In perhaps the largest gathering yet of Bitcoin participants, Miami hosted Bitcoin 2021. Over 12,000 tickets were sold for the event (which weren’t cheap at $1,500 – $15,000) so it was incredibly well supported.

As with all conferences, it was 90% canapé and hangover with 10% value thrown in. Perhaps the best summary came from Nic Carter of Castle Island Ventures:

- The Nation State Land grab has begun, not just for BTC but related resources

- There will be a push to bring technology experts in this sector into countries

- Mining wil move on-shore in the US

- The sooner countries secure these resources, the better for them

- Realistically, no country is launching their own digital currency until they have a complete grasp of this space and some participation in it. There aren’t that many people out there who understand it. Grab them now.

- See below for discussion on El Salvador.

- Hashrate migration has begun

- Miners are leaving China (a source of recent negative price action)

- Many are moving to North America

- Miners are awake to ESG

- Clearly the extent of renewable in miner mix is going to be hugely relevant to their long term viability (currently 40% and rising)

- Look for bitcoin & renewable projects cropping up everywhere (see below for Square and Blockstream solar mining project)

- The bitcoin lightning network – works

- Talked about forever; now genuinely being used in anger and working well

- Miles to go here. Wait until it is integrated with social media (expect twitter first)

- Proof of Reserves will happen:

- This is about exchanges cryptographically proving they own the assets they claim they have. It’s actually trivial to do with cryptography but nobody does it. Once one domino falls here, all will follow because if you cannot prove your reserves people will ask why when many others do.

- There will be a shake out when this happens as there is suspicion that some exchanges sell bitcoin and other assets they do not actually have. Hence why you never leave assets on an exchange

- Cultural salience

- I think most important of all was this recognition

- Bitcoin is on Bloomberg every day (normally bad news)

- It is in the mainstream media every day (normally bad news)

- People want to be associated with Bitcoin for a whole variety of reasons (normally good ones)

There is a long way to go but Miami has reminded everyone just how much is happening and how many talented people are making it happen.

El Salvador

Saturday 5th June (Miami conference in full swing)

During the conference The President of El Salvador took the stage by video link and announced that the country would move to make Bitcoin legal tender. Should it be passed into legislation this would mean that retailers are required to accept it as a valid payment protocol.

El Salvador is a small country, if they converted their entire foreign currency reserves into bitcoin they would still own less than MicroStrategy. Their GDP of $27 billion equates to 1.5 days of US Government spending. Monetarily, this is not significant.

The significance perhaps is that people now realise there is an alternative to the USD. You might argue that gold could be used, but gold is extremely vulnerable to theft and too difficult to transport and just not that handy when you are paying with your mobile phone.

Tuesday 8th June (when I drafted this)

Wednesday 9th June

Hacking is bad. Bitcoin must be banned

In early May the Colonial Pipeline that serves fuel to the Eastern Seaboard of the USA was hacked and production systems were compromised. Colonial immediately turned off their systems and paid the hackers US$5m in bitcoin to obtain a software patch that would reverse the effect of the hack.

It emerges this week that the FBI have now recovered these bitcoins. Apparently, on receiving the amount, the hackers sent the bitcoins to a custodial wallet (i.e. a cryptocurrency exchange) and the FBI traced it and issued a warrant to the exchange to recover the bitcoin; which they did.

Since then, we have been on the receiving end of a number of headlines about why digital currencies are bad, not least from economist and former IMF Head, Kenneth Rogoff in the Financial Review.

Rogoff’s argument runs that cryptocurrency was designed to make ransomware, illicit laundering and the circumvention of capital controls easier and it should therefore be heavily regulated in its use or banned. He totally misses the point this new technology is simply a more convenient, more private, and safer way to transfer value.

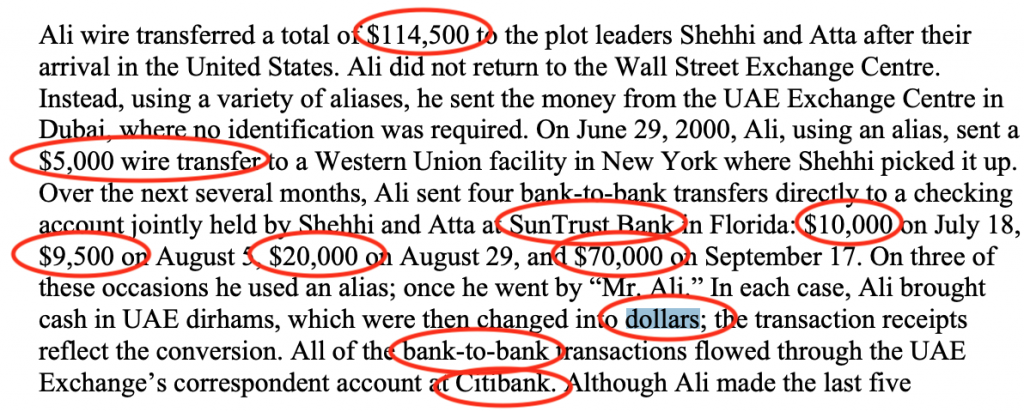

Banning new technology is rarely the correct answer, and I present Exhibit A. An extract from the United States government’s report on the financing activity for the 9/11 terror attacks.

That’s right, entirely US dollar driven. Bank to bank transfers, Citibank (again). Yet nobody called for the end to the USD, because it is not really the fault of the USD that at the time it was easy, convenient and trusted.

The report goes on though, Exhibit B. No need to highlight this one since the whole paragraph is about the US banking apparatus.

The simple fact is people will choose to adopt the best technology available in any sector, including finance. Yet here we are with coordinated articles from across the world from prominent economists in the pay of the US government. To be fair to Rogoff he has been consistent having written a paper in 2016, “The Curse of Cash”, calling for the full removal of all physical currency. A point of view that seems curiously in line with the desires of central bankers. He has a point though, there is absolutely no crime network in history like the US dollar network.

Something isn’t quite right about the Colonial Hack. Closing down an entire pipeline in the US is no trivial matter and requires a high degree technical sophistication. I struggle to believe that such perpetrators would then be foolish enough to send their ill-gotten gains to an exchange inside America when it is so trivial to send it to your own wallet or node. Everyone knows how easily traceable bitcoin is, particularly hackers.

What’s more, we are advised that the FBI miraculously recovers the money? No damage is done to Colonial via the pipeline hack other than to the reputation of their IT department. Then, immediately on recovery the usual suspects are in every global daily singing from the same hymn sheet. The whole thing stretches credulity.

Nobody wants to see hacking; nobody wants to facilitate crime. Useful and beneficial technology tools will be used, by everyone. Good and bad. Just like encrypted messages are. People value their privacy; they value speed and ease of use and they will all gravitate to the best provider of that.

As to hacking more generally, we are likely in the middle of a cyber-war. Most businesses and countries are miles behind the curve in that war. The answer has nothing to do with banning things. We have to move away from the mass collection of data and the creation of tempting honey pots for hackers. We have to educate people on “what goes on the internet – stays on the internet”. So, be careful with what you send and where you send it to.

Tech will be the answer here. Banning things likely won’t.

Solar powered mining

Jack Dorsey’s Square in partnership with Blockstream are investing in an entirely solar mining grid. Initially it will be small and is designed as a proof-of-concept for 100% renewable bitcoin mining. It will come complete with 24/7 open source dashboard so everyone can see the facilities performance, power output and bitcoin yield.

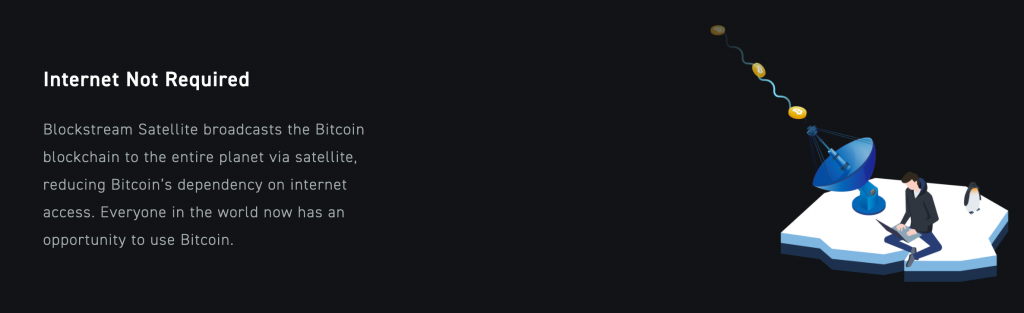

Best of all though is the facility will communicate with the Bitcoin network via the Blockstream satellite, which since 2018 has beamed the blockchain across the world for anyone with a satellite dish.

What are actually seeing is a network that can participate in the global economy while requiring no access to the internet, no access to an electricity grid and no access to the traditional financial grid. If you think about that carefully it is incredibly hard to imagine how that could ever be done, but it has happened.

This is effectively a parallel settlement system emerging outside of the existing world of finance. That is not the objective of this particular exercise, but who knows where it might take things. What are actually seeing is a network that can participate in the global economy while requiring no access to the internet, no access to an electricity grid and no access to the traditional financial grid. If you think about that carefully it is incredibly hard to imagine how that could ever be done, but it has happened.

This is effectively a parallel settlement system emerging outside of the existing world of finance. That is not the objective of this particular exercise, but who knows where it might take things.

Euro-Trash

It’s just a tiny bit depressing this. I can’t really point to anything that Agent Lagarde has done other than buy a lot of bonds. I can’t see any vision; I can’t see any difficult choices; I don’t see any bright future on the horizon because she made a tough choice to her personal cost, that would benefit anybody else. It’s all politics and money printing.

The most depressing thing about this latest bout of French prize-giving degeneracy is that Turgot, in whose name the prize is given, was a fabulous economist. He laid the groundwork for the recovery from one of France’s most famous financial disasters in which John Law had brought the economy down by printing unlimited paper money.

I can think of no person less worthy of a prize in Turgot’s name than Lagarde, but she has no shame. Her speech will make stomach bile accelerate through your cranium. If you wish to read it, it’s here. Have a bowl ready.