Cantor Fitzgerald

Paolo is the CEO of Tether. That tweet is how he announced their latest transaction, the sale of 5% of Tether to Cantor Fitzgerald for $600m. The subtlety here is the understatement. He understands something that few people appear to have their heads around.

Cantor is an old school American financial services firm. Tether, not four years ago, was in the line of fire of the New York Attorney General’s office for all manner of crimes of which they were exonerated. I have no doubt, in the early days, Tether pushed the envelope but they are now the seventh largest holder of US Treasuries. They own more US debt than Germany and the UK. Crucially America now has a stake in that. Strategically, they have to have a stake in it.

The significance of the transaction is this though: If I own 1 USD, I must deposit that in a bank account. I am then subject to the operations of US banking. My money is guaranteed by the FDIC only up to a certain level. My transactions will take up to three days to process, I also cannot use my bank account on weekends. My account can be frozen, seized or closed.

If I own 1 USD of Tether, I can send the money anywhere I want, whenever I want. 24/7. What is more, that money (we can now safely say) is 100% backed by US Treasuries. A 100% liquid asst. Recall that the reserve requirement at US banks is 0%. Tether is held to a much higher standard, it has a 100% reserve. Essentially owning Tether is the closest thing possible to having an account with the Federal Reserve itself. It sounds ridiculous, but happens to be true.

Arguably then, $1 USDt >> $1 USD

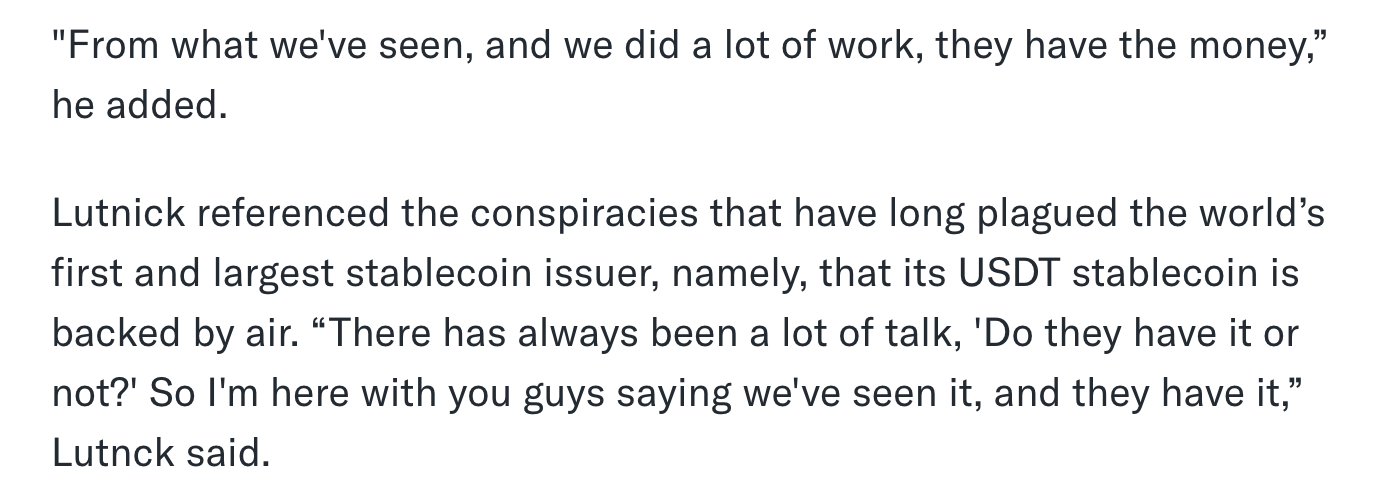

This was Cantor boss Howard Lutnick at Davos earlier this year.

That statement was a seminal moment for Tether. Clearly the realisation earlier in the year prompted Cantor to undertake the transaction.

Most of us believe that the money they have in the bank is backed by liquid assets and we can withdraw it when we like. That just is not true, the liquid asset ratio is around 10%, maybe 20%. Beyond that, the bank collapses. That will not happen of course in Australia because our four banks are so ridiculously large they are essentially arms of the government.

Even so, a parallel system of banking is being born before our eyes here. Nobody sees it.

Big moment for Tether. Huge moment for digital assets. Total mentions in the AFR : zero.

The Pysop

So the ‘mis and dis information’ bill is withdrawn. It was a fascinatingly awful piece of legislation. Designed to protect the population from things that were false and misleading. The Australian government had rather missed the point though.

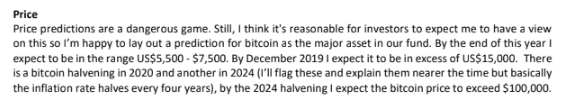

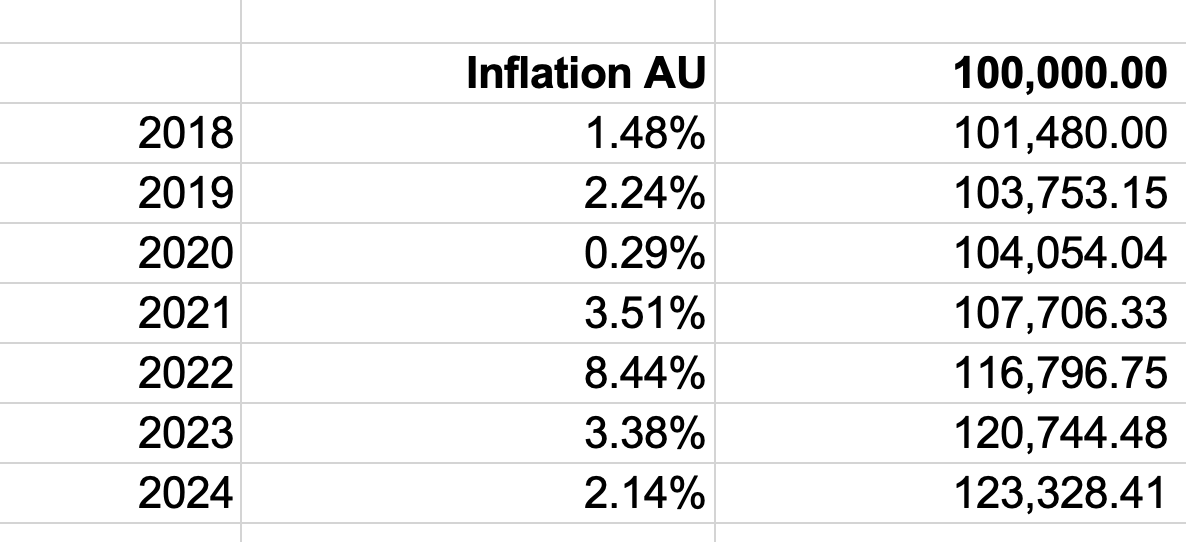

I was thinking about it as we approached US$100k over the weekend (and failed to get there). How long have we been waiting for this? Our fund started in 2018, so that alone is nearly 7 years. Were we thinking about $100k at the start? We definitely were. So much so that I even wrote about it in my investor update Q3 2018, many of you were with us at that point.

In December 2019 bitcoin was having a tough time. $15,000 hadn’t happened. It was $7,200, we couldn’t find a friend at that point. When we got to the halving in 2024, bitcoin was not $100k, closer to $70k. More importantly though, all the while, the targets themselves were silently moving.

Most of us do not believe the official CPI because it does not match the lived experience. A far better guide is house prices. They cannot be manipulated, the record keeping is excellent and they represent an asset that people want and need. You cannot opt out of housing (either as renter or buyer).

The median house price in Australia (as at 2 November this year) was $1,004,385. In 2018 it was $687,800. This is a far better guide to the true inflation figure because it’s a fact, it is not really subject to the machinations of government statisticians. It also happens to be the dominant proportion of most households spending.

Adjusted for this, our $100,000 target of 2018 is actually more like $146,000. That suggests reported inflation is roughly half what it actually is; I think that feels more like it.

Price is meant to convey only one thing, information about demand and supply. Is it mis or dis information when the price level moves as quickly and opaquely as it does for reasons other than demand or supply?

The biggest psyop of all is run by the people that want to protect you from exactly that sort of thing.

Fiat is the mis-information machine. Thanks to a recalcitrant group of Australian Senators, almost none of whom I like, we are still allowed to say so.

Humanity for the win

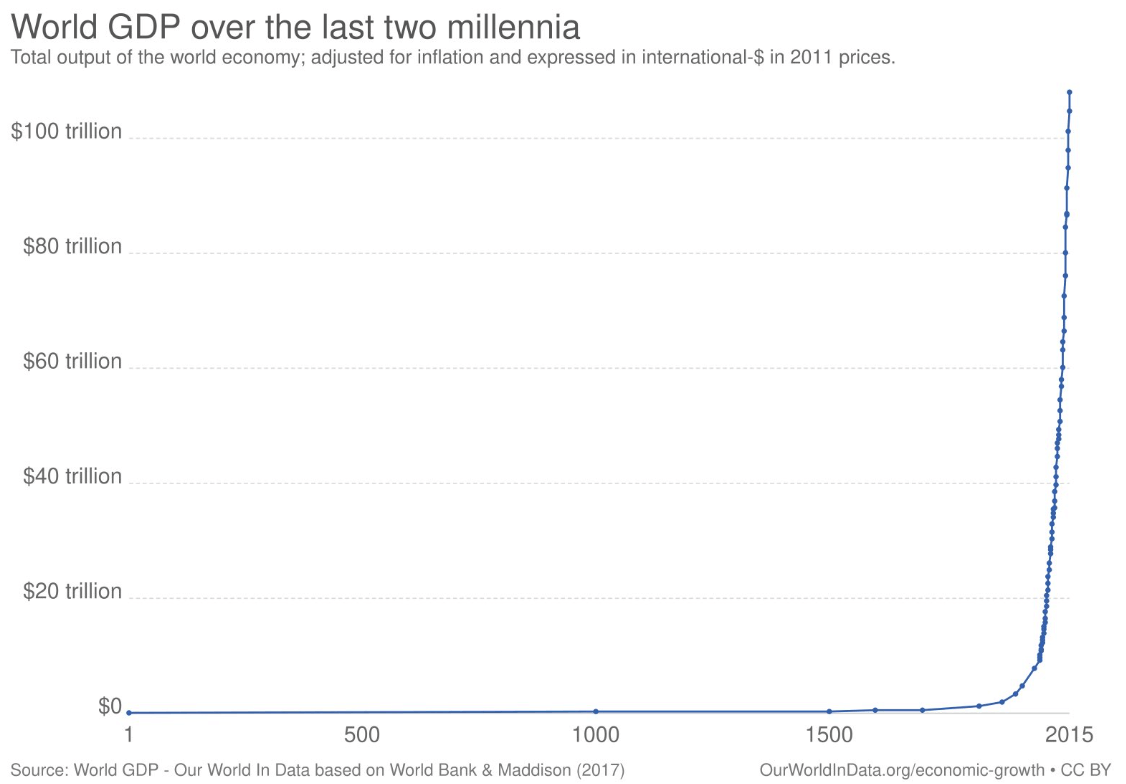

There isn’t really a strategy out there that says I’m just going to back humanity for the win. As an alien you might look at the investment opportunity on earth and think:

They keep getting better at everything; their new technology is always better than their old technology save for when they outthink themselves about power generation. They have gone past the exponential moment and none of them can really compute what is happening. It keeps getting faster and faster and more confusing. As it gets faster, it keeps getting faster, they will get more confused and I will seize the opportunity.

I feel a bit like that when it comes to technology. Some of it is so advanced that people ignore it despite the profound effect it might have on their lives. It requires in some cases quite an effort, an effort that often only the young are prepared to make because they know of nothing else. The issue now is that profound effects are now not taking a generation anymore; they are playing out in under a decade. It will be engage or get left behind.

It’s not that the stock market can’t correct 50%, I’m sure at some point that will happen. The debt reckoning of sovereign states will also happen and bondholders will be destroyed on the rocks of reality.

Even then, your computer is never getting slower from here, only faster. Your air-conditioning is never getting warmer, only more temperate, with better filtered air. Your access to knowledge is currently sky-rocketing on a monthly basis. Your health care is only going to improve, with personal diagnoses from machines that sit in your house and are on call immediately when needed.

Doomsayers will have their six months of glory at some point. Once they finish their victory lap they will continue their unbroken record of just being wrong.

The United Kingdom

The rewards of human progress will not be spread equally though. You have to choose to want them. With that in mind, would you welcome Britain’s new Prime Minister, Sir Keir Starmer.

It’s been a struggle for his new government. Their inheritance tax changes suggest taxing farmers 20% on death when they have a business worth more than one million pounds. While that is a lot of money, it would be pretty difficult these days to be a farmer and not have a business worth that much. Arable land in the UK trades for about £10,000/acre. 100 acres is considered a back garden in parts of Australia, so you can see why UK farmers are upset.

Sir Keir is not deterred though. His government will ‘get people back to work’. An interesting ploy given the unemployment rate is about 4.5%, meaning 95.5% of people are already down his salt mines. He cannot resist getting the government involved. In any other environment ‘no more tinkering’ would be seen as a threat. Inevitably it will end up in red tape and the poor house.

The continual injection of the UK government into matters that don’t concern them was felt far away in the US this week. In September 2022, Adobe announced it would acquire interface design software company Figma for $20 billion. It was a big deal at the time, because Tech was in a slump post Covid and this marked the turning of the tide. The deal has now collapsed. Two years of legal pain and distraction because the UK regulator has effectively blocked it.

Two massive US companies want to merge. They are based in Silicon Valley, their shareholders are overwhelmingly American, their employees are overwhelmingly American and the UK Regulator somehow blocks them?

The options for American companies are increasingly just to leave Europe out. It’s a shame the UK is as insane as the EU in regulating private enterprise out of existence.

For the avoidance of doubt. I am from the UK, I will always support the English cricket team and I will always want the UK to do well. It’s sad to watch though because the UK is becoming a poor country fast.

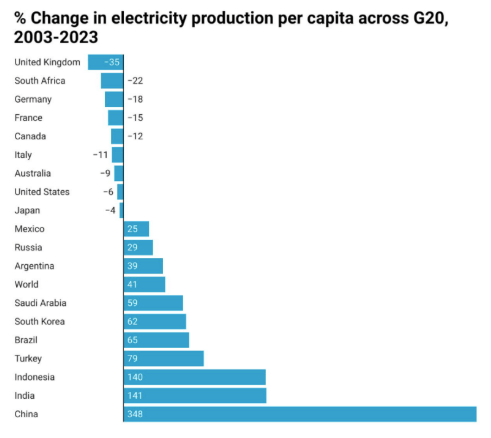

Once again “THERE IS NO SUCH THING AS A LOW ENERGY RICH COUNTRY”.

Euro-Trash

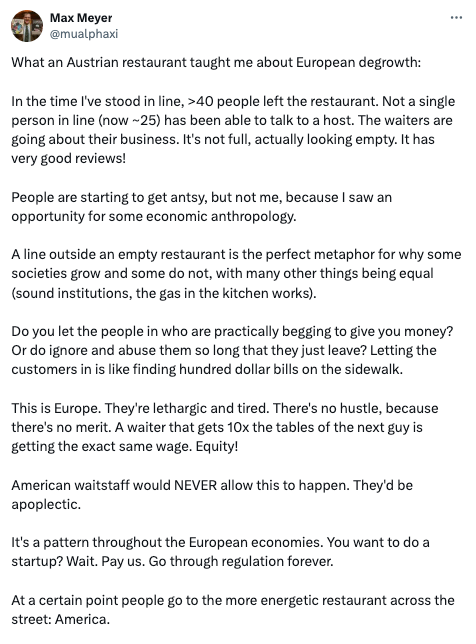

Sometimes Euro-Trash writes itself. This restaurant experience is described by Max Meyer, an American technologist. It resonates strongly, it’s exactly how Europe feels. They just are not that arsed. The feeling generally is that minimum is best and there is no point trying any harder than that. As he puts it “there is no merit”. I accept that is also part of the appeal but it’s going to be tough to keep pace with the rest of the world from here.