China ban #46

Bitcoin fell sharply on Friday after China announced its latest ban on cryptocurrency. While I am certain they mean business, the issue for China is they have announced a new ban every year since 2013. The headline above is from the first ban that year which caused bitcoin to “plunge more than 20% below $1,000”.

The mining ban earlier this year proved just how hard it is to stop bitcoin. If it were easy, it would not need to be done annually in a new, innovative and “this time we mean it” sort of way.

The timing of this might be interesting though because China will likely be first to launch its (CBDC) Central Bank Digital Currency this year. Naturally, they would prefer that the digital currency of choice will be the digital yuan and not bitcoin. So, it makes sense to throw a few roadblocks in front of your competitors first.

China bans are an interesting investment metric, here are some examples:

- YouTube

- Netflix

- Roblox

For the last decade if you had simply bought the things that China has banned for your portfolio then you would have done fabulously well. Nothing is more banned than Bitcoin of course and it has outperformed all of them.

For those of you at a loose end who want to be a billionaire, you might launch an ETF called “China Banned It”. The ticker code CBI is available on the ASX and I suspect it would do well.

El Salvador

This is a rather encouraging sign from El Salvador. I think we should temper the President’s excitement a little and point out that people are using the wallet to get the free $30 it contains and there is no guarantee they will continue using it. Still, to have more users than any bank in the country is quite the achievement.

More than that though, the infrastructure supporting these transactions is other people’s computers around the world; lightning users create the lightning network. It is not as though El Salvador had to build some massive banking infrastructure to make all this happen, it simply exists on the laptops of enthusiasts all over the world. That fact alone is incredible, a nationwide banking infrastructure with almost zero spend.

That is the power of open-source systems.

The network itself is growing quickly now, up to 2,900 BTC ($125m). Still tiny, but the day when there is over a billion dollars in the lightning network might not be that far away. At that level it could support many hundreds of billions of dollars of transactions per day. That activity will be happening with no central server or authority.

It took 20 years for 1.8 million Salvadorans to have a bank account and only 19 days for more than that to have a lightning wallet. El Presidente thinks “This is wild”. Hard to argue.

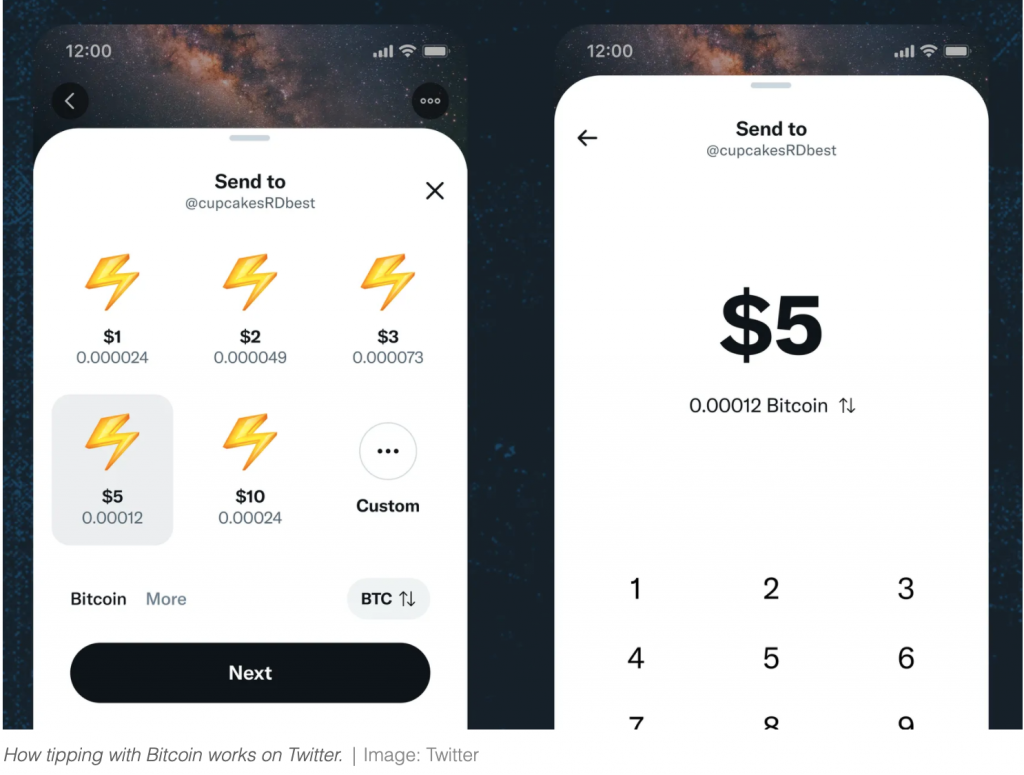

This might be the biggest story of the year, but it didn’t seem to get much traction anywhere. Twitter has integrated bitcoin lightning network payments into its tipping service.

To have Lightning integrated into Twitter means you can remit funds across the social network with a few clicks (so don’t need their bank account number just their Twitter handle). Twitter takes no cut from the transaction.

There is no limit to the amount you can tip either, so if your wallet is funded you could send millions of dollars as a ‘tip’ if you wanted. The naming convention is quite cute as well, calling them ‘tips’ has a certain emotive element that you are paying a small amount to someone as a gesture of goodwill. It is likely to attract much less attention than calling it “Twitter International Payments” (TIP) for example. I hope I haven’t given the game away there.

Twitter has 300 million daily active users. Arguably, they just created that many new bank accounts.

Twitter, again

This is the missing piece of the jigsaw for NFTs. It’s fine to spend $250k on a jpeg but how do you prove to everyone that it is real? You need an ecosystem for it to reside in. Once Twitter, Facebook, Instagram etc. start validating NFTs then they might absolutely thrive in the biggest digital ecosystems of all.

It is worth explaining how significant this is. At present, to validate an NFT the owner needs to cryptographically sign the NFT with their private key and send that output to the person querying their ownership. They will then validate that with their own key. It is a technical (but simple) process that would take skilled people a few minutes to execute. Now we are talking about this process happening as standard because the platform is doing it for you.

In many ways it is like receiving a message in WhatsApp from someone. You might vaguely be aware that messages you receive have been cryptographically signed by the sender and your phone is validating that fact, decrypting the message giving you confidence that the message is from the person you think. How it works? You do not care; the app does the heavy lifting and you are happy enough with that. Validating NFTs for the platforms will be trivial since they do it with basically every message that has ever crossed their platform.

The explosion of activity in this ecosystem hasn’t even begun. Wait for it in video games, I know I keep saying it ……..but watch what happens.

Euro-Trash

Lagarde talks a lot about trust and communication. She knows well that trust in the Euro and the ECB are critical to the overall support of the Euro project. I think it’s fair to say that trust in the Euro has been a tenuous thing throughout its life. A lot of countries (in particular Italy & Greece) saw serious price increases ever since the launch in 1999. More recently, right across Europe, every day prices are rising again.

The problem with her explanation is wages are not rising in Europe. 1 million more people are also unemployed than was the case two years ago. If prices rise 10% in the meantime and wages do not move, then everyone is 10% poorer. Prices do not fall back.

So, honestly communicated, Lagarde might have said “while the price increases themselves are temporary, their effect is permanent, and you are meaningfully poorer. Have a nice day.”

Do I expect her to say anything else? No, not really, but I do think her weasel words deserve to be called out.