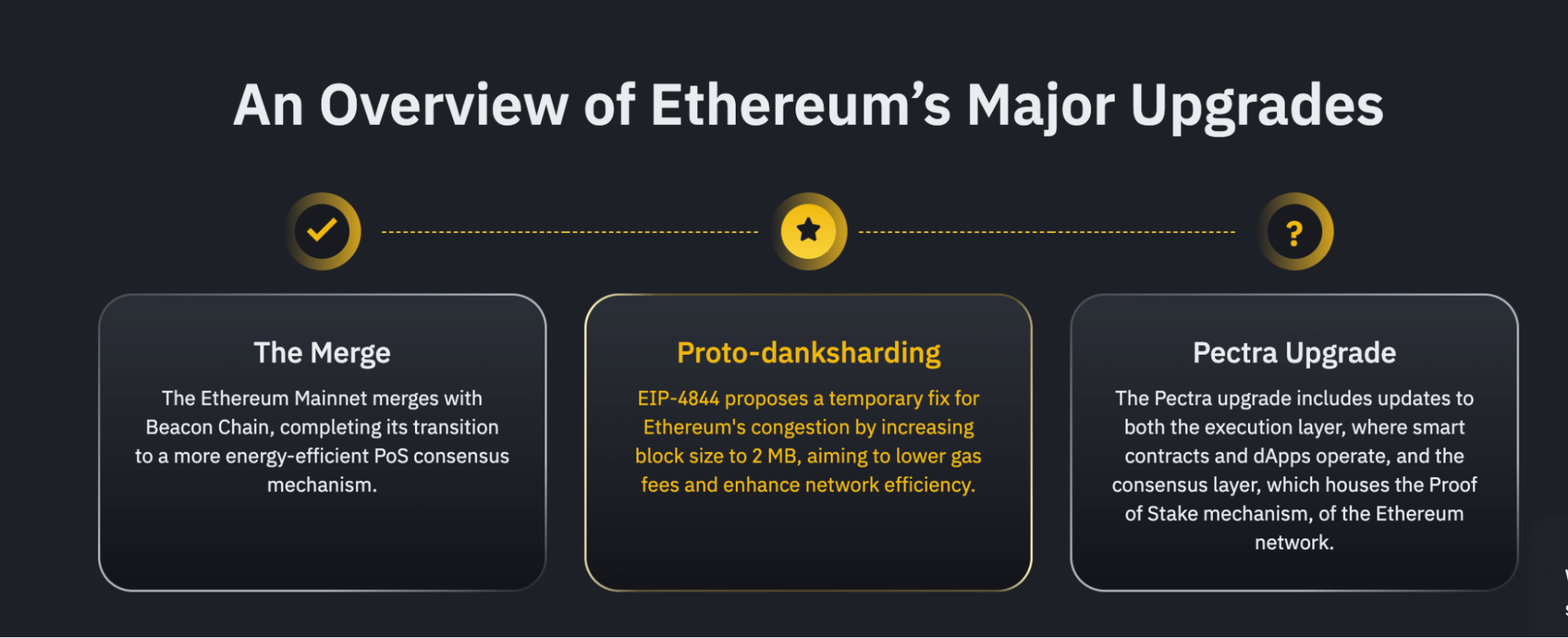

Ethereum’s latest change known as the ‘Pectra Upgrade’ was scheduled to go live this month. As is now customary, this will be delayed but when it does go live it will have some interesting features. Perhaps most notably, ‘gas fees’ will be payable in currencies as well as ETH (so you could use stable coins).

ETH’s best chance of success is going exactly this and owning the stable coin landscape which is already huge and only going to get bigger. The amount of ETH that can be staked in the network also increases with Pectra (32 ETH to 2,048 ETH.) The current limit is theoretical since you could stake multiple times but it will certainly make life easier for institutions.

Once ETH ditched proof-of-work with the Merge in 2022, it ceased really to be a competitor to bitcoin (if it ever was). I think the path of technical development they have chosen is complicated and fraught with risk but the market they address is huge. For example stable coins are a massive business and will continue to be. The market for low transaction fee transfers is huge and growing, if they get this right they can address it. Finally the market for yield generating assets is the largest in the world, the bond market. If Pectra takes Ethereum to a place where it can host that kind of asset, and they can actually explain where the yield comes from. Then good.

I can perfectly imagine how that could be done.Stablecoin issuers start recycling some of their yield from treasuries back into their host protocols (e.g. USDt paying interest).

Ethereum’s main risk apart from technical complexity is that someone beats them to it and does it on bitcoin first. A possibility that some think is in fact a high probability event. It’s covered in some detail in Bitcoin is Venice by Allen Farrington and Sacha Meyer. Heavy going (they have thought about things a lot) so you could try before you buy here.

Euro-Trash

What?

The ECB announcement on Friday was a complete shambles. Lagarde attempted to play hard ball “if the data says cut, we cut. On the other hand if the data does not say that, we will pause”.

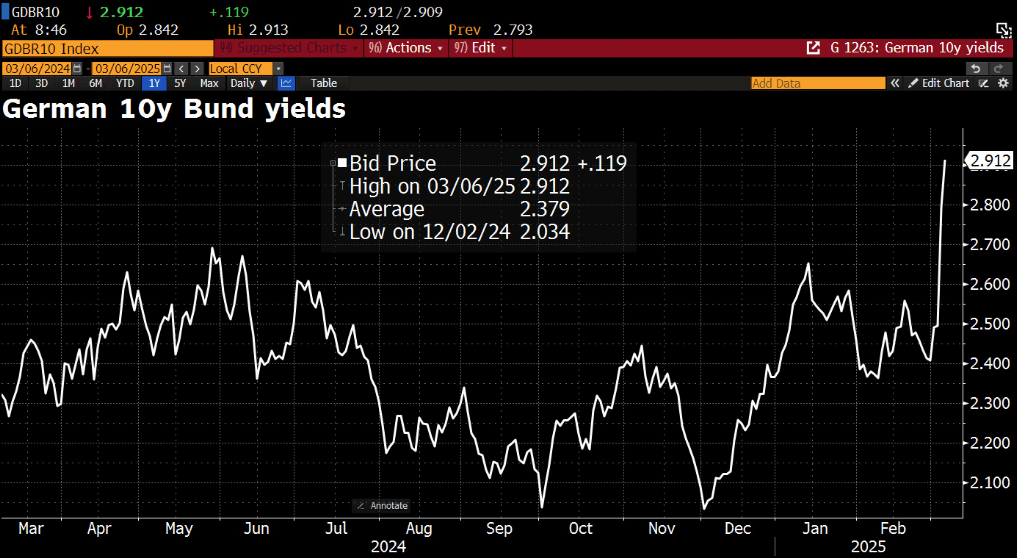

What about raise? What about the fact that bond yields in Europe had a 2008 moment last week because of the proposed defence spending. Germany’s 10 year yield went straight to 2.9% just as Lagarde took her pretend Euro rate to 2.5%. To keep it there for any length of time she will need to buy an awful lot of bonds.

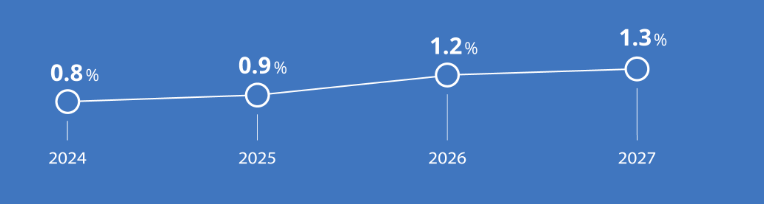

The press conference got more and more depressing when the growth projections for the next few years were revealed. 1.3% in 2027 and less than that until then. I don’t think you could publish that kind of figure and not demand that some sort of radical action is taken but none of it. In reality it is likely to be far lower than this and it should be compared to the rest of the world. Europe, even in its own estimation, will be going backwards until the end of the decade? How is this acceptable?

They have only one option here and that will be for the ECB to buy a lot of the bonds Germany issues. Wholesale monetisation of debt. It will simply be a matter of how this is disguised. I look forward very much to the slide deck.

Monetary policy announcements were not enough. Gender equality was back on the menu in Europe, unless of course it involved getting shot.

Niche Links

Lots of clicking last week, so ‘Niche Links’ lives another day. Most popular last week was Bitfinex Alpha (surprisingly).

This week Ethan Mollick returns on the theme of vibe coding. Give it a go it is actually incredible what you can build now just with the AI toys. By way of example this game was built entirely by AI and has been improved daily by the developer (Pieter Levels). It was meant to be an example of what could be done and in 3 weeks is now grossing USD87,000 per month. Mostly that’s because Pieter is ‘famous’ but it also proves it can be done. As you can see, the graphics are less than compelling. Full write up here.

The IEEFA (doesn’t matter) put this out this week. A general discussion on LNG supplies to Japan. Getting new supply from America has been difficult and is about to get significantly less difficult due to falling regulatory barriers. It’s terrible (and weirdly unspoken) news for Australia. A Japanese LNG executive had this to say:

“In contrast to Australia, in the US there are expectations of abundant future new supply, cheaper prices, lower cost of production and labour and faster approvals for LNG projects … .serious action to address the competitiveness of Australian LNG is needed now”.

I guess we can return to this comment in a few years when there are massive unemployment issues in Perth and Darwin.

This you might find boring but they are the latest toys from openAI. It’s tech heavy but those toys will be embedded within a lot of things you interact with in 24 months. Worth watching if you have a business or employ staff. The computer use is the most interesting.

Finally, lots of talk about how the Coalition are ‘ahead’ in the Federal Election. They lead on primary vote 39-32 but preferences mean minority labour is the likely result. Minority anyone looks terrible to me since whoever actually forms the government will have to pork barrel all sorts of nonsense to get anything done.

Bad times loom for AUD. From a fund perspective it might not be so bad though because weak governments are inclined to spend far more money than they actually have.