An appeal to envy

So we enter a new phase. The strategy among global central banks of insisting ‘bitcoin is a bubble that will fail’ has not worked. The ECB website is littered with attack articles going back decades. What is new this time is the basis of the argument. Author, Ulrich Bindseil is a long serving Director General of the ECB, so the paper cannot be dismissed as the musings of some back of house PhD student. They have taken some reputational risk here.

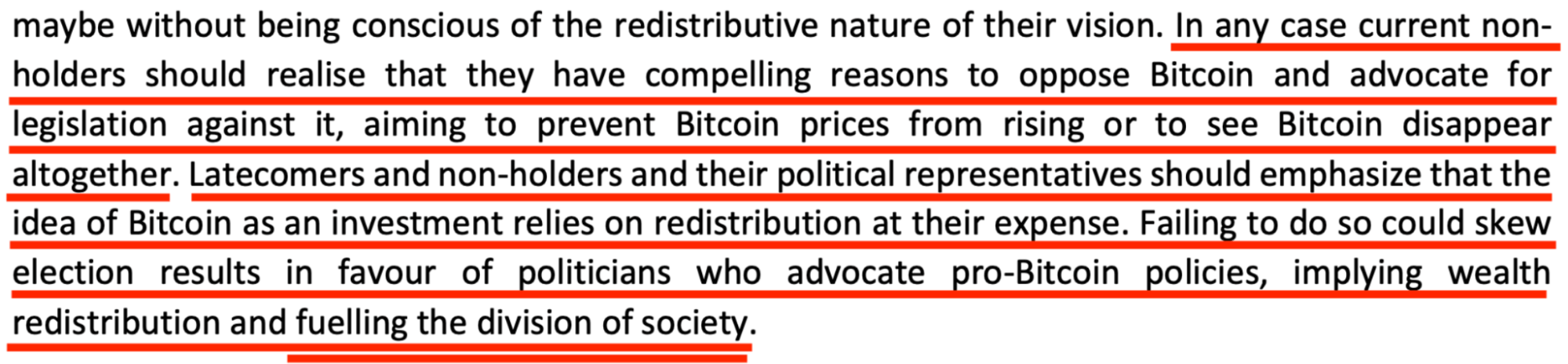

This time around, the vector of attack is “if bitcoin succeeds and you don’t have any, you will become relatively poorer”. Yes, you will.

They advocate here for “non-holders” to oppose bitcoin because it represents a direct transfer of wealth from them to the earlier adopter. As far as the Euro is concerned, this is true but it is only true because the Euro is corrupt. The better argument would be that bitcoin has features people find attractive, like a fixed supply. Perhaps take those features to prevent governments monetising other people’s wealth. In effect, make the Euro better, and actually compete with the enemy.

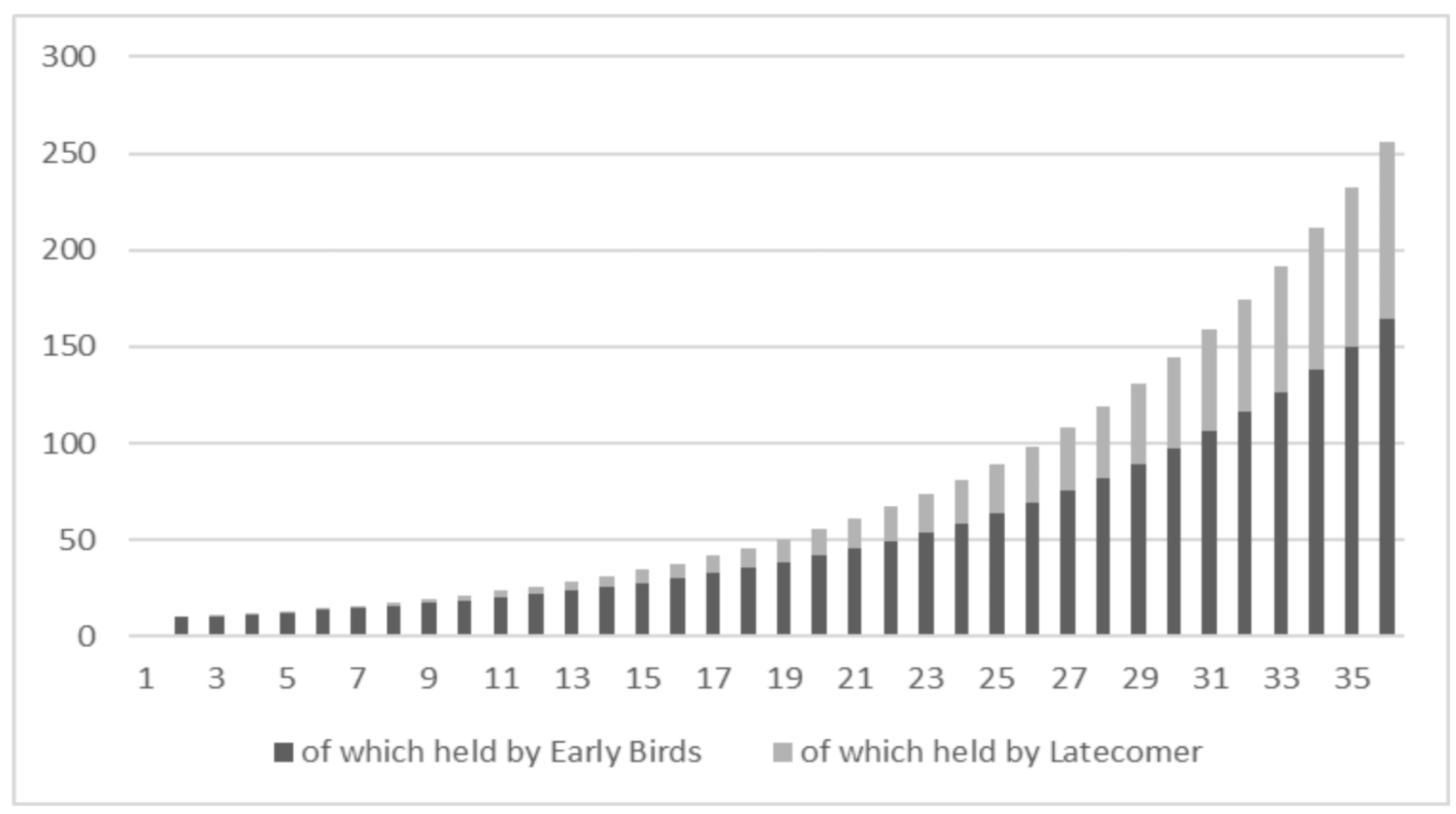

To illustrate their point, they include a chart which indicates the extent to which early adopters will dominate the bitcoin wealth curve, roughly ⅔ to the early adopter group. Is this not true of any successful investment though? In fact it is normally far more extreme.

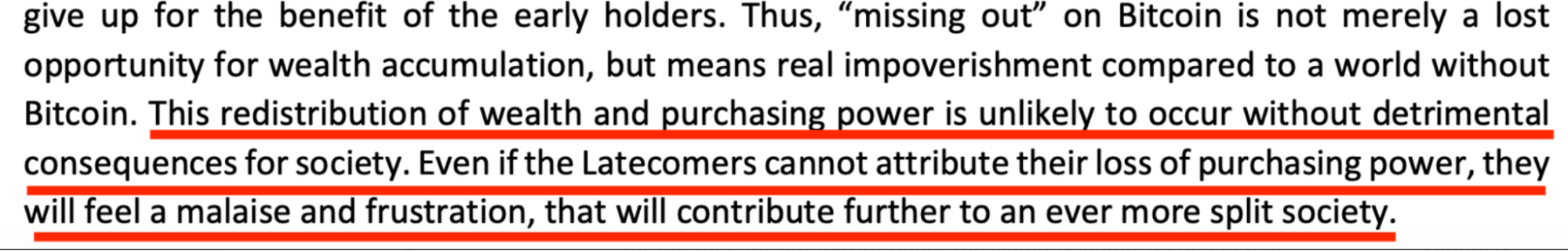

They then make some extraordinary claims about the effects on ‘Latecomers’ which will cause societal splits.

There is no discussion that the true societal split effectively happened in 2008, when the general public bailed out the banking class. It was that moment that gave rise to bitcoin as the solution, which is now falsely (at least in my view) painted as the problem.

The ECB are not stupid. Their strategy to date has palpably failed. This new approach appears to sow the seeds of envy. Those seeds can then be politicised to tax bitcoin or introduce some other legislation to slow its progress. Undoubtedly too they will be aware that the American election has been impacted by the sector. There is a clear political movement supporting bitcoin and cryptocurrency more generally and American politicians are being forced to embrace the sector. That has not happened in Europe yet, and this paper seems to be a clear move to try and head off such an occurrence.

The problem Europe has is the transnational nature of the asset. There is a real possibility that Trump wins the US election. Should he do so, I expect him to be bitcoin neutral but even that position will be in very stark contrast to Europe.

This sort of paper just drives another nail in the European economic coffin. Not because anything specific will come from it but because it indicates the overwhelming desire to regulate and control. Europe is being crushed by the USA and China on every metric, economically, politically and militarily.

Their desire for control simply chokes the whole continent. They cannot see it, but it sings loudly from this paper.

Schaaf

The author himself published his own summary which I thought was worth sharing. Naturally, he posted on Twitter naturally – the platform Europe seeks to ban.

To me it is one of the greatest adverts for bitcoin ever written. Ditch the politically controlled money. Ditch it as soon as you can and the sooner you do the better for you.

What is this argument here? Vote for the Euro and we can all be poor together? Never invest in anything that might make someone else rich and you poorer.

Schaaf really hates bitcoin. His 2022 message when we were reeling from the FTX collapse said everything. “Isch over…” he claimed.

Isch is far from over though. My simple prediction is this. Bitcoin will outlast the Euro; not by decades but by hundreds of years.

Accounting v reality

In little over three months the accounting rules for cryptocurrency will change. Up until now, companies have been required to treat the assets as “intangible”. Essentially they are held at cost, but if the value goes down they must be written down permanently. The insanity worked like this:

-

Buy bitcoin for corporate treasury $100,000,000

-

Bitcoin doubles in value – no change to value; no benefit to P&L

-

Bitcoin halves in value – $50,000,000 loss to P&L

-

Bitcoin triples in value – now its worth $150,000,000 in the market: no benefit to the P&L

You could only ever recognise a loss in your profit and loss account and not a gain. Corporate treasurers would avoid bitcoin like the plague. Who wants to have to explain that to the Board, “we bought an asset that as far as our P&L is concerned can only go down and never up”?

Microstrategy saw through this. They followed the accounting rules but it became ridiculous when all considerations around the value of the company had to ignore the official accounts. It made a mockery of the standards. This embarrassed the American Accounting Standards Board into action and they came up with the not very complicated solution of simply allowing companies to value the asset at the market price, which seems both obvious and sensible.

From 1 January next year the prospects for Bitcoin as a corporate treasury asset are far different from where they have been to date. We shouldn’t expect a tidal wave of money from it, simply another barrier has been removed from adoption. When considering the amount of cash that sits on corporate balance sheets is there a faint possibility that Apple or Google might allocate to bitcoin? As a marketing stunt, yes. Apple in particular have worked very hard in recent years to bolster their credentials as a privacy focussed company. It would barely move the roundings for them if they allocated a few billion in bitcoin’s direction.

Accounting treatments really do matter. In particular for banks. One rule stands out in this regard “Held to Maturity Investments”. This rather interesting nuance allows banks to value bonds at their face value rather than taking a write down to market value. In the last 18 months this has been enormously advantageous.

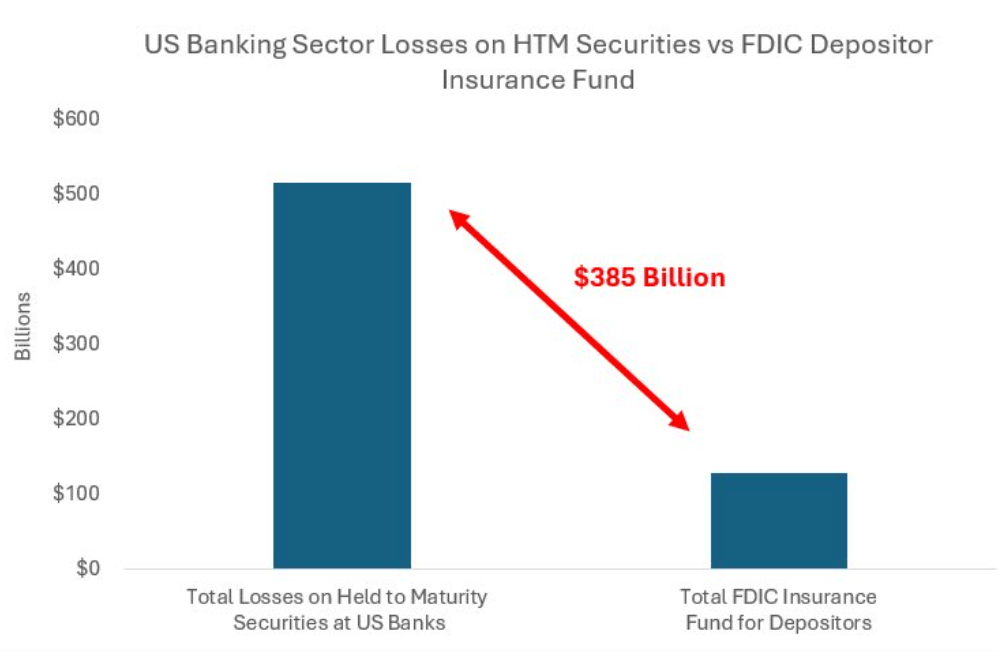

This handy little trick is particularly helpful at the moment. US Banks have amassed enormous losses on their bond portfolios since interest rates began rising. It’s around half a trillion dollars in losses versus the current market price. Most of this is 2 – 10 year bonds, which is fine because the bank can indeed sit on them and get the face value back.

The issue only arises when depositors withdraw. The bank is then forced to sell the bonds at a loss and cannot meet creditor demands and we get a Silicon Valley Bank situation. To avoid this, you might recall that the Federal Reserve simply allowed banks at the time to post those assets 100% of the maturity value, irrespective of the market value. Essentially just monetising the loss across the citizenry.

Some assets receive massively advantageous treatments (bonds). Others receive much harsher treatments (Bitcoin). Why is that?

Without these internal bailouts and Held to Maturity pretend valuations, the bond market would convulse. US yields would be closer to 10% than 5%. You can only pull the trick for so long, as we are beginning to see.

Rate setting

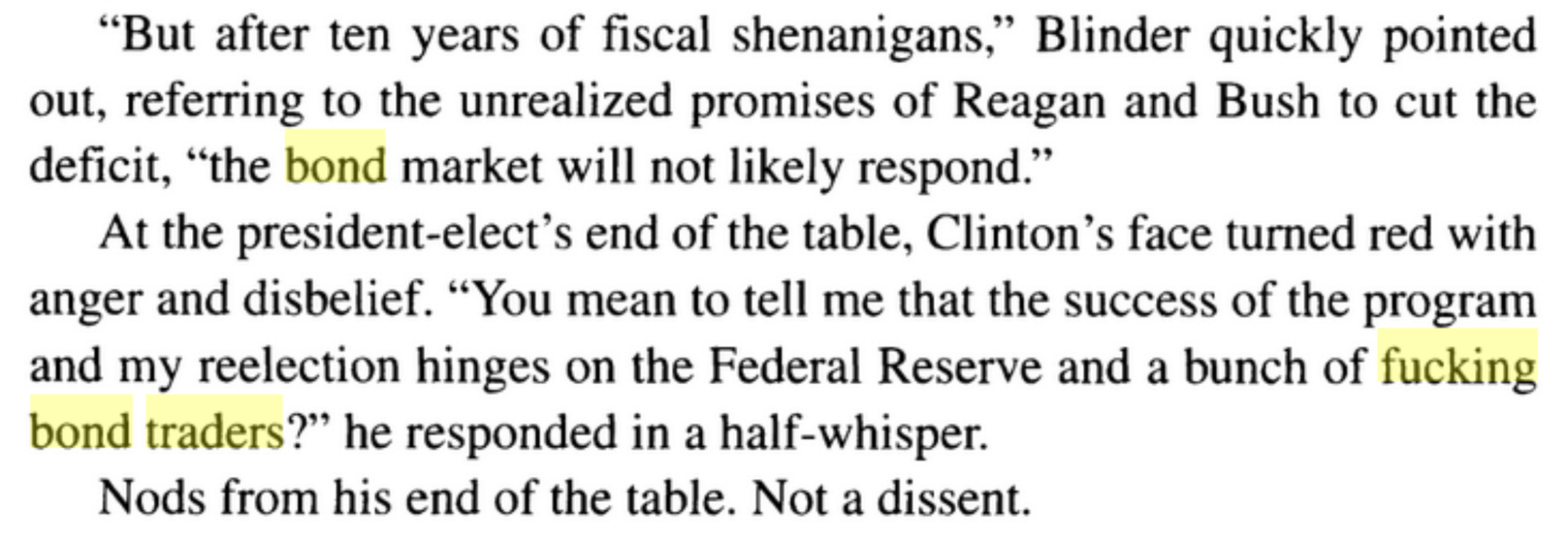

As Bill Clinton discovered, the market sets the interest rate.

Since the Federal Reserve cut on 18 September, the 30 year Treasury yield has risen 60bp. 4.5% for 30 years? I wouldn’t do it for 8%. Increasingly, I am starting to share the view of those people who think interest rates are going up and not down.

Euro-Trash

The absolute worst case scenario for the European Union is a Donald Trump victory. In an interview this week he explained that Tim Cook had called him to complain about the EU fines. It must be said, there is some truth in the EU complaints about Apple’s walled gardens which lead to extreme financial capture by them.

“Tim, I got to get elected first. … But I’m not going to let them take advantage of our companies. That won’t be happening,”

Remember Nokia? They had the phone that dominated the whole world, they even designed and built it in Europe. Then they made a dog’s dinner of it. Did America ever levy fines on Nokia when it dominated global telecommunications?

It just seems to be an odd dynamic. Rather than “we better improve and make better stuff ourselves”, the EU seems to believe they can simply milk overseas cows with fines.

Cook apparently made the comment “they use these fines to fund their operations”. It’s quite the condemnation because they can’t really fund their bureaucratic machine with much else. They have no tax raising powers.

We really do have quite a few weeks coming up. The US election may well turn out to be far more consequential for Europe than it is for America.

Nervous days in Brussels. Very nervous days.