Exponential trend

Do you invest in exponential trends? Maybe not, in this case if you invested $10k when it first fell 90% you’d have $5m now. People kept using it and it kept on growing and growing. Sure enough, another crash happened. Investing $10k at that point would be $800k now.

It’s Amazon.

The government released a short note on its proposals for “crypto asset reforms” this week. Here’s what they said and what it really means:

The Australian Taxation Office estimates that more than one million taxpayers have interacted with the crypto asset ecosystem since 2018.

There are 12.8 million taxpayers, so the industry has ~8% market penetration which is quite low still. Given the portfolio allocations this is likely less than 1% of investable assets.

Our Government is ready to start consultation with stakeholders on a framework for industry and regulators, which allows consumers to participate in the market while also better protecting them.

Nothing is going to happen quickly.

As the first step in a reform agenda, Treasury will prioritise ‘token mapping’ work in 2022, which will help identify how crypto assets and related services should be regulated. This hasn’t been done anywhere else in the world, so it will make Australia leaders in this work.

This is essentially classifying each token as a security or not. If it is, assets will need to follow the existing rules. This will be good for bitcoin and not that good for anything else.

With the increasingly widespread proliferation of crypto assets – to the extent that crypto advertisements can be seen plastered all over big sporting events – we need to make sure customers engaging with crypto are adequately informed and protected.

Probable advertising ban on anything other than licensed and regulated products.

The aim will be to identify notable gaps in the regulatory framework, progress work on a licensing framework, review innovative organisational structures, look at custody obligations for third party custodians of crypto assets and provide additional consumer safeguards.

Possibly investment caps on anything that isn’t bitcoin or ethereum.

A public consultation paper on ‘token mapping’ will be released soon.

Interested to read this; we’ll say more when it comes out. We will of course make a submission ourselves which I will share here in MoneyBits.

18.6%

UK inflation continues to accelerate with Citi forecasting 18.6% by January next year. The main issue is wholesale energy prices, which are absolutely exploding.

At some point the tolerance for the price increases will have to end. There is no way households can afford quarterly bills approaching £3,500.

We are moving into a different phase of monetary debasement now. Governments across Europe are simply going to have to hand out money to pay for heating and power because the alternative is literally a population freezing to death in winter. As we know, dead people only vote in America, so I doubt very much this will be allowed to happen.

I don’t think it’s hyperbole to suggest there is no easy solution to this energy crisis. Sooner or later, the printers are coming back on. If the alternative was recession, that would be tolerable; in this case the alternative is worse.

In Europe, the European Commission just approved a €27.5 billion subsidy scheme to German industry to offset power bills. Ordinarily this would be against EU law, since it gives an unfair competitive advantage to German manufacturers. Those laws are out of the window now. €27.5 billion might be pocket change to Germany but it will add up if they keep doing it. The forward price for energy is now €0.70c/KWh; 14 times the seasonal average of the last five years.

It took decades to negotiate the rules of the European Union and create a single market. It’s taken one session of parliament to throw them out the window. The Euro-bind is really significant; the EU cannot afford to have weak German manufacturing since it is by far the largest economy in the bloc. The rest of Europe cannot similarly afford to bail out their own industries. If you happen to be an Italian manufacturer, I’m afraid it’s curtains because the EU has already restricted Italian borrowing capability, it’s doubtful they will be waving through billions in subsidies.

If you’re Italian though, how is that fair?

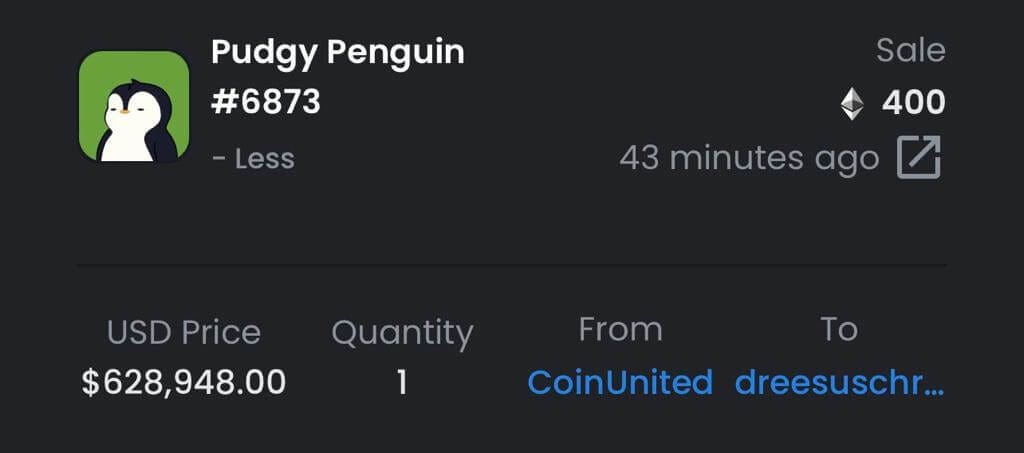

Pudgy Penguin

If you thought the NFT craze was over, it would seem not. In a transaction I’m at a loss to explain, this “Pudgy Penguin” just sold for $628,000.

The entire penguin collection can be found on OpenSea. The rest of them are a lot cheaper. Owners of Pudgy Penguins get access to ‘exclusive experiences and events’. Currently on pudgypenguins.com no such experiences or events are listed but I assume they will involve swimming in icy water and being randomly slaughtered by a killer whale when it’s most unexpected.

My guess is someone meant to pay 4ETH (which is the market price of all the others) and accidentally paid 400. Roughly a $624,000 mistake but it will make a great story one day. I hope they get sent a special can of tuna for becoming a member.

Euro-Trash

It is very hard to provide feedback to the European Central Bank. There is no real open forum by which you can tell them you don’t like their unlimited Italian bond buying, the amount they spend on their canteen, or indeed any other aspect of their policy.

Happily, our European cousins have found a way. Google Maps allows users to leave comments on particular buildings they have visited. Around 50% of the comments on the ECB headquarters are not about the architectural appeal of the building but rather the performance of the ECB Board. It would appear that surging inflation is causing a surge in comments too because they have already had more reviews this year than any other.

H. Tess is delighted with the ECB’s work. 5 stars from him or her. They clearly have an understanding of the link between money printing and asset prices. The H. Tess pension fund is going well it seems.

Others are less enthused. Moritz clearly confuses the role of the ECB with that of an iPhone app. Bemoaning the ‘user experience’ while calling for prison sentences for ECB staff. Naturally, I support this measured view.

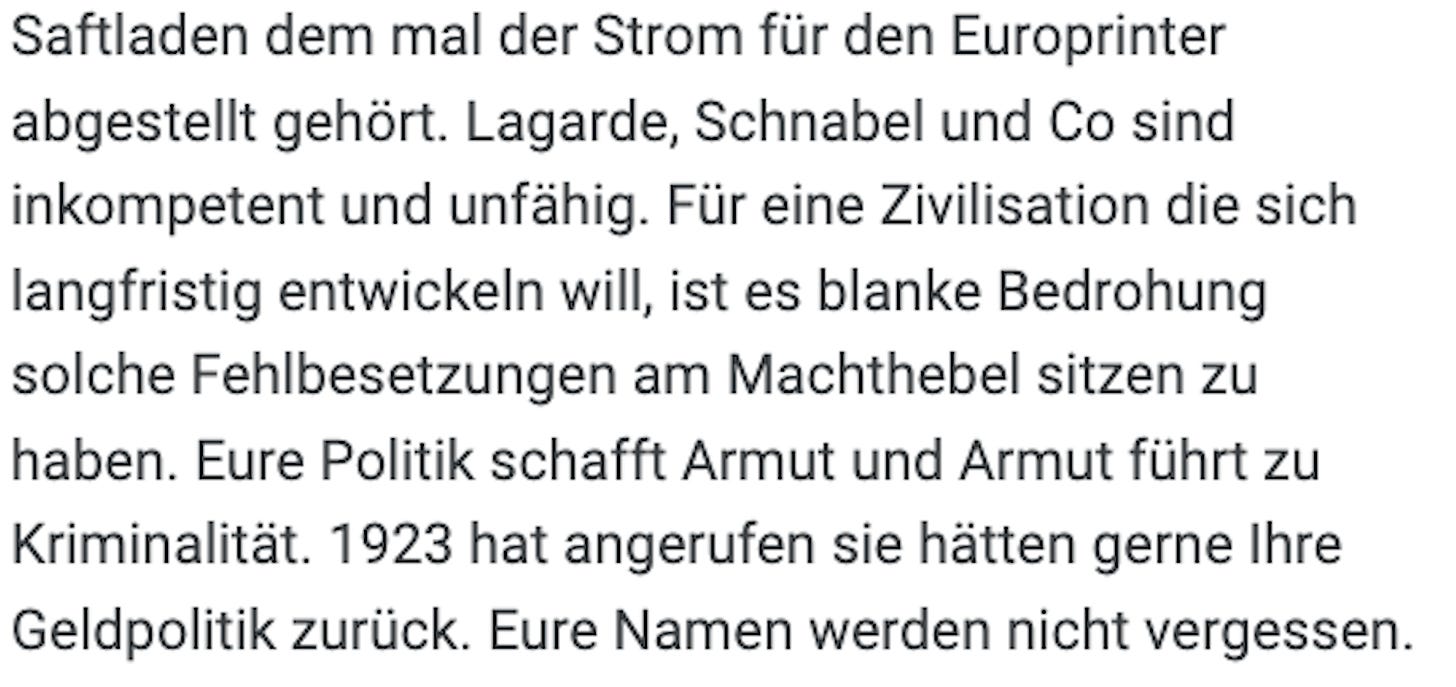

Many of the comments are in German. This one roughly translates to “Lagarde and co are rubbish”, before adding “1923 called and would like their monetary policy back”. Unusually amusing for a German.

And so … what about the comments on the Reserve Bank of Australia? Well I don’t want to ruin it for you. They can be found here, many of them too rude to republish. Enjoy.

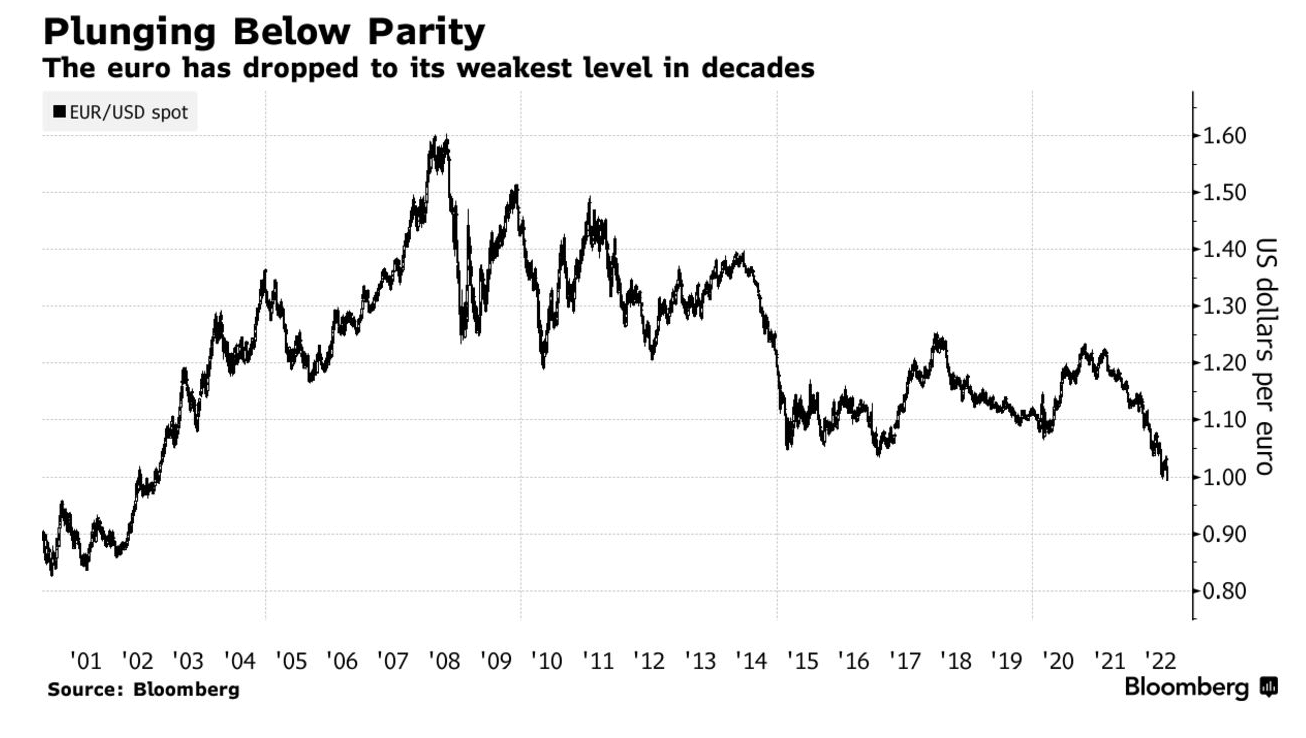

Quick Euro footnote too; we are back below parity with the US dollar after a little bounce along the x axis. We need Christine back at her desk. On Monday I’m told she’ll be back with hand on the tiller.