Elon Musk is right

It makes no sense to mine bitcoin with coal. That is why almost nobody does. Coal is simply too expensive. Bitcoin miners can only operate profitably at 3 cents per kilowatt hour and less. Fully costed coal is a lot more than that, hence most bitcoin mining takes place at the bottom of hydroelectric plants or via stranded or otherwise wasted energy.

Wherever there is cheap power, there will be consumers and some of them will mine bitcoin and some of them will charge their cars. You can have all the electric cars you want, but they need to be charged with power, from somewhere, and in most cases that will involve an element of fossil fuel.

The answer here is to have maximum efficiency in the use of power and properly priced externalities. So if you spew smoke into the atmosphere then there is an externality, that must be priced into the power. The same is true for batteries, we will eventually face a sea of lovely old battery acid that will need a home, that ultimate externality needs to be priced today.

I would also contest the view that we need to use less power. On the contrary, we need to use more because power usage is directly correlated with rising living standards and falling poverty, we just need better ways of generating it. As we can see below, we are getting there but not fast enough.

This mural was the first of many by Paris-based artist, Pascal Boyart. His studio, fittingly, is based in the old gold foundry on the outskirts of the City. He came to prominence through the use of his bitcoin QR code on all his work. You can see it in the bottom right of this picture and again below.

On top of the gold foundry is another mural. Inspired by Gericault’s “Raft of the Medusa”. Pascal explains it all in the video below.

Most movements have their attendant art, whether paintings or music. For those looking for validation for bitcoin beyond the usual arguments, look beyond Wall Street. For the “Bitcoin is backed by nothing” crowd it is another reminder that there is something happening here. Not only is Bitcoin thriving, the art market that surrounds it is too. That one exists at all should make you sit up and think.

These guys would not sell their work for vapourware. In the world of street art, they prefer bitcoin to fiat currency.

One of the more popular platforms for buying these works is website scarce.city. It uses the bitcoin lightning network to manage auctions and as you will see, some of those works sell for reasonable sums. This work being a collage of ripped US dollars depicting Julian Assange which sold for US$55,000 a few weeks ago.

Over in the US, artist Alex Schaeffer is making a name for himself too with his Bitcoin inspired work. His most popular art seems to be burning banks. The last one sold for over US$50k, so I’m interested to see what he get for this one of Wells Fargo. Once again it will be auctioned on scarce.city.

If you work for JP Morgan or Goldman it might look rather nice in your foyer.

Remember “intel inside”? One of the best brand marketing campaigns of the last 30 years. It was ubiquitous but subtle, you saw it everywhere multiple times a day and never noticed. The pervasiveness of that campaign reflected that traditionally, software programs were written to operate efficiently on a certain style of microchip. For a long time most of the chips in PC’s were made by intel. This was particularly true when they had a very close relationship with Microsoft, whose programs ran best with intel inside.

Aside from the trouble intel is having, something else seems to have changed. Previously the hardware led the game, it was very important, and the software would run to keep up. Much like when PlayStation released a new console, it would take years before the games were anywhere near capable of making the most of the new kit.

Hardware led but that seems to be changing. One of the first major examples of this was with specifically designed chips for bitcoin mining. When bitcoin mining went professional (somewhere around 2014/15) chip sets were built specifically to address the problem presented by the Bitcoin protocol. It’s not that this is new, there are of course many types of microchip built to a very specific purpose. What is new though is that in this particular case the hardware is in an arms race to make the software run faster, no longer is the software running to keep up.

I had thought that this would be unique to Bitcoin, but it seems not.

Apple are now designing and manufacturing their own chips to deliver extreme performance with Mac software. It’s a very bold play since if they are successful in embedding their chips sets in software design requirements, the moat around the Apple ecosystem will grow wider. Intel dominated for 25 years; Apple might have 25 more if they get this right.

The only downside is you are one bad chip design from disaster. As we discovered in 2018 when the world’s largest bitcoin miners, Bitmain, produced some pretty ordinary equipment. They went from total dominance to irrelevance in little over 12 months.

Australia’s Federal Budget

With one year to go (or thereabouts) until the next Australian Federal Election we expected a frenzied giveaway in the budget and we were not disappointed. You would no doubt have read all about it already, so I want only to focus on one point. The falling trend in real wages.

Generally in any announcement the government has the smoke and mirrors out and manages to present a shiny future. Not this time, the government does not expect real wages to rise for a couple of years.

The growth in returns to labour are materially lower than they were a decade earlier, a point we made last week particularly about the US.

More worrisome for those of us selling our labour is that the government has a terrible record at predicting this kind of thing. As you can see, they materially overestimate the future rates of growth in real wages. Based on the history of their efforts we can expect rates of growth somewhere from 0 – 1% having discounted their optimism factor.

Strangely, there was no discussion of why this is the case, although I think it is clear that automation is a large part of it, plus white collar jobs are simply being outsourced across the world. Here’s a good example from the recent results announcement at Westpac.

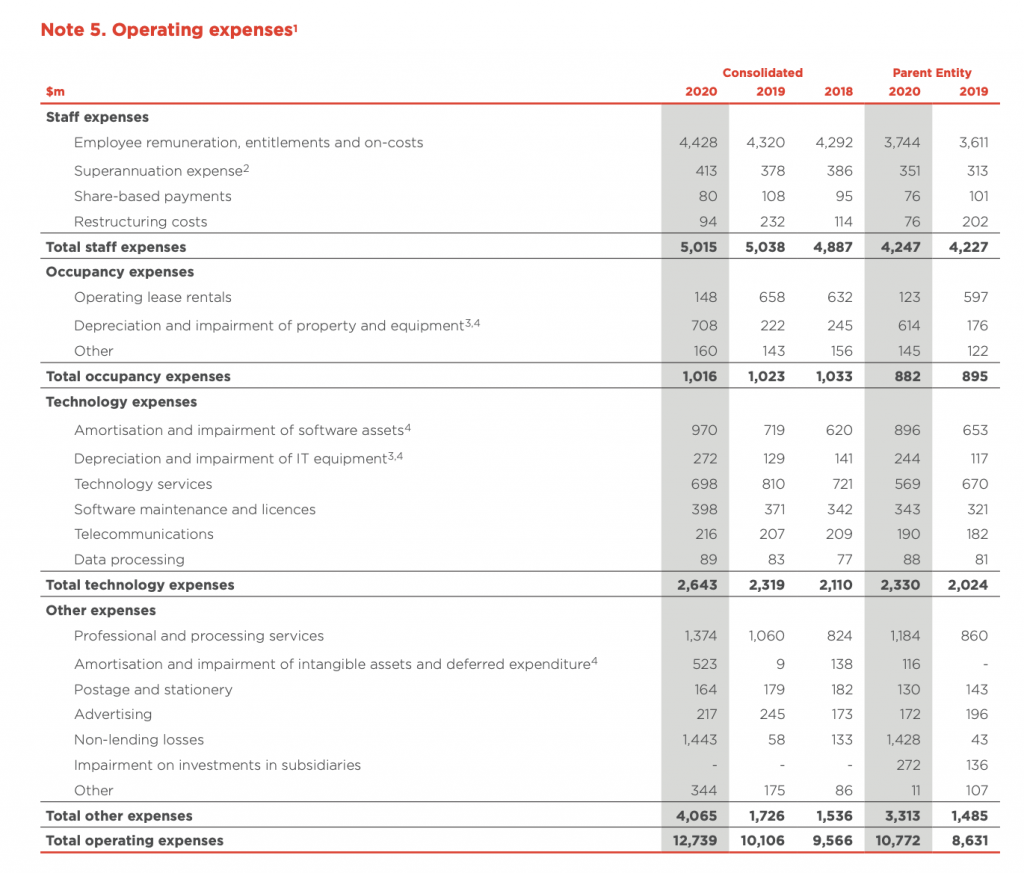

Looking at the Westpac cost base, it totals $12.7bn:

Staff – 40% (closer to 50% when you remove the fines from ‘other’)

Property 8%

IT – 20%

Other – 31%

Westpac disclosed their ‘digitisation strategy’ which one imagines includes all sorts of cloud fantasies and promises of future savings. As anyone who has tried it knows, IT savings rarely materialise. If you were the CEO then, where would you look?

This story is replicated across financial services industries in Australia and the developed world. Machines are disrupting blue collar and software is killing white collar.

There will be no option here for governments other than to keep priming the inflationary pump. They have to sustain the illusion that wages are rising, even though they are not and they can only do that through nominal increases in salary (not much they can do about real increases).

It’s right in the sweet spot of the playbook for our funds.

Euro-Trash

Agent Lagarde was this week honoured by the “Friends of Europe Group”. She is, they tell us, “responsible for steering the Eurozone out of the crisis of the Covid-19 Pandemic”.

Well done Christine. I had thought Europe was rather still in the crisis, but maybe not.

It turns out, the friends of Europe Group are funded by the ‘Citizens Programme of the EU’, which itself is funded by the European taxpayer via the European Union. That long route is to make sure plenty of Eurocrats can have lunch on the way through and wallow in some self congratulation at having done something good. The same people ultimately have to pay Christine’s salary. The same people in fact who have paid for Christine’s solution to everything, which is to spend everyone else’s money.

Agent Lagarde continues her fine work there. The ECB balance sheet this week rose to 76% of Euro-area GDP, adding 20 billion this week alone.

Our hero has now overseen the largest and most obvious sovereign default in history through her ‘work’ with Argentina at the IMF. She was convicted by a French court of looking after her political mates with hundreds of millions of euros of taxpayer money and now she is fêted by fake institutions that are paid for via her own insane largesse.

I could go on. I have an appointment though, I’m going to rob a member of the public. With the money I will start an organisation called “Friends of Robbers”. It will be fully funded (by the theft). I will then rob someone each week and after having paid myself handsomely from the loot (plus 20.7% for my pension), I am going to give the rest of the money away to help the public. It is the right thing to do and they will love me for it.

Then, in two years time I will start releasing articles via the entirely independent “Friends of Robbers” about my profound foresight and contribution to society. Shortly thereafter, I will dine out with our sister organisation, the European Central Bank and we will toast our great work with fine wine.