Gas again

The latest EU plan to address the gas crisis is barrelling into view. After the single largest one day fall in gas prices ever last week, Russia responded by turning gas off completely. The response was predictably perverse from Ursula von der Leyen, a person not fit to care for goldfish, less still a whole continent.

Not knowing a tremendous amount about the Euro gas market I still think these policies are unlikely to succeed. The price caps are only relevant for importers who buy Russian gas and then sell it on. They will now sell at a loss and guess what, they won’t import any more, exacerbating supply issues.

The credit lines for those facing margin calls feel exactly like the London Nickel Exchange debacle, where large market participants were bailed out at the expense of everyone else. Unfortunately, if the large power operators have gone bust (as they have in Austria and Finland) then they have gone bust. Some new operator can take over and expunged of a debt burden will likely make electricity at a much lower marginal cost. Calling bankruptcy a “liquidity challenge” is surely peak denial.

It’s strange the EU doesn’t seem to understand how the market works. If you don’t actually produce something you are a price taker and not a price setter. Price caps mean nothing.

Imagine walking into a Ferrari garage, baulking at the $1m price tag and then sending them a letter saying I’ve introduced a price cap of $300, I’ll be along tomorrow to collect my vehicle. Red please. Thanks, Ursula.

Australia has a lot of work to do in the next few years to avoid a euro-style energy collapse. I covered this in a detailed piece this week on Livewire earlier in the week.

The rise of the machines

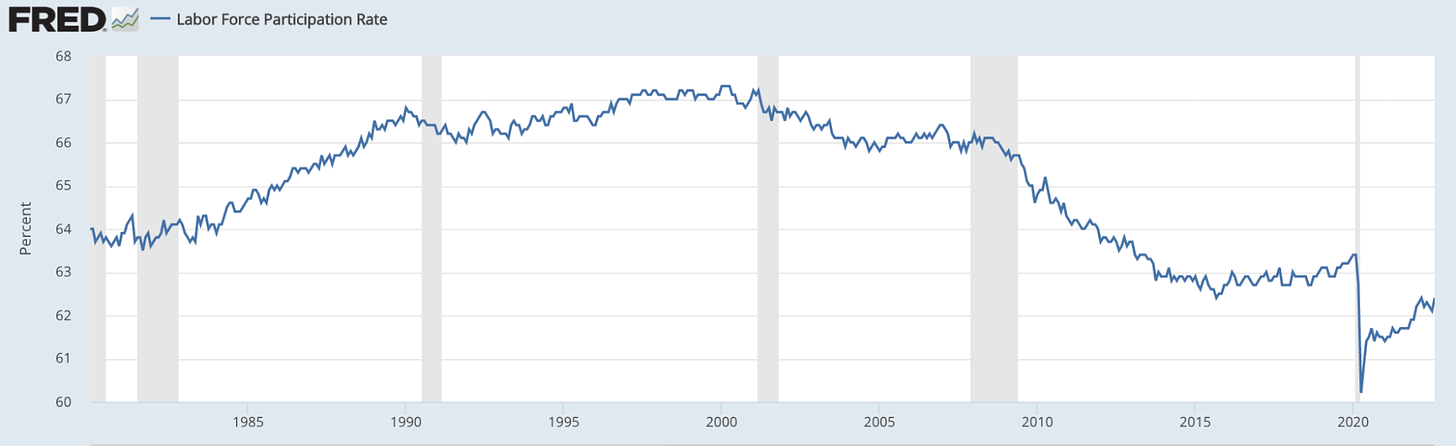

Despite record job numbers, record low unemployment and record everything, the labour force participation in the US continues to dwindle. It hasn’t recovered from Covid and even then it is materially lower than the highs reached in the 1990s. 67% participation in 2000 compared to 62.5% now is a big difference.

The population in question is beautifully described by the US department of statistics as the ‘civilian noninstitutional population”. In other words, people who aren’t in prison. Amazingly, there are still 260 million such persons in America.

Retirees are excluded from this analysis, so 11.7 million people have stopped working altogether for other reasons. Why?

The answer may well be the increasing use of machines. The average headcount per McDonald’s has fallen from 14 to six over the course of a decade as they increasingly automate their procedures, a 60% decline. Now America’s largest employer, Walmart, is introducing automation in all 42 of its giant distribution centres.

Automation is overall a net good. Let’s face it, many of the jobs the machines do, nobody else wants. The idea though that central banks were going to drive up real wages through policy management was always ridiculous. Up against the unstoppable forces of technology and economic incentives, it was destined for failure from outset.

Most people accept now that automation is reality, that software will dominate every aspect of their lives and in most cases they won’t even notice. Somehow, those same people think that won’t happen with money.

Baltic get-together

There are more hyped bitcoin conferences but perhaps the best is Baltic Honeybadger. Hosted in Riga, it sorts the wheat from the chaff because it’s hard to get to. Plenty of highlights but most notable was the launch of Debifi, a bitcoin lending solution.

Given the collapse of major lending platform Celcius this year, I thought it might take longer for superior solutions to emerge, though apparently not.

“If you look at the recent spate of implosions with centralized lending platforms that are based on opaque relationships and unsecured loans, it’s clear that the old system is fundamentally broken”

Debifi’s model is somewhat different in that it builds a multisignature wallet to escrow bitcoin being held as collateral for a loan. They have no exposure to the loan as a platform provider. It is designed so banks can lend against the escrowed assets and users can borrow against their bitcoin. Crucially, it does not permit rehypothecation which will prevent the recurrence of Celcius-style collapses. It also acknowledges the specialism of the Debifi team is actually securing the assets; leaving the lending to the banks who are more skilled at that.

Serious backing for this from BitFinex, Blockstream and others. Sign a few decent sized banks on the other side and it has a real chance.

Bitcoin is the purest form of collateral there is by nature of it being a bearer asset (you cannot pledge it twice) so risk assessments against bitcoin are easier for banks to make. Bitcoin loans should be easy and instant.

For the first time in the sector there appears to be a bit of respect for some of the skills that reside in traditional finance and after the lessons of the last six months, we need them.

Gold

Gold is worth exactly what it was a decade ago, $1,700 US dollars. In that time Australian house prices have doubled, the NASDAQ rose 5x and bitcoin has risen 1500x. During one of the largest monetary expansions in history it’s hard to explain gold’s performance and gold bugs continue to wait for the explosion in value in their special metal. There are a number of factors working against it of course, not least digital alternatives.

The biggest buyers of gold in recent years have been Russia and China who continue to hoard it. If, as rumours suggest, their new international trading currency is indeed backed by gold then it might be the rocket fuel that gold needs so we should not discount it.

The stagnation in price isn’t putting off Australian gold miners. Local production is up 9% year over year and global production is expected to be 5% higher this year than last. That increasing supply is a drag on price but it’s still much better than fiat currency.

History has its lessons though. Generally that people will tend to the scarcest thing, whatever that is. These days … it isn’t gold.

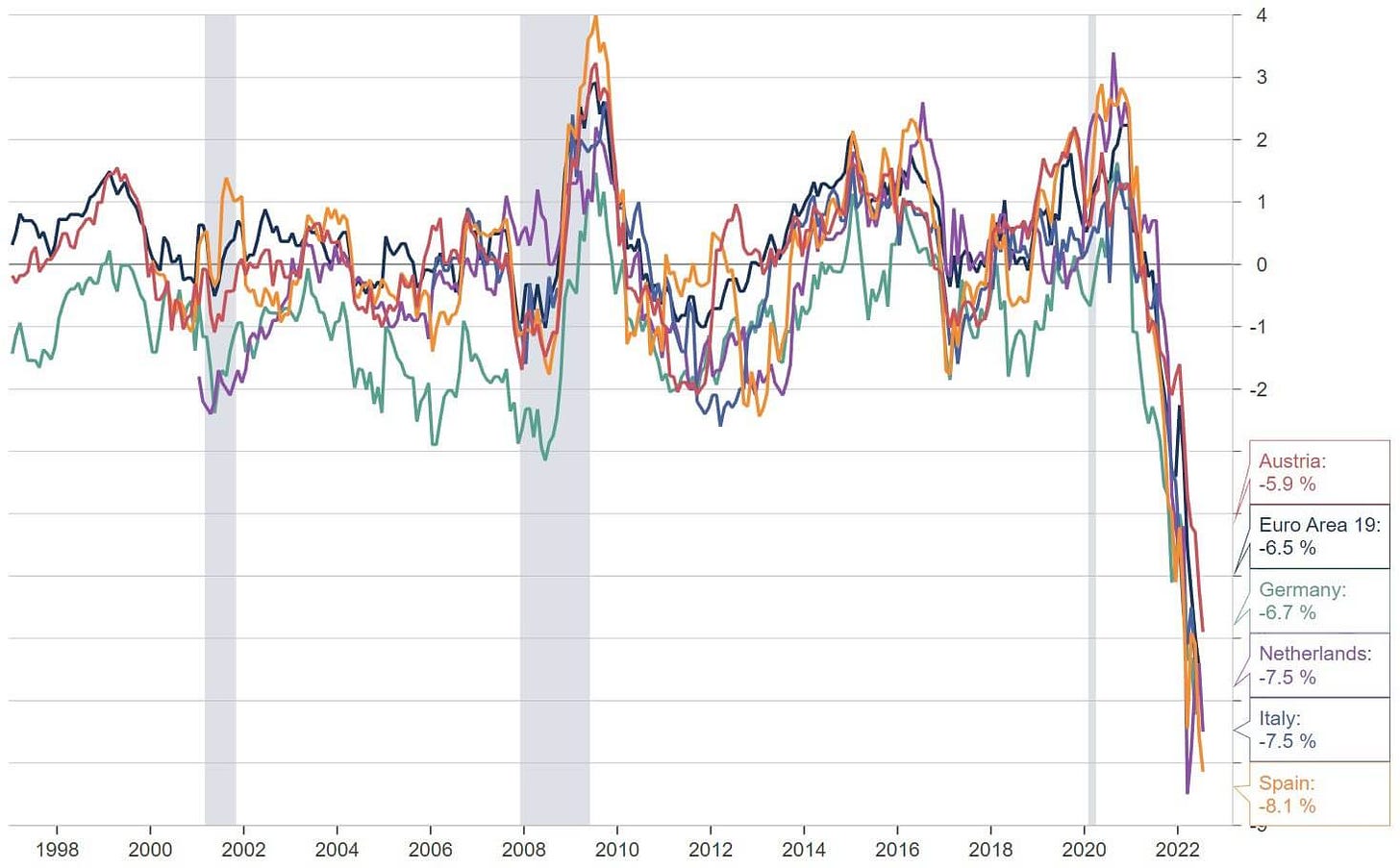

Euro-Trash

Real wages in Europe have now started crashing as inflation bites. It’s an acceleration of a recent trend. As you can see, for decades real wages have bounced around the x axis and in many cases made no progress at all. As with the US labour force participation rate, it’s likely due to mechanisation that labour cannot command the same premium it once did.

None of that makes Europe a bad place but increasingly it’s for holidays only and certainly not for business. Who could navigate their myriad of laws and regulations? Who could tolerate their taxes which are incredibly high and who could afford to heat a home in the colder climates? In some ways that all works to protect their cultural identity in the same way it does in Japan (making both places nice for holidays). It also means decline at a fundamental level.

Contrast that with a place we talk about very little here (due to ignorance really), India. It recently went past the UK as the world’s fifth largest economy. Its birth rate is holding up nicely at 2.2, so above replacement rate but not so crazy as to stress out the infrastructure.

If you want to know the reason they are doing so well, firstly the growing population but secondly their embrace of technology. They operate the largest open API project in the world known as IndiaStack. It has been running for 12 years and conducts billions of requests for businesses each year. In the race to digital economies China and India are so far in front it’s not even a contest. Meanwhile in the West, we haven’t even heard of these projects and are scared to turn the heater on.