It was the annual gathering of Buffett sycophants last week. Tell us more Warren about how you have underperformed the market for the last 15 years etc. etc.

Year after year they are asked about bitcoin and still have not come up with a coherent critique. It’s difficult to let this year’s vitriol slide though, so we might just have to hit the ball back over the net.

One of the biggest positions at Berkshire since 1988 has been the Coca Cola company. It has performed fabulously well for Berkshire and made the two men very rich. Let’s do some due diligence on their contribution to society. All statistics are provided by the US centre for disease control.

There are 37 grams (g) of added sugar, which equates to almost 10 teaspoons (tsp), in a single can of cola.

A 2015 study attributed 184,000 global deaths each year to the consumption of sugary drinks.

Coca Cola’s market share in soft drinks is about 43%. So, we could suppose that this beverage company contributes to 79,000 deaths per year. Charlie Munger has owned the company for 33 years. So that’s about 2.6 million people and to be fair, Berkshire’s stake is only 6.2%, so that’s 161,000 dead people from sugary drinks on his watch.

Anyway, let’s continue. It’s in the interests of civilisation after all:

“Within 40 minutes of drinking it, the body has absorbed all of the caffeine from the cola. This caffeine causes the pupils to dilate and the blood pressure to increase. By this point, the Coca-Cola has blocked the adenosine receptors in the brain, preventing drowsiness.”

“The way that Coca-Cola stimulates these centers is comparable to the effects of heroin. It triggers a person’s urge to drink another can.”

It’s best not to pretend you are a great guy doing great things for humanity when you aren’t. Neither Buffet nor Munger are, they made their money selling diabetes to the poor.

They then took things to the next level with their €1 billion bond issue at 0% coupon in 2019. They had no need for the cash, they just took advantage of the ECB largesse at the expense of the European public.

Shall we stop? No. I don’t think so, let’s continue with another Berkshire investment. The very beautiful Wells Fargo company. Berkshire bought 13% of it in 1994, it’s a company they still hold. Unfortunately, Wells has had a bit of a chequered relationship with the truth on Charlie’s watch.

184 offenses, $21 billion in fines. That doesn’t seem so good, surely some explanation, Charlie? The list is long. Mortgage violations, fraud, employee discrimination, sanctions violations and many others.

The fact of the matter is that the traditional financial system has been and remains one of the biggest criminal rackets of all time. It is rigged against the public; it is regulated to prevent competition and its institutions are so large that they can never be allowed to fail. Not one banker from 2008 has gone to jail and however much money laundering they engage in; they never get more than a fine. How is this possible?

That these frauds are being replaced by new technology is long overdue and Munger doesn’t like it because he isn’t involved and its damaging the legacy companies in which he holds equity.

Since their early success (which is undeniable), these guys have just hovered at bailout/QE tap guzzling their Coca Cola poison and other people’s money. They have profited from bank fraud, distributed diabetes across the globe and sat on their podiums mumbling platitudes. All in the interests of humanity though they tell us.

Labour Day

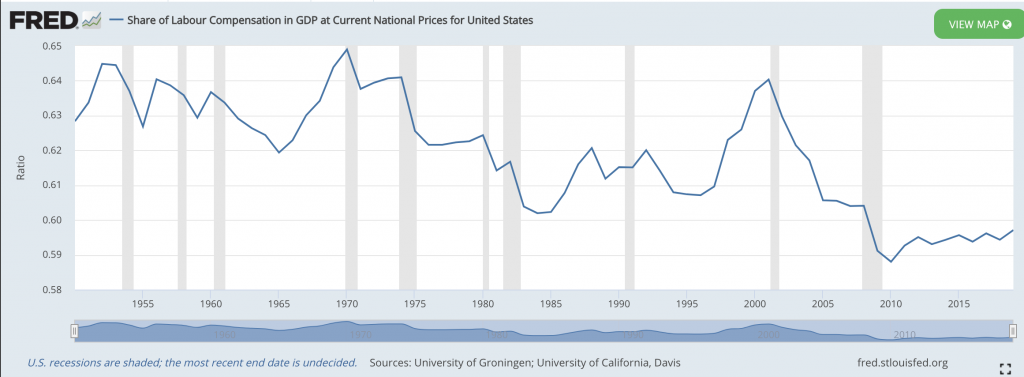

Much of the world was holidaying on Monday for Labour Day. One might make an argument that this holiday should be shortened a little, reflecting the decline in labour’s contribution to the economy. Labour morning anyone?

In a worrying trend labour now makes up less than 60% of the economy (capital being the balance). It was as high as 65% in 1970.

The most surprising thing about the chart to me is just how resilient labour has been. Computers, automation, robots, I’m surprised it isn’t 30%. The internet explosion in 2000 propelled the decline for over a decade before a pause. I suspect the next downward leg is coming now people have seen what is possible with technology during Covid.

The trend is not confined to the U.S. and perhaps Japan is the leading indicator. Most first world countries have Japan-like characteristics, ageing populations and more machines being used in production. Theoretically, the increasing mix of capital in an economy should make a nation wealthier, but that wealth will not necessarily be distributed evenly.

The more unlikely professions to be impacted by this are knowledge professions like medicine and tertiary education. For example, if you could consult the entire lexicon of medical knowledge and cross reference against a database of other humans with similar characteristics to you, would you do that or choose your GP? Likely it will be a combination of both, but the returns will go to the database and the medical practice will have to live with that loss.

On the other hand, the big winners in this change are will be highly skilled manual tradespeople. No machine is replacing a plumber fiddling around your sink to install a pipe. Similarly, electricians, carpenters and builders. Their work contains so much intricacy and individual nuance that it is out of the reach of machines for many years to come.

I recall from economics a theory about hairdressers along these lines. Cutting hair is a very local business, you cannot import more haircuts, and nobody flies overseas to have their haircut. Hairdressers are exactly as wealthy as the nation in which they cut hair. The country goes well, the hairdresser goes well, the trick of course is to be in Luxembourg not Haiti. They will never be replaced by machines though wherever they are, vastly intricate work if you watch them closely.

Not all bad then, provided you have something to offer that a machine cannot. Don’t confuse knowledge with skill though. Increasingly, people will find knowledge for free, but will pay handsomely for skill.

Taproot

The bitcoin upgrade ‘taproot’ has now begun its signalling period. If you are interested in following how bitcoin upgrades actually work, then this is a fascinating one to watch. Bitcoin is an open-source platform and you can run whatever software you like. Upgrades are very hard to do though because they require a change in software (or upgrade) for everyone.

The taproot upgrade is using miner signalling. Which means bitcoin miners, when they produce a new block can signal to the community if they support a particular upgrade. You can track how miners are currently signalling at taproot.watch. Green blocks in the image below indicate miners signalling for taproot, red ones are not.

To activate the change, 90% of miners in any two-week difficulty period (2016 blocks) need to signal for taproot. We already know that in the period we are in this cannot happen because 10% of the blocks have already not signalled. The activation period remains open until the end of August, signalling is rising each day and we have eight more difficulty periods before the window closes.

If we don’t get miner activation, the ball will back in with users. If the majority of bitcoin node operators (users) upgrade that will likely force miners to do the same.

A smooth upgrade would be lovely, but this is bitcoin and much more likely is an all-out bloody war between users and miners. That might not sound great, but Bitcoin is an adversarial network. It is designed for nobody to trust each other, nobody to work together and it assumes everyone acts in their own best interests.

Bitcoin understands humans better than we understand ourselves and for that reason it will likely outlive anyone around today.

Inflation

Hooray! There is almost no inflation says the government.

The official inflation figures would be better expressed as:

30% of your personal cost base rose at 1.1%. The 70% we don’t include because we use some archaic and irrelevant measures is rising at an annual rate well into double figures.

Since we don’t measure it. It doesn’t count.

1.1% it is then.

Euro-Trash

You will recall some months ago that I had applied for the job as the ECB Head of Climate Change Centre. I was not successful, but we now have the opportunity to congratulate the winning candidate, Irene Heemskerk. Please welcome her to the ECB team.

In the interests of self-improvement I looked into Irene’s credentials on LinkedIn with a view to identifying the causes of my failure.

Concerningly, it turns out Irene doesn’t know that much about climate change. Although being Dutch, she likely owns a bike. She is in fact a lawyer who works for the Dutch Central bank and her sole experience appears to be in publicly funded bodies. Her only engagement with climate change was spending some time in 2018 at Oxford University studying “Sustainable Finance”.

- Embark on the unique ‘Oxford experience’ and explore first-hand the richness that the city has to offer including candlelit college dinners and the opportunity to immerse themselves in one of the global homes of education.

It does in fact, sound lovely.

Irene is currently employed as the ‘Sustainability Fellow’ at the Institute of Financial Reporting Standards. Having searched extensively I have found no obvious contributions from her in that role. That does not mean there aren’t any, but it certainly increases the likelihood.

This sparsely credentialed lady will now report directly to one of the most powerful people in the world, Special Agent Christine Lagarde. She will earn in excess of €210,000 per year based on her role grading, with a 20.7% pension contribution on top.

Yet another win for everyone in Europe.

From my perspective as an unsuccessful applicant, it is disappointing. What better way to go down though, than in a slew of canapés and candlelight?