Overreach

There were two instances of institutional overreach this week (more later on the second). The first was the G20, who, at the suggestion of the Americans, have “agreed” that there should be a global minimum tax rate of 15% on companies. Firstly, this is strange because no G20 country has a tax rate that low. Even non-members Switzerland and Singapore tax at 14.9% and 17% respectively. So they’re agreeing to change nothing?

The full list of rates from the G20 and friends is listed below.

World Bank (WB),

World Health Organization (WHO),

International Monetary Fund (IMF), and

World Trade Organisation (WTO)

Organisation for Economic Cooperation and Development OECD

Financial Stability Board (FSB)

Inter-Agency Group on Economic and Financial Statistics (IAG)

United Nations (UN) – surprised this still exists. I really thought they had given up.

Institute of International Finance (IIF)

Bank for International Settlements (BIS)

Financial Action Task Force (FATF)

FATF-style Regional Bodies (FSRBs)

Task Force on Climate-related Financial Disclosures ((TCFD)

U.K.

Some rare positive noises from the UK this week. The Chancellor announced new regulations next year that would “support the safe adoption of cryptoassets and stablecoins”. It was all based on a report he commissioned last year, it produced the following 5 point plan which has ideas in it that could preface almost any government policy.

The usual tropes were rolled out “retraining”, “Action Plans” and the mandatory fraud “R&D”. It’s all nonsense of course. The U.K.s record in launching tech unicorns being less than impressive.

All we needed to know was they are not banning it, and they are not. You can pretty much leave the rest to the private sector.

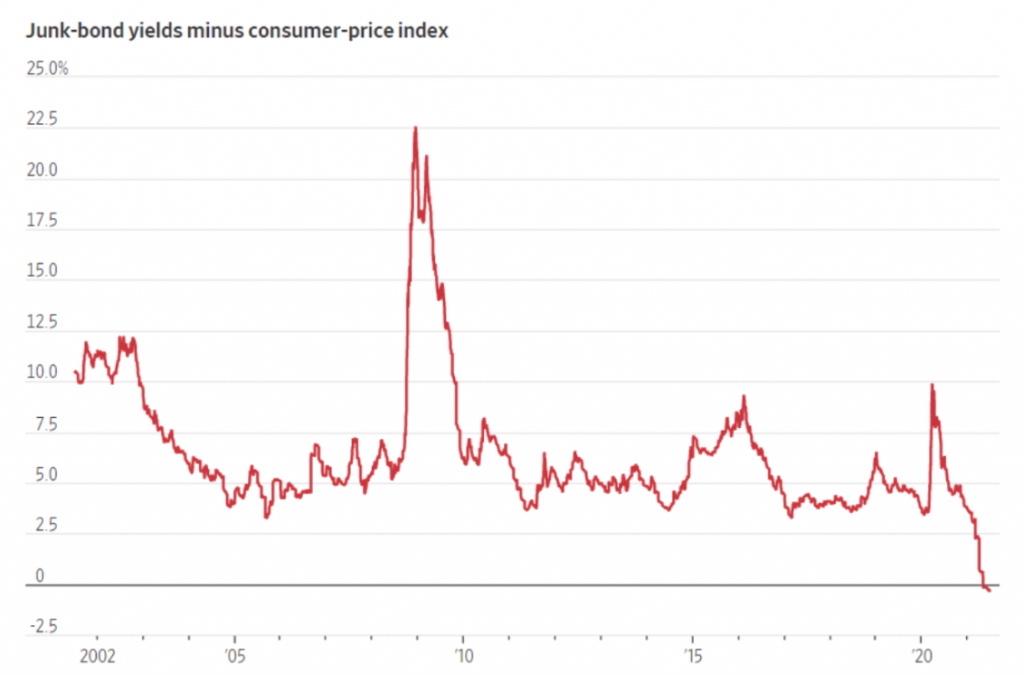

Junk Bonds

I know the bond talk is tedious but this one highlights the issue rather. Real returns on junk bonds have now turned negative. The Q2 2020 inflation number was very low so it is skewed by that and should return above the zero in Q3. Even so, the bond market is speaking of deflation, it is really saying that asset prices ought to be in decline. There is a good argument for this too, given the ageing global population dynamics.

You are left with a decision to make, will governments allow asset prices to collapse, crippling retirees? Or will they continue to print money to artificially inflate them? Based on the size of the voting cohorts and recent experience, I think we have our answer. The string central bankers push against is really the one of ageing populations. The more they push, the more expensive assets (like houses) become and the fewer children people have as they wait in vain for things to improve.

It really is that sad and that simple.

Australian success

From junk bonds to AAA rated, gold standard, best investment in the world stuff. It’s the Australian Government November 2027 bond auction.

Participants bid furiously to receive -1.0295% yield (negative) on their investment. For six years. It was 4.68 times oversubscribed. They sold $100 million of this garbage, mostly to unknowing savers via their pension funds.

The only way this can make sense is if nominal interest rates drop to -3%. While that seems very unlikely, the Financial Review was reporting this week that APRA was following up with Australian banks to make sure their systems are ready for such an outcome.

I’d be even more withering, but the oldest saying in finance is that “bonds never lie”. So, let’s play out a scenario where it might happen:

- COVID infections soar again in vaccinated countries like the UK and US as winter approaches

- Lockdowns return with no obvious way out as the virus morphs quicker than vaccines are developed

- Confidence collapses and the stock market crashes

- Central banks intervene, this time it’s the big bazooka; negative rates and full Japan approach of buying equities too

- Bond prices soar and the ‘idiots’ who participated in this bond auction make out like bandits

Not so crazy now, is it? The Northern Hemisphere winter should tell us.

Euro-Trash

The contortionists were in full swing at the ECB this week as they released their 111-page report on Climate Risks.

The ECB has a single mandate which is to achieve price stability in the Euro-Zone. It has no other role, unlike the Fed is does not need concern itself with unemployment and certainly not with matters environmental which are reserved exclusively for the governments of Europe.

Remarkably, the ECB has concluded that one of the biggest risks to European banks, is floods. Yes, floods. Not bad credit or excess leverage, or fraud, or grift. No, water. They have even modelled the risks across using their sophisticated ECB computers, normally reserved for computing bond yields.

As you can see, the projections clearly show that Europe has turned into a large lake. Perhaps most surprisingly though, while Glasgow appears to under 10 metres of water, Belfast has turned into the Sahara Desert. While I look forward to holidaying on the Shankill Road, I suspect there may be some modelling error. The track record in that regard at the ECB isn’t great.

Almost certainly the prescription from the bank will be that if you wish to invest in industries which “cause flooding” then you will have a higher capital requirement than those banks that do not. It is a highly politicised banking model because banks themselves exist to assess these sorts of risks for themselves. Having the central bank override that with an additional risk premium is strange and no doubt the consequences will be even stranger.

The whole thing represents huge overreach by the ECB, because it effectively sets member state climate policy by proxy. One day they will wake up to it.